Market Analysis

In-depth Analysis of Pipeline Monitoring System Market Industry Landscape

The Pipeline Monitoring System (PMS) market is undergoing significant changes driven by a combination of technological advancements, regulatory pressures, and the increasing need for efficient and secure pipeline operations. As pipelines play a crucial role in transporting oil, gas, and other hazardous materials, the demand for reliable monitoring systems has surged in recent years.

One key driver of market dynamics is the rising concern for pipeline safety and integrity. Governments and regulatory bodies worldwide are imposing stringent regulations to ensure the protection of the environment and public safety. Pipeline operators are thus investing in advanced monitoring systems that can detect leaks, corrosion, and other anomalies in real-time, minimizing the risk of accidents and environmental damage.

Technological innovation is another pivotal factor shaping the pipeline monitoring system market. With the advent of advanced sensor technologies, artificial intelligence, and data analytics, monitoring systems have become more sophisticated and capable of providing comprehensive insights into pipeline conditions. The integration of IoT (Internet of Things) devices allows for remote monitoring and control, enabling operators to respond swiftly to any detected issues.

The global shift towards renewable energy sources also influences the market dynamics of pipeline monitoring systems. As the energy landscape evolves, pipelines are being repurposed to transport alternative fuels such as hydrogen. This transition requires adaptive monitoring systems capable of addressing the unique challenges associated with different types of transported materials. The market is responding by developing versatile monitoring solutions that can accommodate the changing nature of pipeline contents.

Moreover, the growing importance of predictive maintenance is impacting the market dynamics. Pipeline operators are increasingly adopting predictive analytics to anticipate potential issues and schedule maintenance activities proactively. This shift from reactive to proactive maintenance not only enhances the reliability of pipeline operations but also reduces downtime and maintenance costs.

The geographical distribution of pipeline infrastructure also contributes to market dynamics. Regions with extensive pipeline networks, such as North America, the Middle East, and Asia-Pacific, witness higher demand for monitoring systems. The need for continuous monitoring and the replacement of aging pipeline infrastructure in these regions drive market growth.

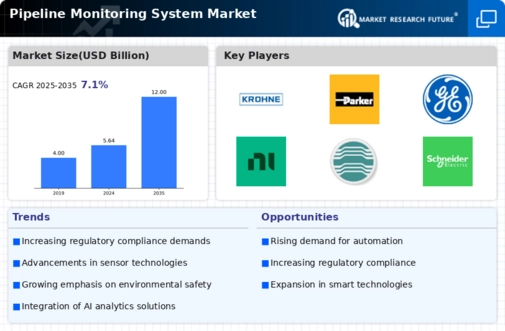

The competitive landscape further shapes the market dynamics of pipeline monitoring systems. A growing number of companies are entering the market, fostering innovation and competition. Established players are focusing on partnerships, mergers, and acquisitions to expand their product portfolios and global reach. This dynamic environment encourages the development of more cost-effective and advanced monitoring solutions, benefitting end-users.

Cybersecurity concerns are emerging as a critical factor influencing market dynamics. As pipeline monitoring systems become more interconnected through digital platforms, the risk of cyber threats increases. The market is responding with the integration of robust cybersecurity measures to safeguard sensitive data and ensure the uninterrupted operation of monitoring systems.

The pipeline monitoring system market is experiencing dynamic changes driven by factors such as increased regulatory scrutiny, technological advancements, the transition to renewable energy, the importance of predictive maintenance, geographical considerations, competitive forces, and the growing emphasis on cybersecurity. The evolution of these market dynamics underscores the need for flexible and adaptive monitoring solutions that can meet the challenges of an ever-changing landscape in the pipeline industry.

Leave a Comment