- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

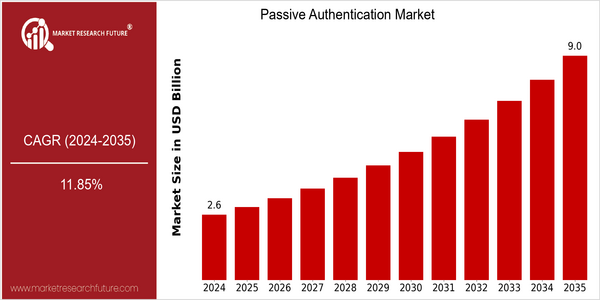

| Year | Value |

|---|---|

| 2024 | USD 2.63 Billion |

| 2035 | USD 9.0 Billion |

| CAGR (2025-2035) | 11.85 % |

Note – Market size depicts the revenue generated over the financial year

The Passive Authentication Market is projected to reach USD 2.63 billion by 2024 and to reach USD 9.0 billion by 2035. This represents a CAGR of 11.86% from 2025 to 2035, indicating a strong growth in demand for passive authentication solutions. The growing need for enhanced security measures and the increasing use of biometrics and machine learning are the main drivers of this market. In order to maintain high security standards while facilitating the use of applications, passive methods of verification are becoming increasingly popular. Passive solutions are especially suited to mobile and wearable devices. In addition, the emergence of the Internet of Things and the integration of artificial intelligence in security solutions are also contributing to the growth of the market. Microsoft, Google and IBM are at the forefront of this development, investing heavily in research and development to improve their passive solutions. Strategic initiatives, such as the establishment of strategic alliances and the integration of advanced authentication technology into existing platforms, are also contributing to the growth of the market. The development of the passive authentication market will continue to play an important role in shaping the future of secure user interactions.

Regional Market Size

Regional Deep Dive

Passive Authentication Market is expected to grow significantly across various regions, owing to the increasing demand for better security and the need for more convenient user experience. North America has a well-developed technology industry and high-quality digital services. Europe is focusing on enhancing data security by introducing stricter data protection laws. Asia-Pacific is undergoing rapid digital transformation, which is driving the demand for passive authentication solutions. Middle East and Africa are slowly adopting these solutions due to the need for secure online transactions. The Latin American region is experiencing rapid growth due to the increase in the penetration of the Internet and mobile devices.

Europe

- The General Data Protection Regulation (GDPR) has significantly influenced the adoption of passive authentication technologies in Europe, as organizations seek to enhance user privacy and data security.

- Innovations in AI and machine learning are being leveraged by companies like Gemalto and Thales to develop advanced passive authentication solutions that can analyze user behavior patterns for improved security.

Asia Pacific

- Countries like China and India are rapidly adopting mobile payment solutions, which are driving the demand for passive authentication methods to ensure secure transactions, with companies like Alipay and Paytm at the forefront.

- The increasing focus on cybersecurity in the region has led to government initiatives promoting the use of passive authentication technologies, such as the Cybersecurity Law in China, which mandates stronger security measures for digital services.

Latin America

- The increasing smartphone penetration in Latin America is driving the demand for passive authentication solutions, with companies like Mercado Libre integrating biometric authentication into their platforms to enhance security.

- Regulatory frameworks in countries like Brazil, particularly the General Data Protection Law (LGPD), are encouraging organizations to adopt passive authentication methods to comply with data protection requirements.

North America

- The biometrics of the American continent, that is to say, the facial recognition and the fingerprint, are changing the conditions of the passive recognition in the United States. The leaders in this field are the American companies, whose products are enriched with these devices, like the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the American company, the

- In addition, regulatory changes such as the Californian Data Protection Act are driving companies to adopt more secure methods of authentication in order to comply with data protection standards, thus increasing the demand for passive identification solutions.

Middle East And Africa

- The UAE's government has launched initiatives like the Smart Dubai project, which aims to enhance digital security and user experience through the implementation of passive authentication technologies.

- The growing e-commerce sector in Africa is prompting businesses to adopt passive authentication solutions to build consumer trust and secure online transactions, with companies like Jumia leading the way.

Did You Know?

“Approximately 60% of consumers are more likely to engage with a service that offers passive authentication methods, highlighting the growing preference for seamless user experiences.” — Source: Global Consumer Insights Report 2023

Segmental Market Size

Passive Authentication is a rapidly evolving area within the broader security landscape, and is characterized by increasing adoption across industries. The market is mainly driven by the growing demand for seamless user experience and enhanced security, as organizations seek to mitigate the risks associated with traditional methods of authentication. Furthermore, regulatory requirements such as the General Data Protection Regulation and the Californian Consumer Privacy Act of 2018 are putting increased pressure on companies to protect user data and ensure compliance. Hence, the market is currently in the scale deployment stage, with major vendors such as Google and Microsoft driving the adoption of Passive Authentication solutions. These companies are deploying machine learning and biometrics to enhance security without compromising on the convenience of the users. The key use cases of Passive Authentication include financial services, where it is used to detect fraudulent transactions, and e-commerce, where it is used to simplify the process of logging in. The shift towards remote work and the rise in cyber threats are accelerating the adoption of Passive Authentication solutions. Technological developments such as advances in AI and machine learning are further shaping the evolution of this market.

Future Outlook

During the forecast period, the Passive Authentication Market is expected to grow from $2.63 billion in 2024 to $9.0 billion by 2035, at a robust CAGR of 11.85%. It is driven by the increasing demand for enhanced security and enhanced user experience across various sectors such as banking and financial services, e-commerce, and healthcare. Passive authentication technology is expected to gain wide acceptance as more organizations adopt a user-centric approach to security. By 2035, it is expected to be a dominant security solution in the banking and financial services, e-commerce, and healthcare industries. Artificial intelligence and machine learning will play a critical role in the development of passive authentication methods, enabling more accurate and efficient verification of users. In addition, the growing focus on regulatory compliance and data privacy will drive the market, as organizations implement solutions that not only enhance security but also align with evolving regulatory frameworks. The growing trend of remote working will also drive the market. These trends will require organizations to adopt newer authentication methods that can adapt to a range of working environments and user behavior. In the coming years, the Passive Authentication Market will transform the way organizations approach security.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.1 Billion |

| Market Size Value In 2023 | USD 1.34 Billion |

| Growth Rate | 22.10% (2023-2032) |

Passive Authentication Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.