Market Share

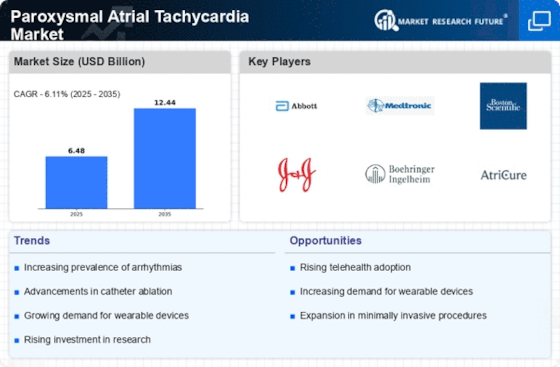

Paroxysmal Atrial Tachycardia Market Share Analysis

Conducting a comprehensive evaluation of the paroxysmal atrial tachycardia (PAT) market is crucial to recognizing key factors, including occurrence quotes, affected person demographics, remedy options, and competitor panorama. Providing instructional resources and schooling packages for healthcare experts to beautify their knowledge of PAT analysis and control is important. This can include workshops, webinars, or continuing medical education (CME) courses. Educating patients about PAT, its symptoms, triggers, and available treatment options is important for improving outcomes and patient pride. Providing informational substances, online resources, or affected person guide programs can help empower patients to control their condition. Investing in scientific studies and trials to demonstrate the safety and efficacy of the agency's products or services in managing PAT is important for gaining regulatory approval and attractiveness within the clinical network. Ensuring compliance with regulatory requirements and obtaining vital approvals from the regulatory government is important for market access and boom. This includes adhering to standards for protection, efficacy, and first-class in the improvement and production of merchandise. Forming strategic partnerships with hospitals, study establishments, and pharmaceutical businesses can beautify the enterprise's credibility and attain it in the PAT market. Collaborations can contain joint study tasks, co-advertising and marketing agreements, or distribution partnerships. Setting aggressive pricing for the enterprise's services or products while considering elements including reimbursement rules and patient affordability are vital for market penetration and getting the right of entry. Establishing efficient distribution channels to ensure the provision of products or services to healthcare centers and sufferers is vital. This may also contain partnerships with vendors, wholesalers, or direct sales channels. Continuously monitoring market traits, competitor activities, and regulatory modifications permits the business enterprise to adapt its techniques for that reason and preserve a competitive side within the PAT market. Utilizing information and analytics to inform decision-making approaches helps perceive opportunities for increase and optimization within the PAT market. Investing in logo-building activities and preserving positive popularity via ethical business practices and extraordinary products or services is essential for long-term achievement. Adopting an affected person-centric approach via prioritizing the affected person's desires, alternatives, and stories ensures that the employer's offerings are aligned with the realities of dwelling with PAT. Engaging with affected person advocacy companies and support networks to elevate cognizance, offer assistance, and advocate for advanced right of entry to care and resources can help the organization as a dependent-on companion within the PAT community.

Leave a Comment