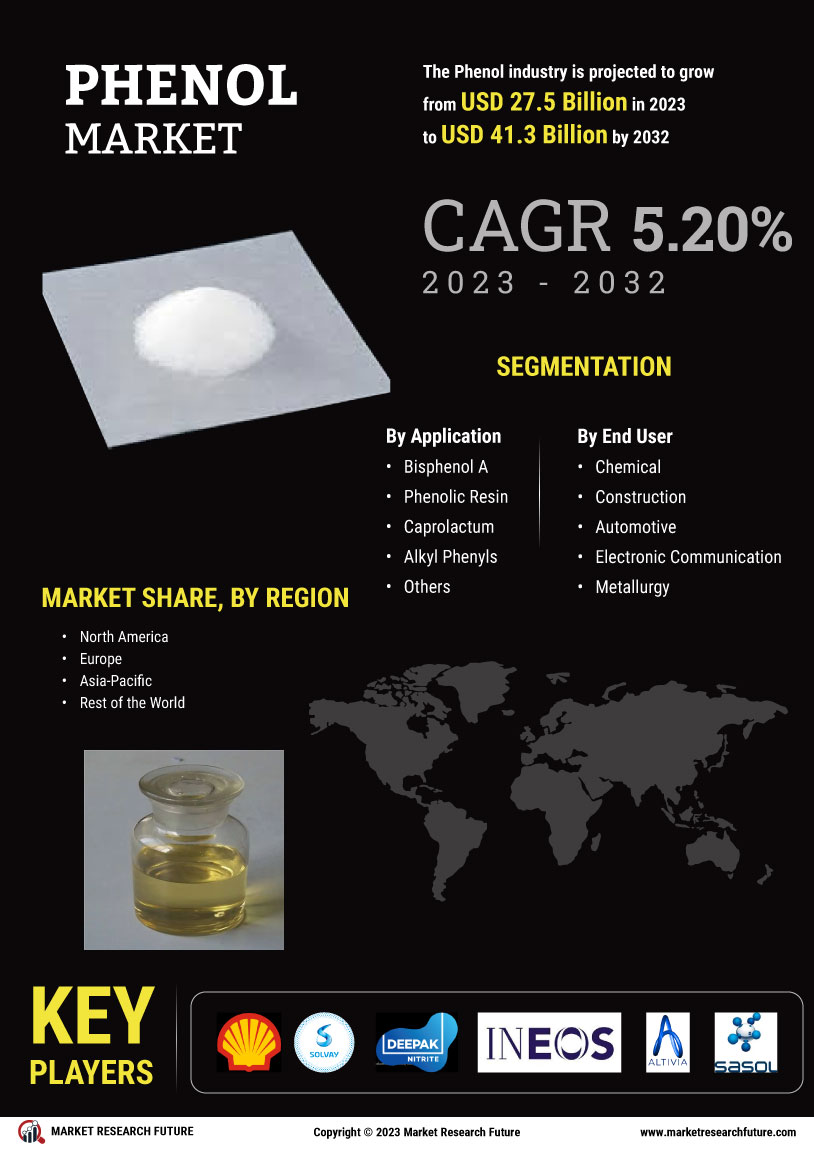

Innovations in Production Processes

Innovations in production processes are playing a pivotal role in shaping the Phenol Market. Advances in catalytic processes and the development of more efficient extraction methods are enhancing the yield and purity of phenol. For example, the introduction of new catalytic technologies has the potential to reduce production costs significantly while minimizing environmental impact. This is particularly relevant as manufacturers face increasing pressure to adopt sustainable practices. Furthermore, the implementation of these innovative techniques could lead to a more competitive landscape, as companies that invest in advanced production methods may gain a substantial market advantage. As a result, the Phenol Market is likely to witness a transformation driven by these technological advancements.

Rising Demand in End-User Industries

The Phenol Market is experiencing a notable surge in demand from various end-user sectors, particularly in the production of plastics, resins, and pharmaceuticals. As industries such as automotive and construction expand, the need for phenolic compounds, which serve as essential building blocks, increases. For instance, the automotive sector's shift towards lightweight materials has led to a heightened requirement for phenolic resins, which are valued for their durability and heat resistance. This trend is expected to continue, with projections indicating that the phenolic resin market alone could reach a valuation of several billion dollars by 2026. Consequently, the growth in these sectors is likely to drive the overall demand within the Phenol Market.

Expansion of the Pharmaceutical Sector

The expansion of the pharmaceutical sector is significantly impacting the Phenol Market. Phenol Market is a critical component in the synthesis of various pharmaceutical products, including antiseptics and analgesics. As the global population ages and healthcare needs evolve, the demand for pharmaceutical products is expected to rise. Reports suggest that the pharmaceutical market could grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This growth is likely to translate into increased consumption of phenol, as manufacturers seek to meet the rising demand for effective and safe medications. Consequently, the Phenol Market stands to benefit from this upward trend in the pharmaceutical sector.

Growing Awareness of Environmental Regulations

The Phenol Market is increasingly influenced by growing awareness of environmental regulations. Governments and regulatory bodies are implementing stricter guidelines regarding the production and use of chemical substances, including phenol. This shift is prompting manufacturers to adopt greener practices and invest in technologies that reduce emissions and waste. For instance, the introduction of regulations aimed at limiting volatile organic compounds (VOCs) is pushing companies to reformulate their products. As a consequence, the Phenol Market may see a rise in demand for bio-based phenol alternatives, which align with sustainability goals. This regulatory landscape is likely to shape the future of the industry, compelling stakeholders to innovate and adapt.

Increased Investment in Research and Development

Increased investment in research and development (R&D) is emerging as a key driver for the Phenol Market. Companies are allocating substantial resources to explore new applications for phenol and its derivatives, particularly in high-performance materials and specialty chemicals. This focus on R&D is expected to yield innovative products that cater to diverse industries, including electronics and construction. Moreover, as competition intensifies, firms that prioritize R&D may enhance their market position by offering unique solutions that address specific customer needs. The emphasis on innovation is likely to propel the Phenol Market forward, fostering growth and diversification in product offerings.