-

EXECUTIVE SUMMARY AND KEY HIGHLIGHTS

-

TOP PERFORMING SEGMENTS

-

KEY TRENDS SUMMARIZED

-

STRATEGIC INSIGHTS

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- Data Mining Process

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- Secondary Research data flow:

-

PRIMARY RESEARCH:

- Primary Research DATA FLOW:

- Primary Research: Number of Interviews conducted

- Primary Research: Regional Coverage

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- Consumption & Net Trade Approach

- Revenue Analysis Approach

-

DATA FORECASTING

- Data forecasting Technique

-

DATA MODELING

- microeconomic factor analysis:

- Data modeling:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET INTRODUCTION AND DYNAMIC

-

INTRODUCTION

-

DRIVERS

- Rising imaging volumes and hospital throughput pressure

- National policies for equitable imaging and digital health

- Interoperability mandates and standards-based workflows

- AI-enabled workflow augmentation and multispecialty expansion

- Workforce constraints, remote care, and equitable access

-

MARKET OPPORTUNITIES

- Enterprise imaging and regional image exchange to cut repeats and speed diagnosis

- AI-ready PACS for workflow triage, quality assurance, and multispecialty growth

- Teleradiology and rural reach under UHC and digital health strategies

-

MARKET RESTRAINTS

- Radiology workforce shortages and burnout slow adoption and change management

- Infrastructure, interoperability gaps, and cybersecurity compliance burdens

- High-throughput pressure without aligned governance can increase repeat imaging and stall quality gains

- Integration debt from heterogeneous legacy viewers and departmental archives

- Workforce capacity and training deficits for governed, lifecycle operations

-

MARKET CHALLENGES

- Secure interoperability across fragmented infrastructures

- Workforce capacity limits change management and optimization

- Throughput pressure without coordinated governance can increase variation

-

INDUSTRY TREND ANALYSIS

-

REGULATORY ENVIRONMENT & COMPLIANCE

-

MARKET TRENDS & INNOVATION

- Enterprise imaging consolidation and cross‑site image liquidity

- Cloud and hybrid PACS for resilience, scale, and remote collaboration

- AI-adjacent PACS workflows for triage, quality, and structured analytics

- Standards-driven interoperability and national exchange enablement

- Equity-driven teleradiology and rural outreach embedded in UHC strategies

-

MARKET ENTRY & EXIT BARRIERS

- Barriers to Structural Entry

- Integration and migration hurdles

- Commercial and operational switching costs

- Exit Barriers

- Mitigation strategies for entrants and incumbents

-

PARTNERSHIPS & COLLABORATIONS

-

CONSUMER & HEALTHCARE PROVIDER PREFERENCES

-

PESTLE ANALYSIS

- Political

- Economic

- Social

- Technological

- Legal

- Environmental

-

CASE STUDY ANALYSIS

- Enterprise imaging consolidation to reduce repeats and increase speed of diagnosis

- Teleradiology Hub-and-Spoke network as a strategy to increase rural reach

- AI‑adjacent PACS workflows for improved quality and efficiency

- Hybrid/cloud PACS for resilience and continuity

- Regional exchange governed by public policy and procurement

-

INVESTMENT & FUNDING SCENARIOS

- Public Capital Programs and Grants

- Hybrid CapEx–OpEx Models

- Financing for consortium and regional imaging exchanges

- AI readiness and innovation budgets

- Risk management and compliance funding

- Return-on-investment framing without market numerics

-

LIST OF KEY PLAYERS, BY REGION

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT

-

OVERVIEW

-

HARDWARE

-

SOFTWARE

- on-premise

- cloud based

-

SERVICES

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY

-

OVERVIEW

-

X-RAY

-

COMPUTED TOMOGRAPHY (CT)

-

MAGNETIC RESONANCE IMAGING (MRI)

-

ULTRASOUND

-

NUCLEAR IMAGING

-

OTHERS

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION

-

OVERVIEW

-

PATHOLOGY

-

RADIOLOGY

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER

-

OVERVIEW

-

HOSPITALS & CLINICS

-

DIAGNOSTIC IMAGING CENTERS

-

AMBULATORY SURGERY CENTERS (ASCS)

-

OTHERS

-

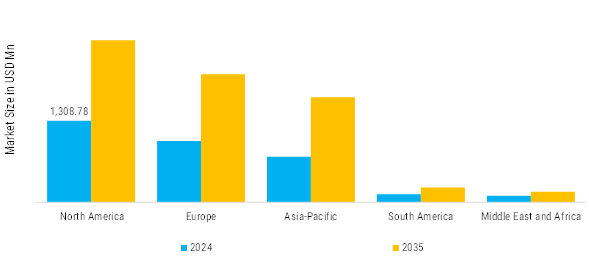

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- us

- canada

-

EUROPE

- GERMANY

- france

- UK

- Spain

- ITALY

- RUSSIA

- Rest of Europe

-

ASIA PACIFIC

- china

- india

- JAPAN

- SOUTH KOREA

- MALAYSIA

- THAILAND

- INDONESIA

- Rest of Asia-Pacific

-

SOUTH AMERICA

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MIDDLE EAST AND AFRICA

- GCC Countries

- South Africa

- Rest of MEA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

COMPETITION DASHBOARD

- PRODUCT PORTFOLIO

- REGIONAL PRESENCE

- STRATEGIC ALLIANCES

- INDUSTRY EXPERIENCES

-

MARKET SHARE ANALYSIS, 2024

-

WHO ARE THE MAJOR DISRUPTORS & INNOVATORS

-

WHAT STRATEGIES ARE BEING ADOPTED BY MARKET LEADERS

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT LAUNCH

- Expansion

- PARTNERSHIP

- recognition and awards

-

COMPANY PROFILES

-

SIEMENS HEALTHINEERS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

GENERAL ELECTRIC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

PHILIPS HEALTHCARE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

CANON MEDICAL SYSTEMS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

AGFA-GEVAERT GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

FUJIFILM HOLDINGS CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

KONICA MINOLTA, INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

SECTRA AB

- COMPANY OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

INFINITT HEALTHCARE

- COMPANY OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

NOVARAD CORPORATION

- COMPANY OVERVIEW

- PRODUCTS OFFERed

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- Key Strategy

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

KEY ENTRY BARRIERS AND IMPLICATIONS

-

PARTNERSHIPS AND COLLABORATIONS

-

REPRESENTATIVE PACS/ENTERPRISE IMAGING PLAYERS BY REGION

-

TABLE 5

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR HARDWARE, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR ON PREMISE, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR CLOUD BASED, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SERVICES, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR X-RAY, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR COMPUTED TOMOGRAPHY (CT), BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR MAGNETIC RESONANCE IMAGING (MRI), BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR ULTRASOUND, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR NUCLEAR IMAGING, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR OTHERS, BY REGION, 2019–2035 (USD MILLION)

-

TABLE 20

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR PATHOLOGY, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR RADIOLOGY, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR HOSPITALS & CLINICS, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR AMBULATORY SURGERY CENTERS (ASCS), BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR OTHERS, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY REGION, 2019-2035 (USD BILLION)

-

NORTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

NORTH AMERICA PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

NORTH AMERICA PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE, BY TYPE, 2019–2035 (USD MILLION)

-

NORTH AMERICA PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

NORTH AMERICA PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

NORTH AMERICA PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

US: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

US: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE, BY TYPE, 2019–2035 (USD MILLION)

-

US: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

US: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

US: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

CANADA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

CANADA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE, BY TYPE, 2019–2035 (USD MILLION)

-

CANADA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

CANADA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

CANADA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

GERMANY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

GERMANY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

GERMANY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

GERMANY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

GERMANY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

FRANCE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

FRANCE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

FRANCE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

FRANCE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

FRANCE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

UK: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

UK: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

UK: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

UK: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

UK: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

SPAIN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

SPAIN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

SPAIN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

SPAIN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

SPAIN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

ITALY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

ITALY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

ITALY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

ITALY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

ITALY: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

REST OF EUROPE : PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

RUSSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

CHINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

CHINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

CHINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

CHINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

INDIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

INDIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

INDIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

INDIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

JAPAN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

JAPAN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

JAPAN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

JAPAN: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

SOUTH KOREA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

SOUTH KOREA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

SOUTH KOREA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

SOUTH KOREA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

MALAYSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

MALAYSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

MALAYSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

MALAYSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

MALAYSIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

THAILAND: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

THAILAND: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

THAILAND: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

THAILAND: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

THAILAND: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

INDONESIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

INDONESIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

INDONESIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

INDONESIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

INDONESIA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWAREI BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

BRAZIL: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

BRAZIL: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD MILLION)

-

BRAZIL: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

BRAZIL: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

BRAZIL: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

MEXICO: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

MEXICO: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD MILLION)

-

MEXICO: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

MEXICO: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

MEXICO: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

ARGENTINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

ARGENTINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD MILLION)

-

ARGENTINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

ARGENTINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

ARGENTINA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

REST OF SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD MILLION)

-

REST OF SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD MILLION)

-

REST OF SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD MILLION)

-

REST OF SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD MILLION)

-

REST OF SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD MILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD BILLION)

-

GCC COUNTRIES: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD BILLION)

-

GCC COUNTRIES: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD BILLION)

-

GCC COUNTRIES: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD BILLION)

-

GCC COUNTRIES: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

GCC COUNTRIES: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD BILLION)

-

SOUTH AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD BILLION)

-

SOUTH AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD BILLION)

-

SOUTH AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD BILLION)

-

SOUTH AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

SOUTH AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD BILLION)

-

REST OF MEA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2019–2035 (USD BILLION)

-

REST OF MEA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, FOR SOFTWARE BY TYPE, 2019–2035 (USD BILLION)

-

REST OF MEA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2019–2035 (USD BILLION)

-

REST OF MEA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

REST OF MEA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2019–2035 (USD BILLION)

-

PRODUCT LAUNCH

-

EXPANSION

-

PARTNERSHIP

-

OTHERS

-

SIEMENS HEALTHINEERS: PRODUCTS OFFERED

-

SIEMENS HEALTHINEERS: KEY DEVELOPMENT

-

GENERAL ELECTRIC: PRODUCTS OFFERED

-

PHILIPS HEALTHCARE: PRODUCTS OFFERED

-

CANON MEDICAL SYSTEMS: PRODUCTS OFFERED

-

AGFA-GEVAERT GROUP: PRODUCTS OFFERED

-

FUJIFILM HOLDINGS CORPORATION: PRODUCTS OFFERED

-

KONICA MINOLTA, INC.: PRODUCTS OFFERED

-

KONICA MINOLTA, INC.: KEY DEVELOPMENTS

-

SECTRA AB: PRODUCTS OFFERED

-

SECTRA AB: KEY DEVELOPMENTS

-

INFINITT HEALTHCARE: PRODUCTS OFFERED

-

NOVARAD CORPORATION: PRODUCTS OFFERED

-

NOVARAD CORPORATION: KEY DEVELOPMENTS

-

LIST OF FIGURES

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET: STRUCTURE

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET: MARKET GROWTH FACTOR ANALYSIS (2025-2035)

-

DRIVER IMPACT ANALYSIS (2019-2035)

-

RESTRAINT IMPACT ANALYSIS (2019-2035)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY COMPONENT, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COMPONENT, 2024 & 2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY COMPONENT, 2024

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY IMAGING MODALITY, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY IMAGING MODALITY, 2024 & 2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY IMAGING MODALITY, 2024

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY APPLICATION, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY APPLICATION, 2024 & 2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY APPLICATION, 2024

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY END USER, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY END USER, 2024 & 2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY END USER, 2024

-

GLOBAL HEALTHCARE MARKET, BY REGION, 2024 & 2035 (USD MILLION)

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET SHARE (%), BY REGION, 2024

-

NORTH AMERICA MARKET: SWOT ANALYSIS

-

NORTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM MARKET, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

NORTH AMERICA: HEALTHCARE MARKET SHARE (%), BY COUNTRY, 2024

-

EUROPE MARKET ANALYSIS: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, 2019-2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

EUROPE: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY COUNTRY, 2024

-

ASIA PACIFIC MARKET ANALYSIS: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, 2019-2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

ASIA PACIFIC: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY COUNTRY, 2024

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

SOUTH AMERICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY COUNTRY, 2024

-

SOUTH AMERICA MARKET: SWOT ANALYSIS

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

MIDDLE EAST AND AFRICA: PICTURE ARCHIVING AND COMMUNICATION SYSTEM (PACS) MARKET SHARE (%), BY COUNTRY, 2024

-

MEA MARKET: SWOT ANALYSIS

-

COMPETITOR DASHBOARD: GLOBAL PICTURE ARCHIVING AND COMMUNICATIONS SYSTEMS (PACS) MARKET

-

GLOBAL PICTURE ARCHIVING AND COMMUNICATIONS SYSTEMS (PACS) MARKET

-

SIEMENS HEALTHINEERS: FINANCIAL OVERVIEW SNAPSHOT

-

SIEMENS HEALTHINEERS: SWOT ANALYSIS

-

GENERAL ELECTRIC: SWOT ANALYSIS

-

PHILIPS HEALTHCARE: SWOT ANALYSIS

-

CANON MEDICAL SYSTEMS: SWOT ANALYSIS

-

AGFA-GEVAERT GROUP: SWOT ANALYSIS

-

FUJIFILM HOLDINGS CORPORATION: SWOT ANALYSIS

-

KONICA MINOLTA, INC.: SWOT ANALYSIS

-

SECTRA AB: SWOT ANALYSIS

-

INFINITT HEALTHCARE: SWOT ANALYSIS

-

NOVARAD CORPORATION: SWOT ANALYSIS

Leave a Comment