Research Methodology on Plastic Films Market

1. Introduction

This research report is focused on the current market for plastic films for packaging, analyzing the trends and future directions for the industry. In this research, Market Research Future (MRFR) has compiled a comprehensive report on the Plastic Films Market that provides detailed insights into the global market from 2023 to 2030. The research is designed to provide an in-depth assessment of the market dynamics impacting key industries, geographical regions, and companies’ businesses. It also offers an overview of the competitive landscape, product portfolio and key growth strategies adopted by players in the market.

2. Research Objectives

The primary goal of this project is to provide an in-depth analysis of the market for plastic films for packaging and determine the size, scope and competitive landscape of the plastic films industry. The specific objectives of this research project are:

- To review the plastic films market size from 2023-2030 in terms of value and volume.

- To identify the factors that are driving the growth of the global plastic films market.

- To identify the key regions, countries and industries that have the highest potential for growth in the plastic films market.

- To identify leading players in the global plastic films market and provide an in-depth analysis of their product portfolio, pricing strategies and growth strategies.

- To identify the strategies being adopted by players in the plastic films market to gain a competitive edge in the market.

3. Research Approach and Data Sources

The MRFR research team used an empirical approach and a combination of primary and secondary research methods to research the global plastic film market. Primary research methods involve the review of industry reports, news articles and other relevant documents. In addition, interviews with industry experts are carried out to gain insights into the market. Secondary research methods involve the review of internal company reports, published industry reports, databases, and other relevant documents. The research also includes an in-depth analysis of the market trends, industry drivers and restraints, product portfolio and strategic business decisions of key players in the market.

4. Geographic Coverage

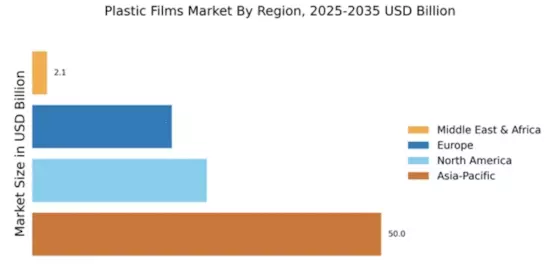

The scope of this report is global and covers the plastic films market in North America, Europe, Asia-Pacific and the Rest of the World.

5. Segment Analysis

The report is segmented into three components: type, application, and region. The type segment includes PE, PP, PVC, Biopolymers and others. The application segment is further divided into food, beverage, pharmaceuticals, personal care, automotive, construction and others.

6. Competitor Analysis

This report also provides detailed profiles of key players in the global plastic films market including Honeywell International Inc., BASF SE, NCP Co. Ltd., Berry Global Inc., LyondellBasell Industries, DowDuPont Inc., Mitsubishi Gas Chemical Company Inc., SABIC, Amino Plastics, ExxonMobil Corporation, KURARAY Group, and Coveris Holdings.

7. Assumptions

The research is conducted by making certain assumptions. It is assumed that the trend of plastic films for packaging will continue in 2023 and beyond as demand for single-use packaging materials increases.

8. Conclusions

This report provides a comprehensive overview of the global plastic films market, its current size and trends, and the competitive landscape. Industries such as food & beverage, pharmaceutical, personal care, automotive, and construction, among others, are projected to drive the demand for plastic films in the coming years. Major players in the industry such as Honeywell International Inc., BASF SE, NCP Co. Ltd., Berry Global Inc., LyondellBasell Industries, DowDuPont Inc., Mitsubishi Gas Chemical Company Inc., SABIC, Amino Plastics, ExxonMobil Corporation, KURARAY Group, and Coveris Holdings are expected to adopt various strategies such as mergers and acquisitions, strategic partnerships, and new product launches to gain a competitive advantage.