Research Methodology on Plumbing Fixtures and Fittings Market

Market Research Report on Global Plumbing Fixtures and Fittings Market by Market Research Future.

The research methodology employed in this market report titled "Plumbing Fixtures and Fittings Market" combines descriptive and exploratory techniques. It includes qualitative insights with surveys, including primary and secondary research. Market Research Future implemented Porter's Five Forces Model to analyze the competitive dynamics of the Plumbing Fixtures & Fittings Market. The objective is to understand the market movement, trends, segmentation, and competitive landscape.

Primary Research

Primary research is conducted by conducting surveys, interviews and focus group discussions. Trend analysis is used to study the factors and expected growth of the market over the forecast period 2023 to 2030, which is used to understand the drivers, restraints, and opportunities for the market. Also, surveys were conducted to debate the opinion of industry-related professionals, consumers, and stakeholders.

Secondary Research

Secondary research is conducted to monitor the market, industry trends, the parent market, and market dynamics. The materials obtained from public sources, company websites and annual reports, news articles, and market reports are used for collecting information for the research purpose.

Market Size Estimation

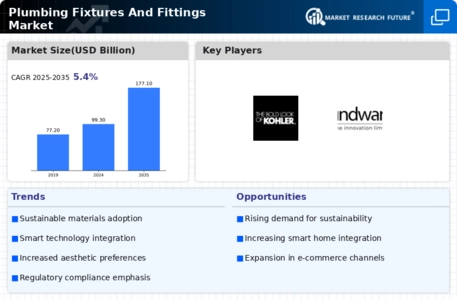

A bottom-up approach and a top-down approach were used to identify the market size for the global plumbing fixtures and fittings market. The bottom-up approach is used to estimate the market's overall size by determining the revenue generated by the key players in the Plumbing Fixtures & Fittings Market. After that, a top-down approach is used to estimate the size of the market segment. For the same purpose, data is collected from various databases such as Bloomberg and Factiva.

Data triangulation

Data triangulation is done by considering the parameters such as demand-supply, end user, and products; this approach is used to extract data from the demand and supply sides. The data triangulation approach is utilized to validate the data collected through the questionnaire administered to market participants.

Market Breakdown and Data Triangulation

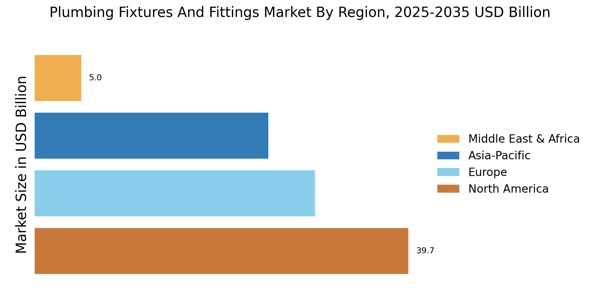

Market breakdown and triangulation are used to ensure that estimates are derived from the sales and production across different regions across the world. Namely, dunes and continents, the Plumbing Fixtures & Fittings market is divided into North America, Europe, Asia Pacific, and the Rest of the World, and segmented into several categories such as materials type and end-use.

Assumptions

Market Research Future assumes the increase in revenue will be because of the escalated demand for Plumbing Fixtures & Fittings globally, and this report has considered the overall market impact, the regional analysis, and the year-on-year growth rate.

Conclusion

The published report by Market Research Future presents an in-depth analysis of the global Plumbing Fixtures & Fittings market. The market size for the Plumbing Fixtures & Fittings market is estimated using a combination of primary research, secondary research and market sizing techniques. Data collected from surveys, interviews and focus groups of various industry stakeholders, company websites and annual reports and news articles are used in the said analysis. A comprehensive analysis of the market dynamics, such as drivers, restraints, and opportunities, is also included in this report, along with the market. Furthermore, a discussion of the current trends, market strategies, and the competitive landscape of the Plumbing Fixtures & Fittings market is included in this report published by Market Research Future.