Market Analysis

In-depth Analysis of Plastic Film Capacitors Market Industry Landscape

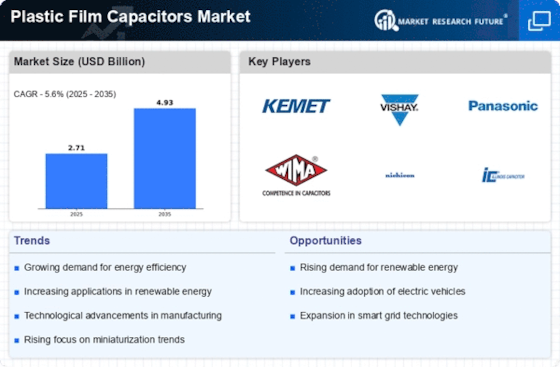

The Plastic Film Capacitors Market exhibits a dynamic landscape shaped by various market dynamics that influence its growth, trends, and overall competitiveness. One of the key dynamics driving the market is the continuous technological advancements in capacitor design and manufacturing processes. As electronic devices become more sophisticated, the demand for plastic film capacitors with improved performance, reliability, and energy efficiency rises. Manufacturers engage in ongoing research and development efforts to stay ahead of the curve, introducing innovative solutions that cater to the evolving needs of diverse industries.

Market dynamics are also significantly impacted by the increasing emphasis on sustainability and environmental concerns. With growing awareness of the ecological impact of electronic waste, there is a push towards eco-friendly materials and manufacturing practices. Plastic film capacitors, being more environmentally friendly compared to certain alternatives, are gaining traction. Manufacturers are responding to this dynamic by developing capacitors that comply with environmental regulations and promote sustainable practices throughout the product lifecycle.

Moreover, the market is shaped by the ever-expanding consumer electronics industry. The proliferation of smartphones, laptops, smart appliances, and other electronic gadgets fuels the demand for compact and efficient electronic components like plastic film capacitors. This surge in demand is further amplified by the trend of miniaturization in electronic devices, requiring capacitors that are not only smaller but also offer high performance. The market responds to these dynamics by providing capacitors that meet the stringent size and performance requirements of modern electronics.

Economic factors also play a crucial role in the market dynamics of plastic film capacitors. Fluctuations in raw material prices, currency exchange rates, and global economic conditions can impact production costs and pricing strategies. Manufacturers must navigate these economic variables to maintain competitive pricing while ensuring profitability. Additionally, economic conditions influence consumer purchasing power, which, in turn, affects the overall demand for electronic devices and components.

The competitive landscape is another dynamic factor influencing the plastic film capacitors market. The presence of key players, the level of competition, and strategic initiatives taken by companies shape market dynamics. Companies often engage in mergers, acquisitions, and collaborations to strengthen their market position, expand their product portfolios, and gain a competitive edge. The strategic moves of key players ripple through the market, influencing trends and market dynamics.

Market dynamics are also impacted by regulatory factors. The plastic film capacitors market is subject to regulations governing product safety, quality standards, and environmental compliance. Manufacturers need to stay abreast of these regulations and ensure that their products meet the necessary standards. Compliance with regulations not only ensures market access but also reflects positively on the reputation of companies in the industry.

Furthermore, the market is responsive to changes in end-user preferences and industry trends. As consumer expectations evolve, manufacturers need to adapt by offering products that align with the latest trends. Whether it's increased energy efficiency, higher capacitance values, or advanced features, market dynamics are shaped by the need to meet the demands of end-users and stay competitive in a rapidly changing landscape.

Leave a Comment