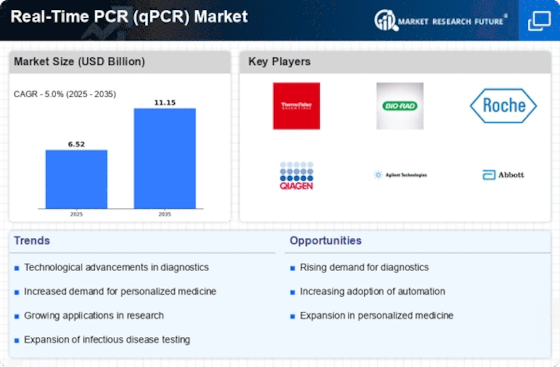

Advancements in qPCR Technology

Technological innovations in Real-Time PCR (qPCR) are propelling the market forward. Recent advancements include the development of more sensitive and specific reagents, improved thermal cyclers, and enhanced data analysis software. These innovations not only increase the accuracy of results but also reduce the time required for testing. The introduction of digital PCR, a more precise variant of qPCR, is also gaining traction, offering absolute quantification of nucleic acids without the need for standard curves. As laboratories seek to improve efficiency and reliability, the adoption of these advanced technologies is expected to drive growth in the Real-Time PCR (qPCR) Market. Furthermore, the integration of automation in qPCR workflows is likely to enhance throughput, making it an attractive option for high-volume testing environments.

Rising Investment in Genomic Research

The surge in investment directed towards genomic research is significantly influencing the Real-Time PCR (qPCR) Market. As researchers explore the complexities of genetic material, the demand for precise and reliable quantification methods has escalated. qPCR serves as a fundamental tool in various applications, including gene expression analysis, genotyping, and genetic variation studies. Recent statistics indicate that funding for genomic research has seen a marked increase, with both public and private sectors recognizing its potential. This influx of capital is likely to foster innovation and expand the application scope of qPCR technologies. Consequently, the Real-Time PCR (qPCR) Market stands to benefit from the growing emphasis on personalized medicine and targeted therapies, which rely heavily on genomic insights.

Growing Demand for Environmental Testing

The escalating need for environmental testing is emerging as a significant driver for the Real-Time PCR (qPCR) Market. With increasing concerns over environmental contamination and public health, the demand for reliable testing methods to detect pathogens in various environmental samples is on the rise. Real-Time PCR offers a rapid and sensitive approach to monitor microbial contamination in water, soil, and food products. Recent data suggests that the environmental testing market is expanding, with qPCR being a preferred method due to its accuracy and efficiency. As regulatory bodies impose stricter guidelines for environmental safety, the adoption of qPCR technology is expected to grow, thereby enhancing its relevance in the Real-Time PCR (qPCR) Market.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the Real-Time PCR (qPCR) Market. As healthcare moves away from a one-size-fits-all approach, the need for tailored diagnostic and therapeutic strategies becomes increasingly evident. Real-Time PCR technology plays a pivotal role in this paradigm shift by enabling the analysis of individual genetic profiles. This capability allows for the identification of specific biomarkers associated with diseases, facilitating more effective treatment plans. The market for personalized medicine is projected to expand, driven by advancements in molecular diagnostics, including qPCR. As healthcare providers seek to enhance patient outcomes through precision medicine, the demand for qPCR applications is likely to rise, further solidifying its position in the market.

Increasing Prevalence of Infectious Diseases

The rising incidence of infectious diseases is a primary driver for the Real-Time PCR (qPCR) Market. As pathogens evolve and new strains emerge, the need for rapid and accurate diagnostic tools becomes paramount. Real-Time PCR technology offers the ability to detect and quantify nucleic acids in real-time, facilitating timely clinical decisions. According to recent data, the market for infectious disease diagnostics is projected to grow significantly, with qPCR playing a crucial role in this expansion. The ability to perform multiplex assays further enhances the utility of qPCR in identifying multiple pathogens simultaneously, thereby streamlining the diagnostic process. This trend is likely to continue, as healthcare systems increasingly prioritize rapid response capabilities to manage outbreaks effectively.