Market Analysis

In-depth Analysis of Pneumatic Components Market Industry Landscape

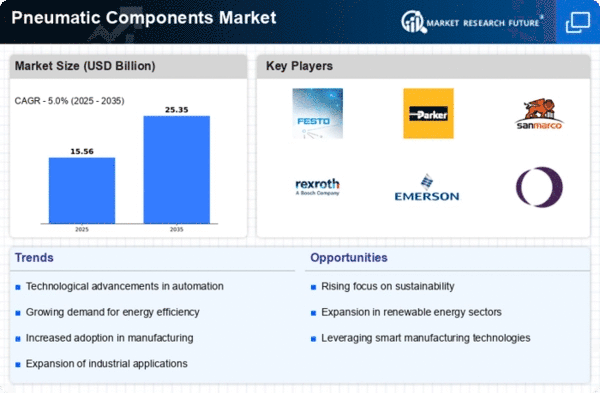

Pneumatic components play a crucial role across diverse industries, including food & beverage, chemicals, packaging, material handling, semiconductors, and electronics. The application of pneumatics extends to various automated industrial systems, encompassing automatic door opening systems, elevators, forklifts, and a spectrum of pneumatic tools. In the evolution and expansion of process automation, the entire spectrum of material movement and displacement within the manufacturing chain has been significantly influenced by pneumatics. The development of efficient, safe, and automatable systems like belts and roller conveyors has been pivotal in meeting the growing demand for pneumatic applications. Pneumatic technology has also contributed to the evolution of robotic systems, enabling precision in rotating, percussive, or direction-changing actions at high speed and accuracy. Among the prominent end users of pneumatic components, the packaging industry stands out. Pneumatic technology has garnered widespread use in packaging machines, serving as a driving force for motion and the activation of machine sequences. This trend has gained favor among machine designers and end users seeking reliable solutions for actuation and material movement in various packaging systems. Pneumatic technology is indispensable in a broad spectrum of consumer goods packaging setups, offering tried-and-true solutions. The latest generation of smart pneumatics stands out for its onboard intelligence and compliance with essential communication standards, facilitating seamless integration into digital packing machine setups. In the packaging machinery sector, there is a concentrated effort on enhancing safety features and ensuring secure operational functionality, a goal efficiently met through the incorporation of pneumatic components. Notably, major packaging machine manufacturers are focusing on creating machines with versatile applicability across regions, requiring minimal modifications. To achieve this, adherence to safety regulations, particularly those applicable in European markets, is a key consideration. Moreover, there is a growing trend among machine manufacturers and end users to utilize pneumatic components not only for integrating safety measures into manufacturing equipment but also for enhancing overall system reliability and lifespan. Pneumatics prove instrumental in extending the operational efficiency and longevity of systems while maintaining a focus on safety standards. pneumatic components have become integral across industries, contributing to the automation of various systems and processes. The packaging industry, in particular, has witnessed a surge in the adoption of pneumatic technology for its reliability and versatility in facilitating motion and actuation in packaging machines. The ongoing evolution of smart pneumatics further accentuates the seamless integration of these components into digital setups, emphasizing safety and compliance with international standards, and showcasing their vital role in advancing industrial automation.

Leave a Comment