Market Trends

Key Emerging Trends in the Pipeline Monitoring System Market

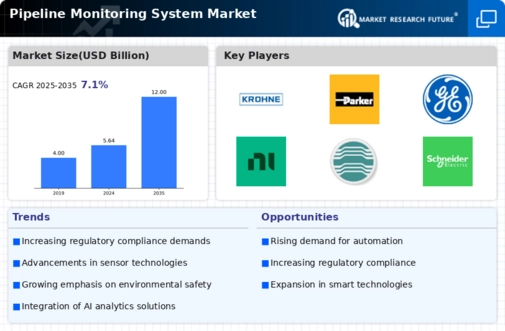

The Pipeline Monitoring System (PMS) market has been witnessing significant trends and developments in recent years, reflecting the growing importance of efficient and secure pipeline operations across various industries. One prominent trend is the increasing adoption of advanced technologies in pipeline monitoring, driven by the need for real-time data and proactive risk management. As industries such as oil and gas, water and wastewater, and chemicals continue to expand, there is a growing demand for sophisticated monitoring systems to ensure the integrity and reliability of pipelines.

The integration of Internet of Things (IoT) technologies is playing a crucial role in shaping the market trends of pipeline monitoring systems. IoT-enabled sensors and devices are deployed along the pipelines to collect and transmit data on various parameters such as temperature, pressure, flow rate, and leak detection. This real-time data allows operators to monitor the health of the pipeline infrastructure and detect potential issues before they escalate, reducing the risk of costly damages and environmental impacts.

Furthermore, the market is witnessing a shift towards the use of advanced analytics and machine learning algorithms in pipeline monitoring. These technologies enable operators to analyze large datasets and identify patterns or anomalies that may indicate potential problems in the pipeline network. Predictive analytics, coupled with artificial intelligence, empowers operators to make informed decisions and implement preventive measures, contributing to the overall efficiency and safety of pipeline operations.

The emphasis on environmental sustainability and regulatory compliance is another key factor influencing market trends in pipeline monitoring systems. Governments and regulatory bodies are imposing stringent regulations to ensure the safe transportation of hazardous materials through pipelines. This has led to increased investments in monitoring systems that can not only detect leaks and spills promptly but also help operators comply with environmental standards. As a result, the market is witnessing a surge in the adoption of environmentally friendly and non-intrusive monitoring technologies.

Additionally, the rise of remote monitoring solutions is reshaping the landscape of pipeline monitoring. With advancements in communication technologies, operators can now monitor pipelines from centralized control centers, providing real-time insights and control over vast and geographically dispersed pipeline networks. This remote monitoring capability enhances operational efficiency, reduces response time to incidents, and minimizes the need for physical inspection, leading to cost savings for the operators.

Cybersecurity concerns are also influencing the pipeline monitoring system market trends. As these systems become more interconnected and data-driven, there is an increased vulnerability to cyber threats. Therefore, there is a growing focus on integrating robust cybersecurity measures into pipeline monitoring systems to safeguard sensitive data and ensure the secure operation of critical infrastructure.

The Pipeline Monitoring System market is undergoing transformative changes driven by technological advancements, regulatory pressures, and the evolving needs of industries reliant on pipeline transportation. The integration of IoT, advanced analytics, remote monitoring, and cybersecurity measures are at the forefront of these trends, contributing to a more resilient, efficient, and environmentally responsible pipeline infrastructure. As industries continue to prioritize the safety and reliability of their pipeline networks, the market for pipeline monitoring systems is expected to witness sustained growth and innovation in the coming years.

Leave a Comment