Market Analysis

In-depth Analysis of Personal Data Recovery Software Market Industry Landscape

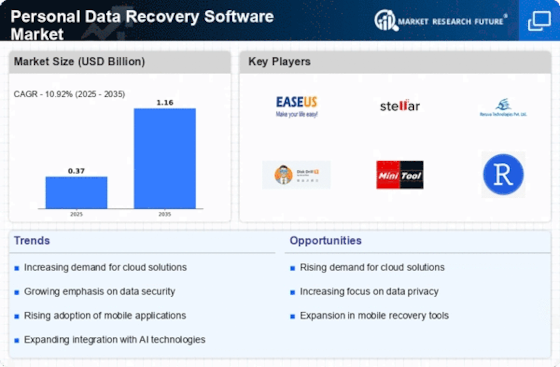

The market elements of personal data recovery software are impacted by different variables that shape its development and advancement. One of the vital drivers of the personal data recovery software market is the heightening dependence on computerized data in personal and expert settings. Personal data recovery software tends to this need by furnishing clients with the necessary resources to recuperate lost or blocked off data, subsequently driving its reception and market development. Moreover, the rising examples of data misfortune and inadvertent cancellation add to the elements of the personal data recovery software market. People and organizations experience data misfortune situations because of different reasons, including equipment glitches, framework crashes, infection assaults, and human blunder. Personal data recovery software offers an answer for these moves by empowering clients to recuperate lost data, reestablish erased documents, and recover out of reach data from volume gadgets. This interest for solid and powerful data recovery arrangements drives the market's importance and engaging quality to a wide client base. Besides, the consistent headways in data recovery innovation and software capacities assume an essential part in molding the elements of the personal data recovery software market. Progressing advancements in data recovery calculations, document framework backing, and UIs add to the improvement of more productive, complete, and easy to use data recovery software. These headways engage people to address a more extensive scope of data misfortune situations, including intended drives, parcel mistakes, and damaged records, improving the market's capacity to take special care of different client needs and specialized prerequisites. Data protection and security concerns, data trustworthiness and exactness issues, and the requirement for thorough client care and training address huge difficulties for the market. Furthermore, the prerequisite for viable marketing and client attention to separate among certifiable and fake data recovery software represents a remarkable obstacle. In any case, continuous endeavors to address these difficulties, for example, the advancement of vigorous safety efforts, data ethics check devices, and client schooling drives, add to the market's flexibility and development.

Leave a Comment