Regulatory Support

Regulatory frameworks promoting the use of renewable resources are emerging as a significant driver for the Palm Oil-Based Oleochemicals Market. Governments across various regions are implementing policies that encourage the use of bio-based products, which may include incentives for manufacturers to adopt palm oil-based oleochemicals. For instance, regulations aimed at reducing carbon emissions and promoting sustainable practices are likely to create a favorable environment for the growth of this market. In 2023, the regulatory landscape for bio-based chemicals was valued at approximately USD 10 billion, suggesting a strong alignment with sustainability goals. As these regulations become more stringent, the demand for compliant and eco-friendly oleochemicals is expected to rise, further propelling the market forward.

Technological Innovations

Technological advancements in the production processes of palm oil-based oleochemicals are likely to play a crucial role in shaping the market landscape. Innovations such as enzymatic processes and green chemistry techniques are enhancing the efficiency and sustainability of oleochemical production. These advancements not only reduce waste but also lower production costs, making palm oil-based oleochemicals more competitive against synthetic alternatives. In 2023, the market for oleochemical technology was valued at around USD 15 billion, with projections indicating continued growth. The integration of automation and digital technologies in manufacturing processes may further streamline operations, thereby increasing the overall output of the Palm Oil-Based Oleochemicals Market. As companies adopt these technologies, they may gain a significant edge in meeting the evolving demands of consumers.

Sustainability Initiatives

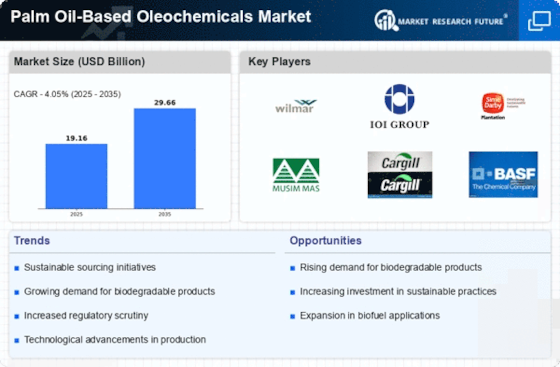

The increasing emphasis on sustainability appears to be a pivotal driver for the Palm Oil-Based Oleochemicals Market. As consumers and manufacturers alike become more environmentally conscious, the demand for sustainable products is likely to rise. This trend is reflected in the growing preference for palm oil-based oleochemicals, which are derived from renewable resources. In 2023, the market for sustainable oleochemicals was estimated to be worth approximately USD 20 billion, indicating a robust growth trajectory. Companies are now investing in sustainable sourcing practices and certifications, which may further enhance their market position. The shift towards biodegradable and eco-friendly products is expected to bolster the demand for palm oil-based oleochemicals, as they offer a viable alternative to petroleum-based chemicals.

Diverse End-Use Applications

The versatility of palm oil-based oleochemicals across various industries is a notable driver for the Palm Oil-Based Oleochemicals Market. These oleochemicals find applications in sectors such as personal care, food, pharmaceuticals, and industrial lubricants. The personal care segment, in particular, has witnessed a surge in demand for natural and organic ingredients, with palm oil-based oleochemicals being favored for their biodegradable properties. In 2023, the personal care segment alone accounted for nearly 30% of the total oleochemical market share, highlighting its significance. As industries continue to seek sustainable alternatives, the diverse applications of palm oil-based oleochemicals are likely to expand, thereby enhancing market growth.

Consumer Awareness and Demand

The rising consumer awareness regarding the benefits of palm oil-based oleochemicals is emerging as a key driver for the Palm Oil-Based Oleochemicals Market. As consumers become more informed about the environmental and health advantages of using bio-based products, the demand for palm oil-derived chemicals is expected to increase. This shift in consumer behavior is reflected in market trends, where products labeled as natural or sustainable are gaining traction. In 2023, the market for natural personal care products, which often utilize palm oil-based oleochemicals, was valued at approximately USD 12 billion. This growing consumer preference for sustainable and ethically sourced products may compel manufacturers to adapt their offerings, thereby driving the overall growth of the market.