Rising Healthcare Expenditure

The paroxysmal supraventricular-tachycardia market is likely to benefit from the increasing healthcare expenditure in the US. As healthcare spending continues to rise, patients are more inclined to seek advanced treatment options for their conditions. In 2023, healthcare expenditure in the US reached approximately $4.3 trillion, accounting for about 18% of the GDP. This trend suggests that more funds are available for innovative therapies and interventions in the paroxysmal supraventricular-tachycardia market. Furthermore, the expansion of insurance coverage and reimbursement policies may enhance patient access to specialized care, thereby driving market growth. The willingness of patients to invest in their health, coupled with the increasing availability of advanced medical technologies, indicates a promising outlook for the paroxysmal supraventricular-tachycardia market.

Emergence of Novel Therapeutics

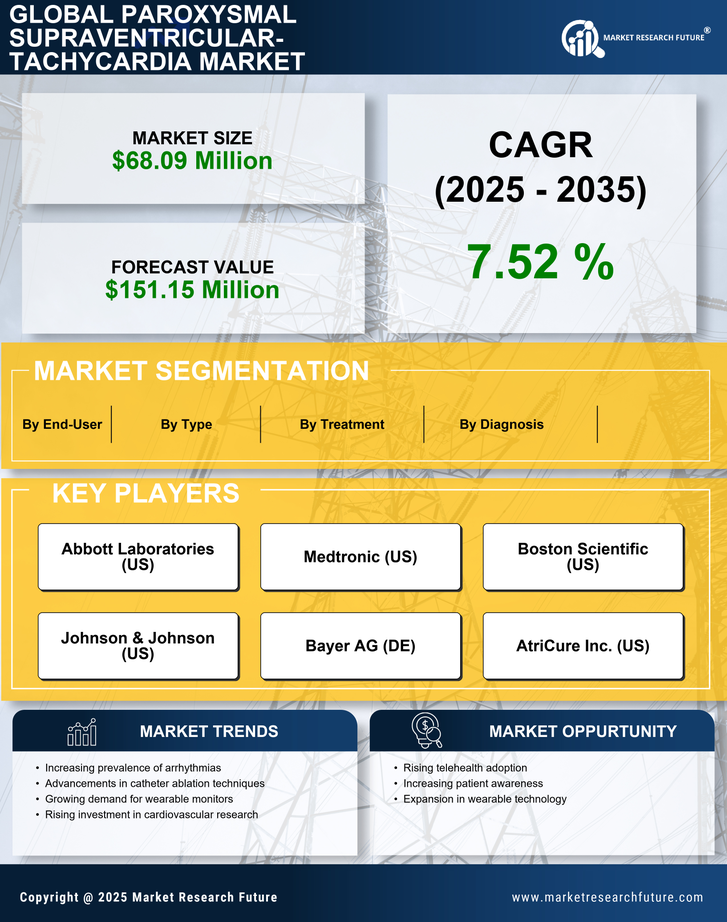

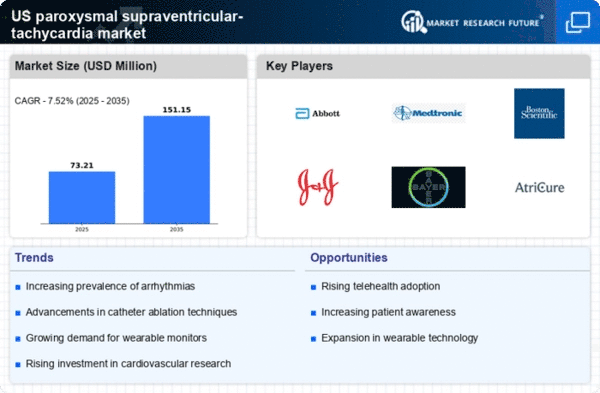

The paroxysmal supraventricular-tachycardia market is experiencing a surge in the development of novel therapeutics. Recent advancements in pharmacological treatments, including antiarrhythmic drugs and catheter ablation techniques, are reshaping the treatment landscape. The introduction of new medications, which may offer improved efficacy and safety profiles, is likely to attract both healthcare providers and patients. For instance, the FDA has approved several new antiarrhythmic agents in recent years, which could potentially enhance treatment outcomes for patients suffering from paroxysmal supraventricular-tachycardia. This influx of innovative therapies may stimulate competition among pharmaceutical companies, further propelling growth in the paroxysmal supraventricular-tachycardia market.

Technological Integration in Healthcare

The integration of technology in healthcare is a pivotal driver for the paroxysmal supraventricular-tachycardia market. The adoption of telemedicine, wearable devices, and mobile health applications is transforming patient monitoring and management. These technologies enable real-time tracking of heart rhythms, allowing for timely interventions and improved patient outcomes. In 2023, the telehealth market in the US was valued at approximately $29 billion, indicating a robust growth trajectory. This technological evolution not only enhances patient engagement but also facilitates better communication between patients and healthcare providers. As technology continues to advance, it is expected to play a crucial role in shaping the future of the paroxysmal supraventricular-tachycardia market.

Increased Focus on Preventive Healthcare

The paroxysmal supraventricular-tachycardia market is influenced by the growing emphasis on preventive healthcare measures. As awareness of cardiovascular health rises, healthcare providers are increasingly advocating for early detection and management of arrhythmias. This shift towards preventive care may lead to more patients being diagnosed and treated for paroxysmal supraventricular-tachycardia at earlier stages. Initiatives aimed at educating the public about heart health and the importance of regular check-ups are likely to contribute to an increase in patient referrals to specialists. Consequently, this trend may enhance the demand for diagnostic tools and treatment options within the paroxysmal supraventricular-tachycardia market.

Regulatory Support for Innovative Treatments

Regulatory support for innovative treatments is a significant driver for the paroxysmal supraventricular-tachycardia market. The US Food and Drug Administration (FDA) has implemented various initiatives to expedite the approval process for new therapies, particularly those addressing unmet medical needs. This regulatory environment encourages pharmaceutical companies to invest in research and development of novel treatments for paroxysmal supraventricular-tachycardia. The FDA's Breakthrough Therapy Designation and Fast Track programs are examples of how regulatory bodies are facilitating quicker access to potentially life-saving therapies. As a result, the paroxysmal supraventricular-tachycardia market is likely to witness an influx of innovative treatment options, ultimately benefiting patients.