Top Industry Leaders in the Passive Authentication Market

The Silent Guardians: Exploring the Competitive Landscape of the Passive Authentication Market

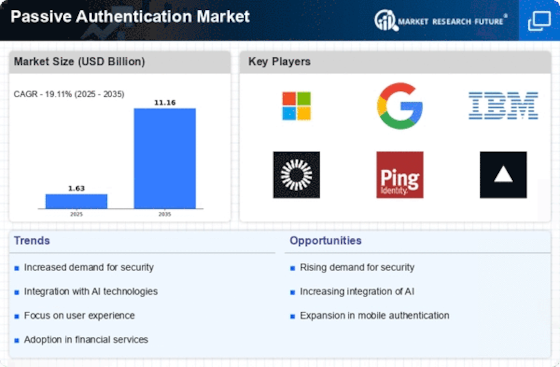

The Passive Authentication Market is experiencing a meteoric rise, fueled by increasing cybersecurity concerns, user fatigue with traditional authentication methods, and the promise of seamless and frictionless user experiences. With a projected CAGR exceeding until 2028, the market is attracting a diverse range of players, all vying for a piece of the action. Understanding the competitive landscape is crucial for navigating this dynamic space and choosing the right solutions to enhance security without compromising user convenience.

Key Players:

- Fortress Identity

- NEC Corporation

- IBM Corporation

- Thales Group

- OneSpan Inc.

- Cisco Systems Inc.

- Nuance Communications Inc

- BioCatch

- NuData Security

- Vasco Data Security International

Strategies for Market Share Growth:

-

Product Differentiation: Players compete on the sophistication of their behavioral analysis algorithms, data integration capabilities, threat intelligence platforms, and the accuracy of biometric identification. Advanced features like adaptive authentication and real-time anomaly detection become key differentiators.

-

Strategic Partnerships: Partnerships with system integrators, managed service providers (MSPs), and other security vendors expand reach and offer bundled solutions catering to specific customer needs. Acquisitions of smaller players provide access to niche technologies and talent.

-

Compliance Driven Development: Integrating solutions with data privacy regulations like GDPR and HIPAA fosters customer trust and market penetration. Compliance-driven feature development attracts organizations in regulated industries.

-

Frictionless User Experience: Balancing security with user convenience is crucial. Players emphasizing seamless integration with existing workflows, minimal user intervention, and fast authentication processes gain a competitive edge.

Factors for Market Share Analysis:

-

Product Portfolio Breadth: The range of data sources analyzed (network activity, device usage, biometrics) and the types of threats detected (insider threats, account takeovers, anomalous behavior) contribute to market share.

-

Customer Base Demographics: The number and type of customers served (enterprise, SMB, government, specific industries) indicate a company's reach and market penetration.

-

Platform Agnosticism: Compatibility with multiple operating systems and platforms expands reach and caters to diverse customer environments.

-

Integration Capabilities: Seamless integration with existing security infrastructure like SIEM and IAM platforms simplifies deployment and enhances overall security posture.

Current Investment Trends:

-

AI and Machine Learning: Investment in developing advanced AI algorithms for user behavior analysis, anomaly detection, and threat prediction is accelerating, fueling the next level of PA sophistication.

-

Cloud Focus: Building secure and scalable cloud-based PA platforms is a major trend, catering to the increasing adoption of cloud-based applications and hybrid IT environments.

-

Biometric Integration: Integrating various biometric modalities like voice, facial recognition, and iris scans creates robust multi-factor authentication solutions for high-security scenarios.

-

Contextual Awareness: PA solutions that factor in context, such as user location, device type, and past activity, significantly enhance accuracy and reduce false positives.

The PA market is dynamic and constantly evolving. Understanding the competitive landscape, including key players, strategies, and emerging trends, empowers businesses to choose the right solutions to enhance security and deliver frictionless user experiences in today's increasingly digital world.

Latest Company Updates:

-

January 9, 2024: FIDO Alliance announces the launch of FIDO2 Go, a new initiative to promote the adoption of passive authentication solutions across various platforms and devices. -

December 13, 2023: Microsoft introduces Windows Hello for Business, a cloud-based passive authentication solution that leverages facial recognition and fingerprint scanning for secure access to business applications. -

November 28, 2023: Apple expands its Face ID technology to web applications on Macbooks, offering seamless passive authentication for online logins.