-

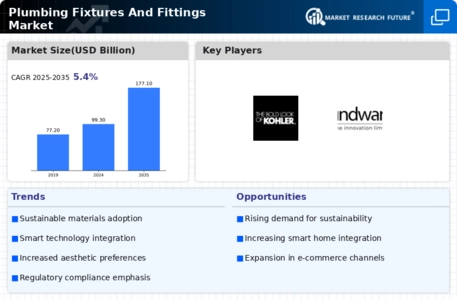

Executive Summary

-

Market Attractiveness Analysis

- Plumbing Fixtures Fittings Market, by Material

- Plumbing Fixtures Fittings Market, by Product

- Plumbing Fixtures Fittings Market, by Application

-

Market Introduction

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

Macro Factor Indicators Analysis

-

Market Insights

-

Market Dynamics

-

Introduction

-

Drivers

- Growing Construction Industry

- Eco-Friendly Plumbing Solutions

- Drivers Impact Analysis

-

Restraints

- Volatile Raw Material Prices

- Restraints Impact Analysis

-

Opportunities

- Technological Innovation

-

Market Factor Analysis

-

Raw Material Supply

-

Product Manufacture

-

Distribution

-

End-Use

-

Porter’s Five Forces Model

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Rivalry

-

Plumbing Fixtures Fittings Market, by Material

-

Overview

-

Vitreous China

- Vitreous China: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Metal

- Cast Iron

- Others

- Metal: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Plastics

- Fiber Glass

- Cast Polymer

- Others

- Plastics: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Plumbing Fixtures Fittings Market, by Product

-

Overview

-

Bathroom Fixtures & Fittings

- Bathroom Fixtures & Fittings: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Kitchen and Sink Fixtures & Fittings

- Kitchen and Sink Fixtures & Fittings: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Toilet Fixtures & Fittings

- Toilet Fixtures & Fittings: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Others

- Others: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Plumbing Fixtures Fittings Market, by Application

-

Overview

-

Residential

- Residential: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Commercial

-

Office Spaces:

-

Educational Institutes:

-

Hospitals & Healthcare Centers:

-

Hotels & Restaurants:

-

Public Utility:

-

Others:

-

Commercial: Market Estimates & Plumbing Fixtures Fittings Market, by Region/Country, 2020-2027

-

Plumbing Fixtures Fittings Market, by Region

-

Overview

-

North America

- Overview

- US

- Canada

- Mexico

-

Europe

- Overview

- Germany

- UK

- France

- Spain

- Rest of Europe

-

Asia-Pacific

- Overview

- China

- Japan

- India

- Australia

- Hong Kong

- Vietnam

- Singapore

- Philippines

- Rest of Asia-Pacific

-

Middle East & Africa

- Overview

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

South America

- Overview

- Brazil

- Argentina

- Rest of South America

-

Competitive Landscape

-

Competitive Overview

-

Competitor Dashboard

-

Major Growth Strategies of Players in the Global Plumbing Fixtures and Fittings Market

-

Competitive Benchmarking

-

Leading Player in Terms of Number of Developments in the Global Plumbing Fixtures and Fittings Market

-

Market Share Analysis

-

Key Developments and Growth Strategies

- Mergers and Acquisitions

- Product Development

- Expansion

- Partnership

-

Company Profiles

-

Geberit AG

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fortune Brands Home & Security, Inc.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

LIXIL Group Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Masco Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TOTO LTD

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Roca Sanitario, S.A.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

GWA Group Limited

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

Elkay Manufacturing Company

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

Kohler Co.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

Hindware Homes (HSIL)

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

Industry Insights

-

Export and Import Analysis

-

Distributors, Traders, and Dealers

-

Export Analysis: China, Vietnam, and European Union

- China

- Vietnam

- European Union

-

Import Tariffs and Duties

-

Appendix

-

References

-

Related Reports

-

List of Abbreviation

-

List Of Tables

-

List of Assumptions

-

Macro Indicators Influencing the Global Plumbing Fixtures and Fittings Market

-

US: Annual Value of Construction, 2013–2020 (USD Million)

-

Vitreous China Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Metal Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Plastics Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Bathroom Fixtures & Fittings Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Kitchen and Sink Fixtures & Fittings Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Toilet Fixtures & Fittings Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Others Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Residential Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Commercial Market Estimates & Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

Plumbing Fixtures Fittings Market, by Region, 2020-2027 (USD Million)

-

US: Value of Construction, March 2019 (USD Million)

-

North America: Plumbing Fixtures Fittings Market, by Country, 2020-2027 (USD Million)

-

North America: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

North America: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

North America: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million) 63

-

North America: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million) 64

-

North America: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

North America: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

North America: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

US: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Country, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

France: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Country, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

China: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

India: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Country, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Rest of Middle East & Africa: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Country, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Material, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Metal, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Product, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Application, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Most Active Player in the Global Plumbing Fixtures and Fittings Market

-

Mergers and Acquisitions

-

Product Developments

-

Expansions

-

Partnerships

-

Geberit AG: Products/Services Offered

-

Fortune Brands Home & Security, Inc.: Products/Services Offered

-

Fortune Brands Home & Security, Inc.: Key Developments

-

LIXIL Group Corporation: Products/Services Offered

-

LIXIL Group Corporation: Key Developments

-

Masco Corporation: Products/Services Offered

-

TOTO LTD.: Products/Services Offered

-

Roca Sanitario, S.A.: Products/Services Offered

-

Roca Sanitario, S.A.: Key Developments

-

GWA Group Limited: Products/Services Offered

-

GWA Group Limited: Key Developments

-

Elkay Manufacturing Company: Products/Services Offered

-

Elkay Manufacturing Company: Key Developments

-

KOHLER CO.: Products/Services Offered

-

KOHLER CO.: Key Developments

-

HINDWARE HOMES: Products/Services Offered

-

HINDWARE HOMES: Key Developments

-

Export Analysis of Fittings, E.g. Joints, Elbows, Flanges, of Plastics, for Tubes, Pipes and Hoses (USD Thousand)

-

Import Analysis of Fittings, E.g. Joints, Elbows, Flanges, of Plastics, for Tubes, Pipes and Hoses (USD Thousand)

-

Export Analysis of Sinks and Washbasins, of Stainless Steel (USD Thousand) 202

-

Import Analysis of Sinks and Washbasins, of Stainless Steel (USD Thousand) 203

-

Export Analysis of Ceramic Sinks, Washbasins, Washbasin Pedestals, Baths, Bidets, Water Closet Pans, Flushing and Others (USD Thousand)

-

Import Analysis of Ceramic Sinks, Washbasins, Washbasin Pedestals, Baths, Bidets, Water Closet Pans, Flushing and Others (USD Thousand)

-

Export Analysis of Ceramic Sinks, Washbasins, Washbasin Pedestals, Baths, Bidets, Water Closet Pans, Flushing and Others (USD Thousand)

-

Import Analysis of Taps, Cocks, Valves and Similar Appliances for Pipes, Boiler Shells, Tanks, Vats and Others (USD Thousand)

Leave a Comment