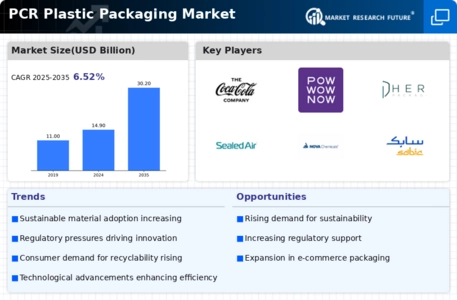

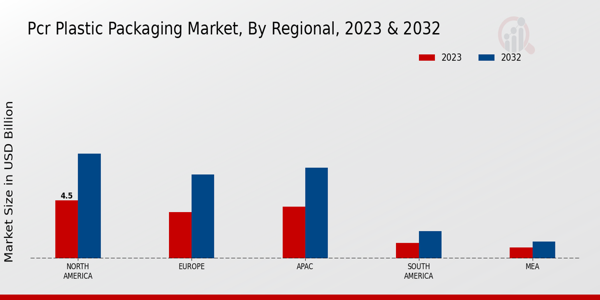

Market Growth Projections

Growing Environmental Awareness

The increasing global consciousness regarding environmental sustainability drives the Global PCR Plastic Packaging Market Industry. Consumers are becoming more aware of the detrimental effects of plastic waste, leading to a heightened demand for eco-friendly packaging solutions. This shift is evident as brands adopt post-consumer recycled (PCR) materials to align with consumer preferences. The market is projected to reach 14.9 USD Billion in 2024, reflecting a significant response to these environmental concerns. Companies are likely to invest in innovative recycling technologies and sustainable practices, further propelling the growth of PCR plastic packaging as a viable alternative to traditional plastics.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are becoming integral to business strategies, thereby impacting the Global PCR Plastic Packaging Market Industry. Many companies are setting ambitious sustainability goals, including commitments to reduce plastic waste and increase the use of recycled materials in their packaging. These initiatives not only enhance brand reputation but also resonate with environmentally conscious consumers. As corporations strive to meet their sustainability targets, the demand for PCR plastic packaging is likely to surge. This trend is expected to play a crucial role in the market's growth trajectory, potentially leading to a market size of 30.2 USD Billion by 2035.

Technological Advancements in Recycling

Technological innovations in recycling processes are transforming the Global PCR Plastic Packaging Market Industry. Advances in sorting, cleaning, and processing technologies enhance the efficiency of recycling operations, making it more feasible to incorporate PCR materials into packaging. Innovations such as chemical recycling and improved mechanical recycling methods are expanding the range of plastics that can be recycled. This not only increases the availability of PCR materials but also reduces production costs, making them more attractive to manufacturers. As the industry adapts to these advancements, it is likely to experience a compound annual growth rate of 6.66% from 2025 to 2035.

Consumer Demand for Sustainable Products

The rising consumer demand for sustainable products significantly influences the Global PCR Plastic Packaging Market Industry. As consumers prioritize eco-friendly options, brands are compelled to adopt sustainable packaging solutions to maintain market competitiveness. This trend is evident across various sectors, including food and beverage, cosmetics, and household goods, where companies are increasingly utilizing PCR materials. The shift in consumer preferences is not merely a trend but appears to be a long-term change, prompting manufacturers to innovate and invest in sustainable practices. This growing demand is expected to contribute to the market's expansion, with a projected value of 14.9 USD Billion in 2024.

Regulatory Support for Sustainable Practices

Government regulations promoting sustainability are pivotal in shaping the Global PCR Plastic Packaging Market Industry. Many countries are implementing stringent policies aimed at reducing plastic waste and encouraging the use of recycled materials. For instance, regulations mandating the use of PCR content in packaging are becoming more prevalent. This regulatory landscape not only incentivizes manufacturers to adopt PCR materials but also enhances consumer trust in sustainable products. As a result, the industry is expected to witness robust growth, with projections indicating a market size of 30.2 USD Billion by 2035, driven by compliance with these regulations.