Market Share

Patient Handling Equipment Market Share Analysis

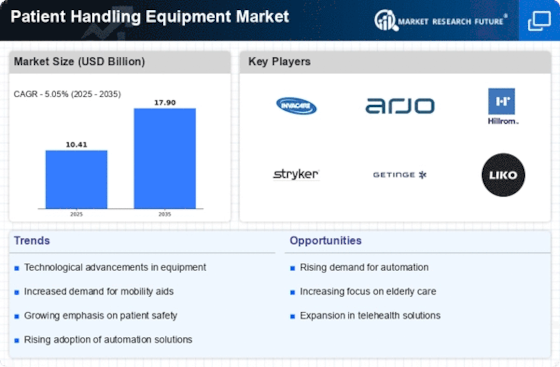

Driving organizations in the Patient Handling Equipment market focus on item expansion and persistent advancement. This includes fostering a scope of equipment, for example, patient lifts, relocation aids, and versatility devices with cutting edge includes that upgrade safety, comfort, and convenience. Development drives item separation and positions an organization as a supplier of state-of-the-art arrangements. Perceiving the different necessities of healthcare offices, organizations center around rebuilding their patient handling equipment for different settings. Fitting items to meet the prerequisites of emergency clinics, long haul care offices, and home healthcare empowers market pioneers to take care of a wide client base and gain an upper hand. Evaluating systems assume a vital part in market share situating. Organizations frequently take on essential evaluating to offer some incentive for cash while guaranteeing rationality for healthcare suppliers. Laying out areas of strength for a suggestion, which incorporates item highlights, unwavering quality, and after-deals provision, improves market infiltration, and encourages client loyalty. Entering worldwide markets is a vital system for organizations in the Patient Handling Equipment area. Recognizing districts with expanding healthcare needs and laying out momentous areas of strength for a presence through organizations and distribution networks add to market extension and expanded market share. Underlining ergonomic plan and easy to use highlights is pivotal for market pioneers. Patient handling equipment that is not difficult to utilize and limits burden on caregivers adds to expanded reception. Ergonomically planned items upgrade client fulfillment, positioning an organization as a supplier of arrangements that focus on both patient and caregiver prosperity. Remaining versatile to changing healthcare models is imperative for supported market positioning. Organizations that adjust their patient handling equipment contributions to developing patterns like locally established care or telehealth show adaptability and relevance in the powerful healthcare landscape.

Leave a Comment