Growth in Electronics Manufacturing

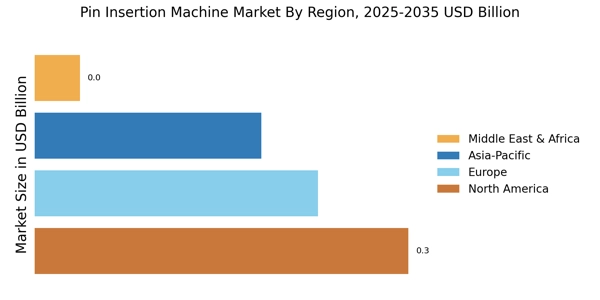

The Pin Insertion Machine Market is closely tied to the growth of the electronics manufacturing sector. As consumer electronics continue to evolve, the complexity of electronic assemblies increases, necessitating more sophisticated pin insertion solutions. The electronics manufacturing industry is projected to expand at a rate of approximately 5% annually, driven by innovations in smart devices and IoT technologies. This growth creates a substantial opportunity for pin insertion machine manufacturers to develop specialized equipment that meets the unique requirements of electronic components. Furthermore, as manufacturers seek to enhance production efficiency and reduce assembly times, the demand for advanced pin insertion machines is expected to rise, thereby propelling the market forward.

Increasing Focus on Quality Control

Quality control remains a critical focus within the Pin Insertion Machine Market, as manufacturers strive to meet stringent industry standards. The need for reliable and consistent assembly processes has led to an increased investment in quality assurance technologies. Pin insertion machines equipped with advanced monitoring systems can detect and rectify errors in real-time, ensuring that products meet quality specifications. This focus on quality is particularly pronounced in sectors such as aerospace and medical devices, where the cost of failure can be substantial. As a result, the demand for high-quality pin insertion machines is likely to grow, as companies prioritize investments that enhance their quality control measures and reduce the risk of defects.

Rising Demand for Precision Engineering

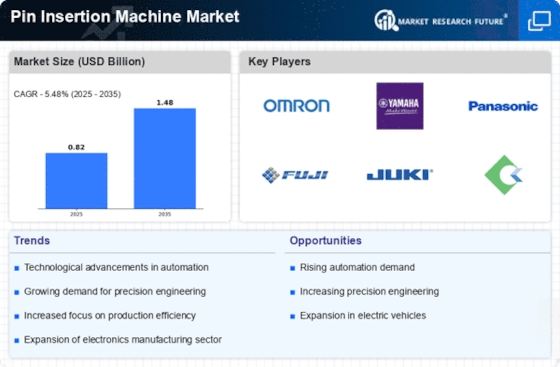

The Pin Insertion Machine Market is experiencing a notable surge in demand for precision engineering solutions. As industries increasingly prioritize accuracy in assembly processes, the need for advanced pin insertion machines has become paramount. These machines are designed to ensure that pins are inserted with exact specifications, thereby reducing errors and enhancing product quality. According to recent data, the market for precision engineering tools is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is driven by sectors such as automotive and electronics, where precision is critical. Consequently, manufacturers are investing in innovative pin insertion technologies to meet these evolving demands, positioning themselves competitively within the Pin Insertion Machine Market.

Technological Advancements in Automation

Technological advancements are significantly influencing the Pin Insertion Machine Market, particularly through automation. The integration of smart technologies and robotics into pin insertion processes is enhancing efficiency and reducing labor costs. Automated pin insertion machines are capable of operating at higher speeds and with greater accuracy than their manual counterparts. Recent studies indicate that automation in manufacturing can lead to productivity increases of up to 30%. As companies strive to optimize their production lines, the adoption of automated pin insertion solutions is likely to rise. This trend not only streamlines operations but also aligns with the broader industry shift towards Industry 4.0, where interconnected systems and data-driven decision-making are becoming the norm.

Sustainability and Eco-Friendly Practices

Sustainability is becoming an essential consideration within the Pin Insertion Machine Market, as manufacturers seek to adopt eco-friendly practices. The push for sustainable manufacturing processes is prompting companies to invest in machines that minimize waste and energy consumption. Pin insertion machines that utilize energy-efficient technologies not only reduce operational costs but also align with the growing consumer demand for environmentally responsible products. Recent reports suggest that companies implementing sustainable practices can achieve cost savings of up to 20%. As environmental regulations become more stringent, the adoption of sustainable pin insertion solutions is expected to increase, driving innovation and growth within the market.