Innovation in Product Development

Innovation plays a vital role in the Personal Care Product Contract Manufacturing Market, as brands continuously seek to differentiate their offerings. The demand for innovative formulations, packaging, and delivery systems is on the rise, prompting contract manufacturers to invest in research and development. This focus on innovation allows manufacturers to create unique products that cater to specific consumer needs, such as anti-aging solutions or multifunctional products. Market data suggests that companies that prioritize innovation are more likely to capture market share and foster brand loyalty. As a result, contract manufacturers are increasingly viewed as strategic partners in the product development process.

Rising Demand for Natural Ingredients

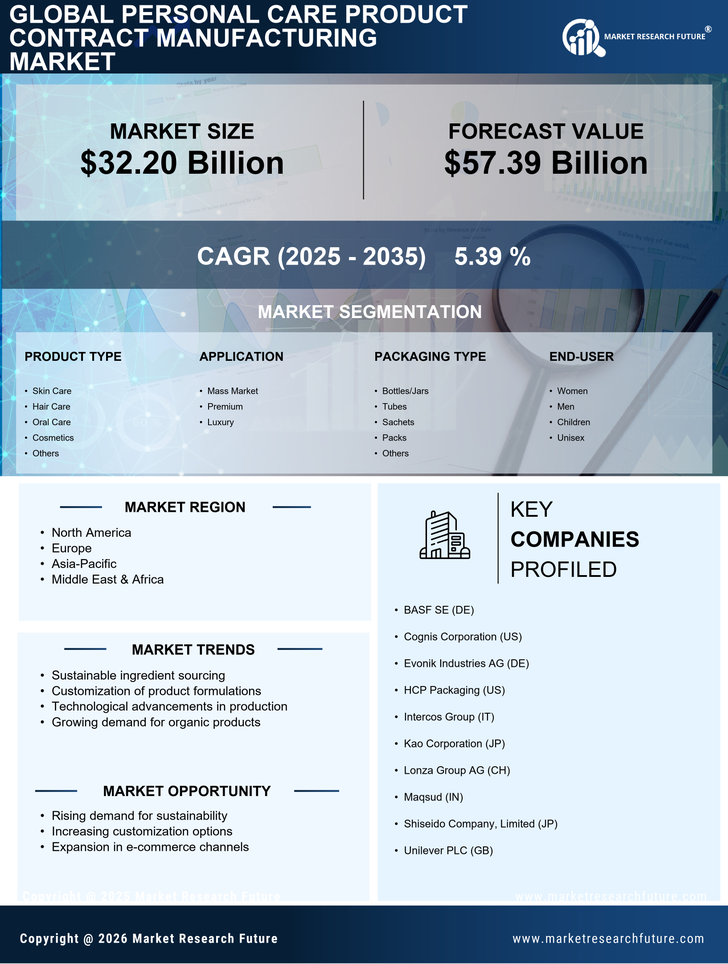

The increasing consumer preference for natural and organic personal care products is a pivotal driver in the Personal Care Product Contract Manufacturing Market. As consumers become more health-conscious, they seek products that are free from synthetic chemicals and harmful additives. This trend has led to a surge in demand for manufacturers who can provide formulations that align with these preferences. According to recent data, the market for natural personal care products is projected to grow at a compound annual growth rate of over 10% in the coming years. Consequently, contract manufacturers are adapting their processes to incorporate natural ingredients, thereby enhancing their market appeal and competitiveness.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a key driver in the Personal Care Product Contract Manufacturing Market, as consumers become more environmentally conscious. Brands are under pressure to adopt eco-friendly practices, from sourcing raw materials to packaging solutions. This shift towards sustainability is influencing contract manufacturers to implement greener production methods and reduce waste. Data indicates that the market for sustainable personal care products is expected to grow significantly, with consumers willing to pay a premium for eco-friendly options. Consequently, contract manufacturers that prioritize sustainability are likely to gain a competitive edge, appealing to a growing segment of environmentally aware consumers.

Regulatory Compliance and Safety Standards

The stringent regulatory environment surrounding personal care products is a critical driver for the Personal Care Product Contract Manufacturing Market. Manufacturers must adhere to various safety and quality standards set by regulatory bodies, which can vary by region. Compliance with these regulations not only ensures consumer safety but also enhances brand credibility. As regulations become more rigorous, contract manufacturers are investing in quality assurance processes and certifications to meet these requirements. This focus on compliance is expected to drive growth in the market, as brands increasingly rely on contract manufacturers to navigate the complexities of regulatory landscapes.

E-commerce Growth and Digital Transformation

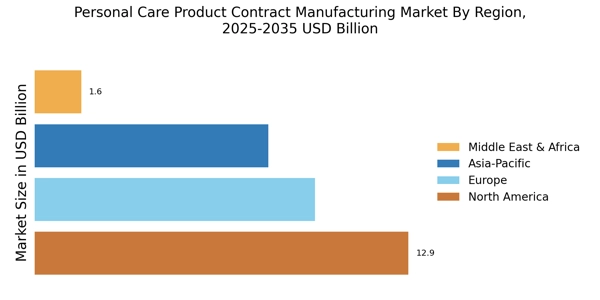

The rapid expansion of e-commerce platforms is reshaping the landscape of the Personal Care Product Contract Manufacturing Market. With more consumers opting to purchase personal care products online, manufacturers are increasingly required to adapt their strategies to meet this demand. The shift towards digital retailing has prompted contract manufacturers to enhance their supply chain efficiencies and improve product visibility. Data indicates that e-commerce sales in the personal care sector have seen a significant uptick, with projections suggesting that online sales could account for over 30% of total sales in the near future. This trend compels manufacturers to innovate and streamline their operations to cater to the evolving consumer purchasing behaviors.