Market Analysis

In-depth Analysis of Patient Handling Equipment Market Industry Landscape

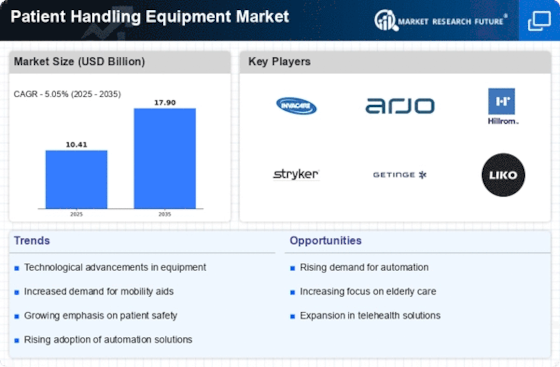

The Patient Handling Equipment market is a fundamental area within healthcare, devoted to giving answers for the protected and productive development of patients. This market envelops an extensive variety of equipment intended to help healthcare experts in lifting, transferring, and positioning patients, advancing both patient comfort and caregiver safety. Market elements are unequivocally affected by segment factors, especially the ageing populace. As the worldwide population ages, there is an expanded universality of persistent conditions and inabilities, driving the demand for Patient Handling Equipment to work with the consideration of older and movability impeded people. The developing pattern towards home healthcare administrations shapes market elements. Patient Handling Equipment intended for home use, like portable lifts and transfer devices, is in demand, mirroring the rising inclination for giving consideration in a home setting. Financial elements, including cost contemplations and spending plan restraints inside healthcare systems, influence market elements. Reasonable and smart patient handling arrangements are essential for boundless reception, impacting buying choices for both enormous foundations and more modest healthcare offices. The pervasiveness of external muscle wounds among healthcare laborers is a critical driver of market elements. Patient handling assignments frequently present actual difficulties, and the demand for equipment that limits the risk of wounds among caregivers is on the rise. Market elements are affected by patterns in equipment rental and renting. Some healthcare offices settle on renting patient handling equipment to oversee expenses and access the most recent innovation without a significant upfront speculation, influencing the market structure. The Patient Handling Equipment market is portrayed by worldwide rivalry among makers. Market elements are impacted by the worldwide presence of central participants, prompting the trading of innovations, evaluating techniques, and a different scope of item contributions. Market elements are molded by patient and caregiver inclinations. Equipment that improves patient comfort, nobility, and autonomy, while additionally facilitating the responsibility of caregivers, is bound to acquire acknowledgment, affecting market patterns and item advancement.

Leave a Comment