Regulatory Compliance and Standards

Regulatory compliance and standards are critical drivers in the Plastics in the Consumer Electronic Market. Governments worldwide are implementing stringent regulations regarding the use of certain plastics, particularly concerning safety and environmental impact. Compliance with these regulations is essential for manufacturers to avoid penalties and maintain market access. As of 2025, it is anticipated that the regulatory landscape will continue to evolve, with an emphasis on reducing hazardous substances in electronics. This necessitates the adoption of safer, compliant materials, thereby influencing the types of plastics used in consumer electronics. Companies that proactively adapt to these regulations may enhance their market position and consumer trust.

Rising Demand for Consumer Electronics

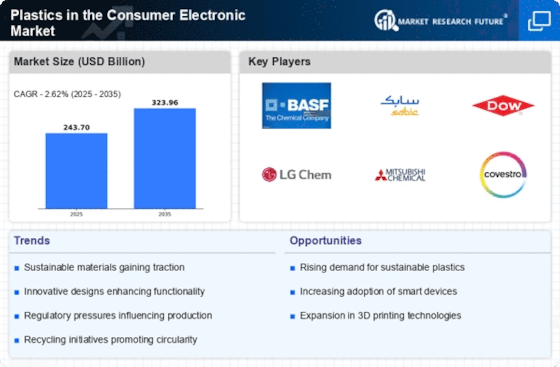

The increasing demand for consumer electronics is a primary driver in the Plastics in the Consumer Electronic Market. As technology advances, consumers are seeking more innovative and multifunctional devices, leading to a surge in production. In 2025, the consumer electronics market is projected to reach a valuation of approximately 1 trillion USD, with plastics playing a crucial role in the manufacturing of devices such as smartphones, tablets, and wearables. The lightweight and durable nature of plastics allows for enhanced design and functionality, making them indispensable in modern electronics. This trend indicates a robust growth trajectory for the plastics sector within the consumer electronics landscape, as manufacturers strive to meet consumer expectations for quality and performance.

Technological Advancements in Plastics

Technological advancements in plastics are significantly influencing the Plastics in the Consumer Electronic Market. Innovations in polymer chemistry and processing techniques have led to the development of high-performance plastics that offer superior thermal stability, electrical insulation, and mechanical strength. For instance, the introduction of polycarbonate and ABS plastics has enabled manufacturers to create more durable and aesthetically pleasing products. As of 2025, the market for advanced plastics is expected to grow at a compound annual growth rate (CAGR) of around 5%, reflecting the increasing reliance on these materials in electronic devices. This evolution not only enhances product longevity but also aligns with consumer preferences for high-quality electronics.

Sustainability and Eco-Friendly Materials

Sustainability initiatives are becoming increasingly vital in the Plastics in the Consumer Electronic Market. As environmental concerns rise, manufacturers are exploring eco-friendly alternatives to traditional plastics. Biodegradable plastics and recycled materials are gaining traction, driven by consumer demand for sustainable products. In 2025, it is estimated that the market for sustainable plastics in electronics could account for over 20% of total plastic usage in the sector. This shift not only addresses environmental issues but also enhances brand reputation and consumer loyalty. Companies that prioritize sustainability are likely to gain a competitive edge, as consumers increasingly favor products that align with their values.

Consumer Preferences for Aesthetics and Functionality

Consumer preferences for aesthetics and functionality are shaping the Plastics in the Consumer Electronic Market. Modern consumers are increasingly discerning, seeking products that not only perform well but also exhibit appealing designs. The versatility of plastics allows for a wide range of colors, textures, and finishes, enabling manufacturers to create visually attractive devices. In 2025, it is projected that nearly 70% of consumers prioritize design in their purchasing decisions, underscoring the importance of aesthetics in electronics. This trend compels manufacturers to innovate continuously, integrating advanced plastics that enhance both the look and feel of their products, thereby driving growth in the plastics sector.