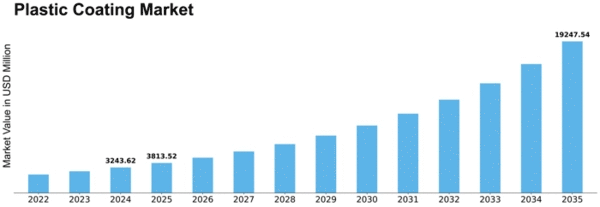

Plastic Coating Size

Plastic Coating Market Growth Projections and Opportunities

Many variables affect the Plastic Coatings Market's dynamics and growth. The adaptability and broad uses of plastic coatings across sectors drive the Plastic Coatings Market. Thermoplastic and thermosetting plastic coatings protect, look good, and work. The automotive, construction, and consumer goods sectors drive global demand for plastic-coated items, expanding the industry and underscoring the importance of plastic coatings in contemporary production.

Construction also drives the Plastic Coatings Market. Plastic coatings are used on pipes, panels, and roofs. Construction projects require robust, weather-resistant, and corrosion-resistant coatings, driving market growth. Plastic coatings protect surfaces from environmental conditions, extending building material life. The market reacts to building industry demands by offering coatings that solve unique problems in various applications.

Plastic Coatings Market is driven by geopolitics and raw material availability. Resins, colors, and additives make plastic coatings. Geopolitical events, trade restrictions, and raw material supply chain disruptions can affect market dynamics. To sustain supply, the market adjusts to geopolitical changes and seeks alternate raw resources.

The Plastic Coatings Market is driven by coating formulation improvements and technological advances. Research and development increase plastic coating performance, sustainability, and application qualities. Innovative polymer chemistry, curing methods, and coating processes make plastic coatings competitive by allowing them to respond to market changes and produce unique solutions.

Environmental restrictions and sustainability drive the Plastic Coatings Market. Water-based and low-VOC plastic coatings are becoming more popular as industry worry about their environmental effect. Environmentally friendly formulas and strict rules help the market evolve. Industry efforts to reduce environmental impact and promote sustainable coatings are met by the market.

Consumer tastes and market trends also shape the Plastic Coatings Market. As customers become increasingly concerned with environmental sustainability, safety, and product attractiveness, plastic coatings with performance and eco-friendliness are in demand. Plastic coatings help products meet aesthetic and practical goals as the market changes to design and functioning trends.

Plastic Coatings Market variables include competitive pricing and alternative coating options. Industries using plastic coatings must assess their cost-effectiveness compared to other materials or techniques. Additionally, the market reacts to alternative coating processes or materials that may affect cost competitiveness and performance.

Leave a Comment