Plastic Coated Wires Size

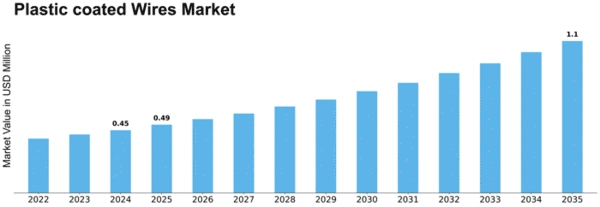

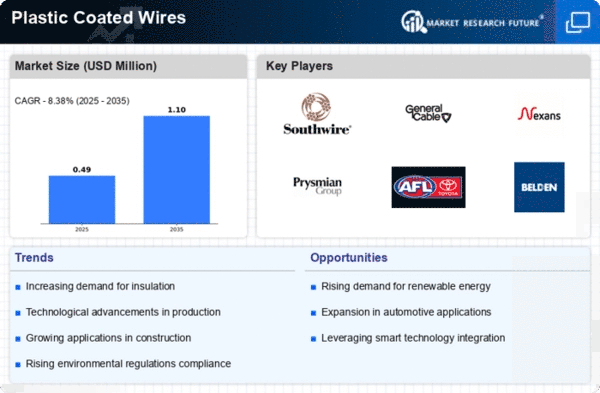

Plastic coated Wires Market Growth Projections and Opportunities

The Subsea Plastic-coated Wires Market is influenced by a range of factors that collectively shape its trends and growth dynamics. One primary driver is the expanding demand for reliable and durable subsea cables and wires in offshore oil and gas exploration and production. The subsea plastic-coated wires are utilized for various applications, including power transmission, control systems, and communication in challenging underwater environments. As the offshore energy industry continues to evolve and explore deeper waters, the demand for subsea plastic-coated wires with enhanced performance characteristics remains a key factor driving market growth.

Global economic conditions play a pivotal role in the Subsea Plastic-coated Wires Market. Economic growth and industrialization contribute to increased investments in offshore energy projects, fostering the need for advanced subsea cables and wires. Developing economies, particularly those with expanding offshore oil and gas activities, significantly drive the market's growth, becoming key contributors to the global subsea exploration and production landscape.

Technological advancements in materials and manufacturing processes impact the market dynamics. Ongoing research and development efforts lead to innovations in the design, coatings, and insulation materials used in subsea plastic-coated wires. Companies that invest in these technological advancements gain a competitive edge by offering cables and wires that withstand harsh subsea conditions, providing improved resistance to corrosion, abrasion, and mechanical stress.

The emphasis on safety and reliability in offshore operations significantly influences the Subsea Plastic-coated Wires Market. Subsea cables and wires play a critical role in the functioning of subsea equipment, control systems, and communication networks. Industries such as oil and gas prioritize cables with robust insulation and protective coatings to ensure reliable performance in subsea environments where conditions can be highly corrosive and challenging.

Geopolitical factors and trade dynamics also play a role in shaping the Subsea Plastic-coated Wires Market. The offshore energy sector often involves international collaborations and partnerships. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of subsea plastic-coated wires. Companies in the market need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Furthermore, the growth in offshore renewable energy projects contributes to the demand for Subsea Plastic-coated Wires. As the offshore wind and tidal energy sectors expand, the need for subsea cables and wires to transmit power from offshore installations to onshore grids increases. The durability and reliability of plastic-coated wires make them essential components in these renewable energy projects, supporting the global transition towards cleaner energy sources.

The telecommunications industry is another key driver of the Subsea Plastic-coated Wires Market. Subsea cables play a crucial role in international telecommunications, facilitating high-speed data transmission across continents. The demand for increased bandwidth and connectivity drives investments in subsea cable infrastructure, contributing to the growth of the subsea plastic-coated wires market.

Raw material prices, particularly those of high-performance polymers used in the plastic coating, play a role in shaping the Subsea Plastic-coated Wires Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of subsea plastic-coated wires. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment