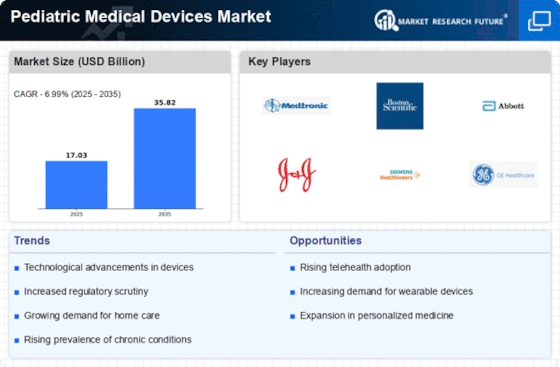

Pediatric Medical Device Market Summary

As per Market Research Future analysis, the Pediatric Medical Devices Market was estimated at 17.03 USD Billion in 2024. The Pediatric Medical Devices industry is projected to grow from 18.22 USD Billion in 2025 to 35.82 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.99% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Pediatric Medical Devices Market is poised for substantial growth driven by technological advancements and increasing healthcare investments.

- Technological advancements are reshaping the Pediatric Medical Devices Market, enhancing device efficacy and safety.

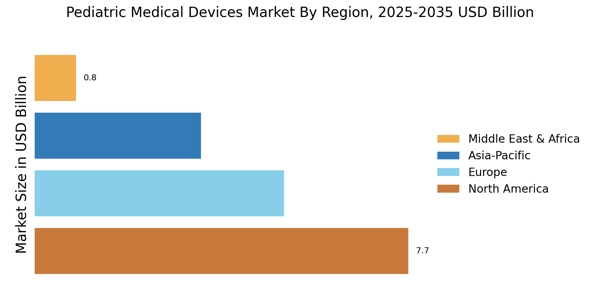

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for pediatric medical devices.

- Monitoring devices dominate the market, whereas telemedicine solutions are rapidly gaining traction among healthcare providers.

- The rising prevalence of pediatric diseases and increased investment in pediatric healthcare are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 17.03 (USD Billion) |

| 2035 Market Size | 35.82 (USD Billion) |

| CAGR (2025 - 2035) | 6.99% |

Major Players

Medtronic (US), Boston Scientific (US), Abbott Laboratories (US), Johnson & Johnson (US), Siemens Healthineers (DE), GE Healthcare (US), Philips Healthcare (NL), B. Braun Melsungen AG (DE), Stryker Corporation (US)