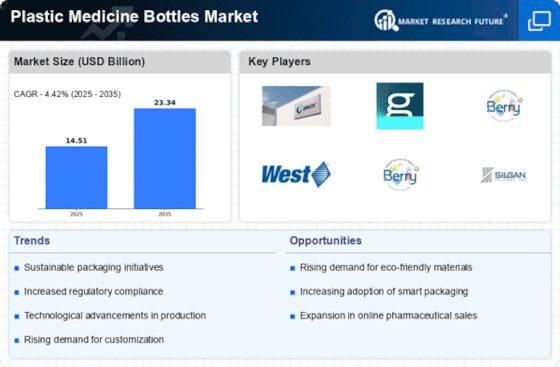

Rising Demand for Pharmaceuticals

The increasing prevalence of chronic diseases and the aging population are driving the demand for pharmaceuticals, which in turn fuels the Plastic Medicine Bottles Market. As more individuals require medication for long-term health management, the need for effective and safe packaging solutions becomes paramount. In 2025, the pharmaceutical sector is projected to reach a valuation of over 1.5 trillion dollars, indicating a robust growth trajectory. This surge in pharmaceutical production necessitates a corresponding increase in the supply of plastic medicine bottles, which are favored for their lightweight, durability, and cost-effectiveness. Consequently, manufacturers are likely to invest in expanding their production capacities to meet this escalating demand.

Innovations in Packaging Technology

Innovations in packaging technology are reshaping the Plastic Medicine Bottles Market. Advances such as child-resistant closures, tamper-evident features, and smart packaging solutions enhance the safety and usability of medicine bottles. These innovations not only improve consumer confidence but also comply with stringent regulatory standards. The integration of technology, such as QR codes for tracking and information dissemination, is becoming increasingly prevalent. As of 2025, it is estimated that the market for smart packaging will grow at a compound annual growth rate of approximately 7%, further driving the demand for advanced plastic medicine bottles. This trend suggests that manufacturers who adopt these technologies may gain a competitive edge in the market.

Sustainability and Eco-Friendly Practices

Sustainability initiatives are gaining traction within the Plastic Medicine Bottles Market. As environmental concerns become more pronounced, consumers and manufacturers alike are seeking eco-friendly alternatives to traditional plastic. The shift towards biodegradable and recyclable materials is becoming a focal point for many companies. In 2025, it is anticipated that the market for sustainable packaging solutions will reach a valuation of 400 billion dollars, reflecting a growing preference for environmentally responsible products. This trend compels manufacturers to innovate and adapt their production processes to incorporate sustainable practices, thereby enhancing their market appeal and compliance with evolving regulations.

Growth of E-commerce and Online Pharmacies

The growth of e-commerce and online pharmacies is significantly influencing the Plastic Medicine Bottles Market. As consumers increasingly turn to online platforms for their pharmaceutical needs, the demand for efficient and secure packaging solutions rises. Online pharmacies require packaging that not only protects the product during transit but also ensures compliance with safety regulations. In 2025, the e-commerce pharmaceutical market is projected to grow at a rate of 10% annually, indicating a substantial shift in consumer purchasing behavior. This trend compels manufacturers to adapt their packaging solutions to meet the specific needs of online distribution, thereby expanding their market reach and enhancing customer satisfaction.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a crucial role in shaping the Plastic Medicine Bottles Market. Governments and health organizations worldwide are implementing stringent safety standards to ensure the integrity and safety of pharmaceutical packaging. Compliance with these regulations is not only essential for market access but also for maintaining consumer trust. In 2025, it is expected that the regulatory landscape will continue to evolve, with an emphasis on safety, quality, and environmental impact. Manufacturers who prioritize compliance are likely to enhance their market position and reduce the risk of product recalls or legal issues, thereby fostering a more stable market environment.