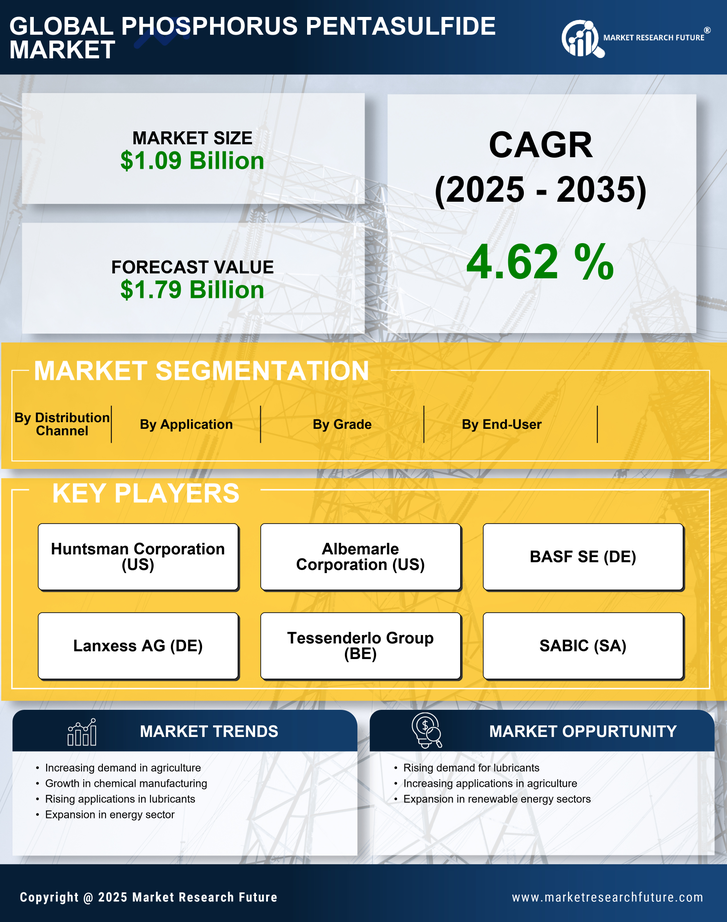

Rising Demand in Agriculture

The Phosphorus Pentasulfide Market is experiencing a notable increase in demand due to its application in agricultural practices. As the need for efficient fertilizers grows, phosphorus pentasulfide serves as a vital component in the production of phosphoric acid, which is essential for creating high-quality fertilizers. The agricultural sector is projected to expand, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This growth is driven by the necessity for enhanced crop yields and sustainable farming practices, which further propels the demand for phosphorus pentasulfide. Consequently, the Phosphorus Pentasulfide Market is likely to benefit from this trend, as manufacturers seek to meet the evolving needs of the agricultural sector.

Industrial Applications Expansion

The Phosphorus Pentasulfide Market is witnessing an expansion in its industrial applications, particularly in the production of lubricants and specialty chemicals. This compound is utilized in the synthesis of various organophosphorus compounds, which are integral to numerous industrial processes. The market for lubricants is anticipated to grow, with projections indicating a steady increase in demand across multiple sectors, including automotive and manufacturing. As industries seek to enhance performance and efficiency, the role of phosphorus pentasulfide becomes increasingly critical. This trend suggests that the Phosphorus Pentasulfide Market will continue to evolve, adapting to the diverse needs of various industrial applications.

Technological Innovations in Production

Technological advancements in the production of phosphorus pentasulfide are significantly influencing the Phosphorus Pentasulfide Market. Innovations in manufacturing processes are leading to increased efficiency and reduced production costs, which may enhance the competitiveness of phosphorus pentasulfide in various applications. For instance, the development of more efficient reactors and purification techniques has the potential to improve yield rates. As production becomes more streamlined, the market could see a rise in supply, which may stabilize prices and encourage broader adoption across different sectors. This evolution in production technology is likely to play a pivotal role in shaping the future landscape of the Phosphorus Pentasulfide Market.

Growing Awareness of Environmental Impact

There is a growing awareness regarding the environmental impact of chemical usage, which is influencing the Phosphorus Pentasulfide Market. Stakeholders across various sectors are increasingly prioritizing sustainability and eco-friendly practices. This shift is prompting manufacturers to develop phosphorus pentasulfide products that minimize environmental harm while maintaining efficacy. As consumers and industries alike demand greener alternatives, the market for phosphorus pentasulfide is likely to expand, driven by the need for sustainable solutions. This trend suggests that the Phosphorus Pentasulfide Market will continue to adapt, focusing on environmentally responsible practices to meet the expectations of a more conscious consumer base.

Regulatory Support for Sustainable Practices

The Phosphorus Pentasulfide Market is benefiting from increasing regulatory support aimed at promoting sustainable practices. Governments are implementing policies that encourage the use of environmentally friendly chemicals in agriculture and industry. This regulatory landscape is fostering a shift towards sustainable fertilizers and chemicals, which often include phosphorus pentasulfide as a key ingredient. As regulations tighten around chemical usage, the demand for compliant and sustainable products is expected to rise. This trend indicates that the Phosphorus Pentasulfide Market may experience growth as manufacturers align their offerings with regulatory requirements, thereby enhancing their market position.