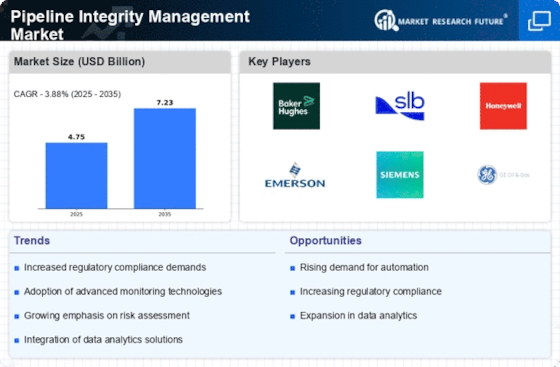

North America : Market Leader in Pipeline Integrity

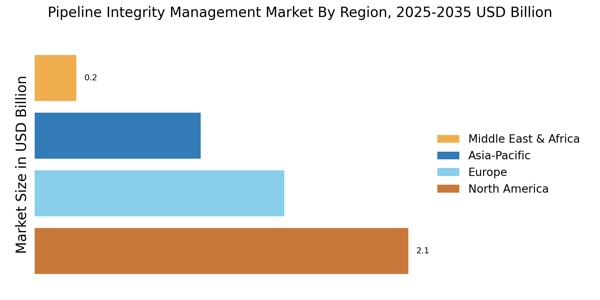

North America leads the Pipeline Integrity Management Market, supported by early adoption of pipeline integrity software, mature regulatory frameworks, and large-scale deployment of pipeline integrity management services. The region's growth is driven by stringent regulatory frameworks, increasing investments in infrastructure, and a rising focus on safety and environmental compliance. The demand for advanced monitoring technologies and predictive maintenance solutions is also on the rise, further propelling market growth.

The United States is the leading country in this sector, with significant contributions from Canada. Key players such as Baker Hughes, Schlumberger, and Honeywell dominate the landscape, leveraging innovative technologies to enhance pipeline safety and efficiency. The competitive environment is characterized by continuous advancements and collaborations among major firms to meet regulatory standards and customer demands.

Europe : Regulatory-Driven Market Growth

Europe is witnessing a robust growth trajectory in the Pipeline Integrity Management Market, accounting for approximately 30% of the global share. Europe continues to expand through regulation-driven adoption of asset integrity management market solutions, while Asia-Pacific is rapidly investing in digital pipeline integrity data platforms to support infrastructure growth. The region's growth is primarily driven by stringent EU regulations aimed at enhancing pipeline safety and environmental protection. The increasing need for modernization of aging infrastructure and the adoption of smart technologies are also significant factors contributing to market expansion.

Leading countries in this region include Germany, the UK, and France, where major players like Siemens and Aker Solutions are actively involved. The competitive landscape is marked by a focus on innovation and sustainability, with companies investing in advanced monitoring systems and data analytics to improve operational efficiency. The European market is characterized by a collaborative approach among stakeholders to meet regulatory requirements and enhance pipeline integrity.

Asia-Pacific : Rapid Growth and Investment

Asia-Pacific is emerging as a significant player in the Pipeline Integrity Management Market, holding around 20% of the global share. The region's growth is fueled by rapid industrialization, increasing energy demands, and substantial investments in pipeline infrastructure. Governments are also implementing regulations to enhance safety and environmental standards, further driving market growth. Countries like China, India, and Australia are at the forefront of this expansion, with a growing number of projects aimed at improving pipeline safety and efficiency. The competitive landscape features both local and international players, including GE Oil & Gas and National Oilwell Varco, who are focusing on innovative solutions to address the unique challenges of the region. The market is characterized by a strong emphasis on technology adoption and strategic partnerships to enhance service offerings.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually developing its Pipeline Integrity Management Market, accounting for approximately 5% of the global share. The growth is driven by increasing investments in oil and gas infrastructure, coupled with a rising focus on safety and environmental regulations. The region's vast energy resources necessitate effective pipeline management solutions to mitigate risks and enhance operational efficiency. Leading countries in this region include Saudi Arabia, UAE, and South Africa, where key players like Emerson Electric and T.D. Williamson are establishing a presence. The competitive landscape is evolving, with a growing number of local firms entering the market, driven by the need for advanced technologies and services. The region presents significant opportunities for growth as governments prioritize infrastructure development and regulatory compliance.

.png)