Petroleum Resins Size

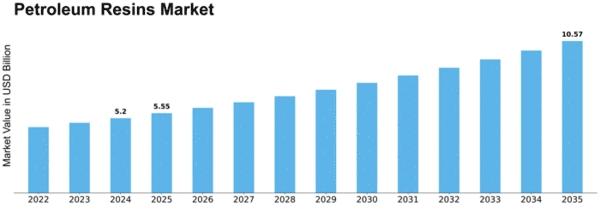

Petroleum Resins Market Growth Projections and Opportunities

The global petroleum resin market, valued at USD 2,956.0 million in 2018, is anticipated to reach USD 4,626.7 million by the end of 2025, reflecting a Compound Annual Growth Rate (CAGR) of 6.65% during the forecast period. In terms of volume, the market stood at 1,869.3 kilotons in 2018, with a projected increase to 2,767.2 kilotons by the close of 2025. The primary driver for this growth is the expanding application of petroleum resin in the production of hot-melt adhesives. Renowned for its high softening point, superior tackiness, and resistance to acid, alkalis, and water, petroleum resin is a key component in adhesives, sealants, and coatings. The paints and coating industry is another significant contributor to the global market, further propelling its growth. Petroleum resins are extensively used in the production of road-marking paints and coatings for the automotive and construction sectors. Their applications extend to rubber compounding, adding to the overall demand. Despite these positive trends, challenges such as volatile raw material prices and the presence of readily available substitutes like rosin resin may pose obstacles to market growth. Nevertheless, the burgeoning construction industry in emerging regions like Asia-Pacific and the Middle East & Africa is expected to present substantial opportunities for petroleum resin producers. The global petroleum resins market is segmented by type, with C5 resins dominating the market with a share of 35.59% in 2018. C5 resins are valued for their aliphatic nature, making them highly compatible with various polymers such as natural and synthetic rubber, hot-melt adhesives, and paints & coatings. The C5 resin segment, valued at USD 1,170.3 million in 2018, is anticipated to grow at a CAGR of 7.43% during the forecast period, reaching USD 1,927.6 million by 2025. Hydrogenated petroleum resins are projected to exhibit the second-largest CAGR of 7.17% owing to their unique performance characteristics. The market is further categorized by form, distinguishing between true and masterbatch forms of petroleum resins. The true form is predominantly utilized across various end-use industries due to its easy availability and cost-effectiveness. The true form segment, valued at USD 2,793.4 million in 2018, is expected to register a CAGR of 6.74%, reaching USD 4,397.1 million by 2025. Application-wise, the adhesives segment holds the largest market share of 40.8% in 2018, valued at USD 1,206.0 million and projected to reach USD 1,935.5 million by 2025, boasting the highest CAGR of 7.04%. Petroleum resin-based adhesives are extensively employed in various end-use industries, including automotive, construction, and personal hygiene. The end-use industry segment categorizes the market into construction, automotive, packaging, personal hygiene, and others. The construction industry commands the market, holding a value share of 38.50% in 2018, with a valuation of USD 1,138.1 million. It is expected to be the fastest-growing segment during the review period, with petroleum resin coatings finding applications in industrial roofing, horizontal masonry, and as a binder for hot-melt road-marking materials used in road construction projects. Geographically, the Asia-Pacific region dominates the global petroleum resins market, contributing 46.80% by value in 2018. This regional dominance is expected to persist due to rapid industrialization, growth in end-use industries such as construction, automotive, and packaging. The Asia-Pacific market, valued at USD 1,383.4 million in 2018, is anticipated to register a CAGR of 7.31%, reaching USD 2,260.4 million by the end of 2025. The growth trajectory is attributed to the region's robust industrial development and increasing demand for petroleum resins across diverse applications. the global petroleum resin market is poised for substantial growth, fueled by its integral role in adhesive, coating, and construction applications, particularly in burgeoning regions such as Asia-Pacific and the Middle East & Africa. Despite challenges, the market is expected to capitalize on emerging opportunities, driven by the expanding construction industry and increased infrastructure development activities.

Leave a Comment