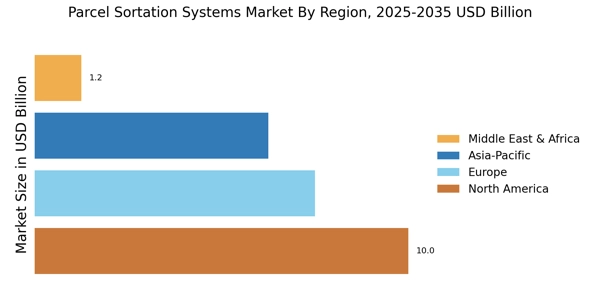

North America : Leading Innovation and Demand

North America is the largest market for the parcel sortation systems market parcel sortation systems, holding approximately 40% of the global market share. The region's growth is driven by the increasing demand for e-commerce, advancements in automation technology, and supportive regulatory frameworks. The rise in online shopping has led to a surge in parcel volumes, necessitating efficient sortation solutions. Additionally, government initiatives promoting automation in logistics further catalyze market expansion.

The United States is the dominant player in this region, with significant contributions from Canada. Within the North America parcel sortation system market, the United States leads due to substantial investment in automated sortation hubs and e-commerce fulfillment centers. Key players such as Honeywell, Dematic, and Siemens are actively enhancing their offerings to meet the growing demand. The competitive landscape is characterized by continuous innovation and strategic partnerships, ensuring that North America remains at the forefront of parcel sortation technology. Companies are investing heavily in R&D to develop advanced systems that improve efficiency and reduce operational costs.

Europe : Emerging Market with Regulations

The Europe parcel sortation system market is a significant contributor to global demand, supported by regulatory focus on automation and efficiency. Europe is witnessing significant growth in the parcel sortation systems market, accounting for approximately 30% of the global share. The region's growth is propelled by the increasing adoption of automation in logistics, driven by e-commerce expansion and stringent regulations aimed at improving operational efficiency. The European Union's focus on sustainability and efficiency in logistics is also a key driver, encouraging investments in advanced sortation technologies.

Germany and the United Kingdom are the leading countries in parcel sortation systems market , with major players like Siemens and Vanderlande leading the charge. The competitive landscape is marked by a mix of established companies and innovative startups, all vying for market share. The presence of regulatory bodies ensures that companies adhere to high standards, fostering a competitive environment that promotes technological advancements. The European market is characterized by a strong emphasis on sustainability and efficiency in logistics operations.

Asia-Pacific : Rapid Expansion and Adoption

Asia-Pacific is rapidly emerging as a significant player in the parcel sortation systems market, holding around 25% of the global market share. The region's growth is driven by the booming e-commerce sector, increasing urbanization, and a growing middle class. Countries like China and India are witnessing a surge in parcel volumes, prompting logistics companies to invest in advanced sortation systems to enhance operational efficiency and meet consumer demands. China is the largest market in this region, followed by India and Japan. The competitive landscape is dominated by both local and international players, including Beckhoff Automation and MHS Global. The presence of key players is fostering innovation and driving the adoption of advanced technologies. As logistics companies strive to improve their service levels, the demand for efficient sortation systems is expected to continue rising, making Asia-Pacific a crucial market for future growth.

Middle East and Africa : Emerging Opportunities in Logistics

The Middle East and Africa (MEA) region is gradually emerging in the parcel sortation systems market, currently holding about 5% of the global share. The growth is primarily driven by the increasing demand for logistics solutions due to the rise in e-commerce and government initiatives aimed at enhancing infrastructure. Countries like the UAE and South Africa are leading the charge, with investments in logistics technology to improve efficiency and service delivery. The competitive landscape in the MEA region is still developing, with a mix of local and international players entering the market. Companies are focusing on establishing partnerships and collaborations to enhance their service offerings. The presence of key players is expected to grow as the region continues to invest in logistics infrastructure, creating opportunities for advanced sortation systems to thrive in this emerging market.