Increasing Regulatory Compliance

The Pharmaceutical Processing Seal Market is experiencing a surge in demand due to the increasing regulatory compliance requirements imposed by health authorities. Regulatory bodies are enforcing stringent guidelines to ensure product safety and efficacy, which necessitates the use of high-quality seals in pharmaceutical manufacturing. As a result, manufacturers are compelled to invest in advanced sealing technologies that meet these regulations. The market for seals that comply with Good Manufacturing Practices (GMP) is projected to grow significantly, as companies seek to avoid costly penalties and ensure uninterrupted production. This trend indicates a robust growth trajectory for the Pharmaceutical Processing Seal Market, as compliance becomes a critical factor in operational strategies.

Rising Focus on Quality Assurance

The Pharmaceutical Processing Seal Market is benefiting from a rising focus on quality assurance within the pharmaceutical sector. Companies are increasingly prioritizing quality control measures to ensure that their products meet the highest standards. This trend is leading to a greater demand for seals that can provide reliable performance and prevent contamination during the manufacturing process. As quality assurance becomes a central tenet of pharmaceutical production, the market for high-performance seals is expected to expand. The emphasis on quality is further supported by the growing consumer awareness regarding product safety, which compels manufacturers to adopt superior sealing solutions. This focus on quality assurance is likely to drive sustained growth in the Pharmaceutical Processing Seal Market.

Growth in Pharmaceutical Production

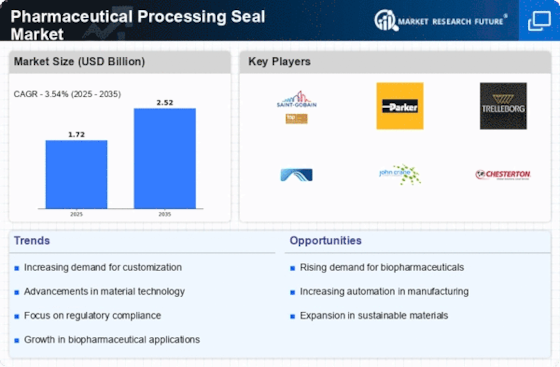

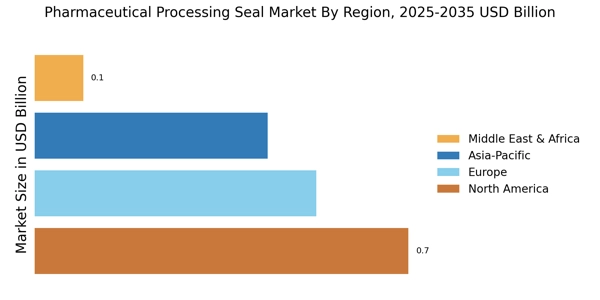

The Pharmaceutical Processing Seal Market is poised for growth, driven by the expansion of pharmaceutical production capacities. As the demand for medications continues to rise, manufacturers are scaling up their operations, which in turn increases the need for reliable sealing solutions. The market is projected to witness a compound annual growth rate (CAGR) of approximately 5% over the next few years, reflecting the increasing investments in production facilities. This growth is particularly evident in emerging markets, where pharmaceutical companies are establishing new plants to cater to local and regional demands. Consequently, the Pharmaceutical Processing Seal Market is likely to benefit from this expansion, as the need for effective seals becomes paramount in maintaining product integrity.

Expansion of Biopharmaceutical Sector

The Pharmaceutical Processing Seal Market is experiencing growth due to the expansion of the biopharmaceutical sector. As biopharmaceuticals gain prominence in the treatment landscape, the demand for specialized sealing solutions is increasing. Biopharmaceutical manufacturing processes often require unique sealing technologies that can accommodate the specific needs of biologics, such as sterility and compatibility with various solvents. The market is projected to grow as biopharmaceutical companies invest in advanced manufacturing techniques and facilities. This expansion is likely to create new opportunities for the Pharmaceutical Processing Seal Market, as manufacturers seek to ensure the integrity and safety of their products throughout the production process.

Technological Advancements in Seal Materials

The Pharmaceutical Processing Seal Market is significantly influenced by technological advancements in seal materials. Innovations in elastomers and polymers are leading to the development of seals that offer enhanced performance characteristics, such as improved chemical resistance and temperature stability. These advancements are crucial for the pharmaceutical sector, where the integrity of products is paramount. The introduction of seals that can withstand extreme conditions is likely to drive market growth, as manufacturers seek to optimize their processes. Furthermore, the increasing adoption of single-use systems in biopharmaceutical manufacturing is creating new opportunities for the Pharmaceutical Processing Seal Market, as these systems require specialized sealing solutions to ensure sterility and prevent contamination.