Market Trends

Key Emerging Trends in the Plastic Film Capacitors Market

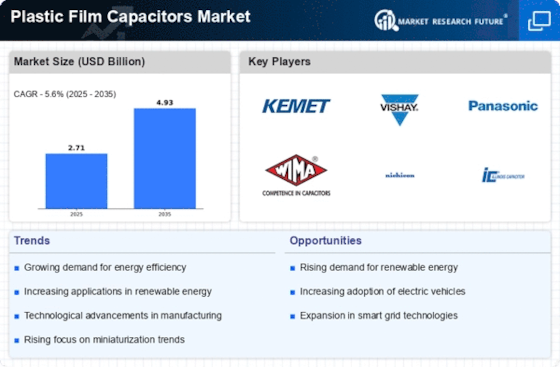

The Plastic Film Capacitors Market is experiencing notable trends that shape the trajectory of the industry and influence the preferences of manufacturers and consumers alike. One prominent trend is the increasing demand for high-capacitance plastic film capacitors. As electronic devices become more advanced and power-hungry, there is a growing need for capacitors that can store and deliver higher amounts of energy. This trend is particularly evident in applications such as electric vehicles, renewable energy systems, and high-performance electronics where capacitors with greater capacitance play a crucial role in ensuring efficient operation.

Miniaturization is another key trend driving the plastic film capacitors market. With the ongoing trend of making electronic devices smaller, lighter, and more portable, there is a heightened demand for compact and lightweight components, including capacitors. Manufacturers are responding by developing plastic film capacitors that are not only smaller in size but also maintain or enhance performance characteristics. This trend aligns with the consumer preference for sleek and portable electronic gadgets and drives innovation in capacitor design and manufacturing.

Energy efficiency is a significant and growing trend in the plastic film capacitors market. As sustainability becomes a central focus across industries, there is an increasing emphasis on developing energy-efficient electronic devices. Plastic film capacitors play a crucial role in this trend by contributing to the overall efficiency of electronic circuits. Manufacturers are designing capacitors that minimize energy losses, reduce power consumption, and enhance the overall energy efficiency of electronic systems. This trend is particularly relevant in applications such as power supplies, where energy efficiency is a critical consideration.

The market is also witnessing a surge in demand for film capacitors with self-healing properties. Self-healing capacitors have the ability to recover from dielectric breakdowns, ensuring a longer operational life and increased reliability. This trend is driven by the need for durable and robust electronic components, especially in applications where the failure of a capacitor could have significant consequences. Manufacturers are investing in research and development to enhance the self-healing capabilities of plastic film capacitors, catering to industries that prioritize reliability and longevity.

Another noteworthy trend is the integration of smart and IoT-enabled features in plastic film capacitors. With the rise of the Internet of Things (IoT) and the increasing connectivity of devices, there is a growing demand for capacitors that can communicate and interact with other components in a system. Smart capacitors can provide real-time data on their performance, allowing for predictive maintenance and enhancing overall system reliability. This trend aligns with the broader shift towards smart and connected technologies across various industries.

Furthermore, the market is experiencing a trend towards the development of environmentally friendly and sustainable plastic film capacitors. As environmental concerns gain prominence, manufacturers are exploring materials and processes that reduce the ecological impact of electronic components. Capacitors made from biodegradable or recyclable materials, as well as those free from hazardous substances, are gaining traction. This trend reflects a broader industry commitment to sustainability and aligns with the preferences of environmentally conscious consumers and businesses.

Leave a Comment