Market Growth Projections

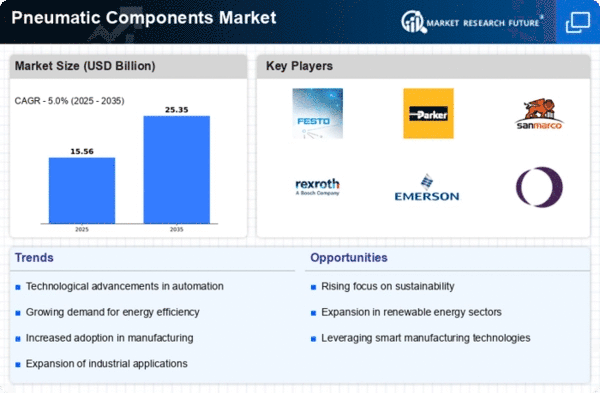

The Global Pneumatic Components Market Industry is poised for substantial growth in the coming years. With a projected market value of 14.8 USD Billion in 2024, the industry is expected to expand significantly, reaching an estimated 25.4 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 5.02% from 2025 to 2035. The increasing adoption of pneumatic systems across various sectors, coupled with technological advancements and a focus on energy efficiency, suggests a robust future for the market.

Rising Automation in Industries

The increasing trend of automation across various industries is a primary driver for the Global Pneumatic Components Market Industry. As industries strive for enhanced efficiency and productivity, pneumatic components play a crucial role in automating processes. For instance, sectors such as manufacturing and packaging are increasingly adopting pneumatic systems to streamline operations. This shift is expected to contribute to the market's growth, with projections indicating a market value of 14.8 USD Billion in 2024. The demand for reliable and efficient pneumatic solutions is likely to escalate as industries continue to embrace automation.

Expansion of Manufacturing Sector

The expansion of the manufacturing sector globally is a significant driver for the Global Pneumatic Components Market Industry. As countries invest in infrastructure and industrial development, the demand for pneumatic components is likely to rise. For example, emerging economies are witnessing a surge in manufacturing activities, leading to increased adoption of pneumatic systems for various applications. This trend is expected to contribute to the market's growth, with a compound annual growth rate of 5.02% projected from 2025 to 2035. The expansion of manufacturing capabilities will likely create new opportunities for pneumatic component manufacturers.

Increased Focus on Safety Standards

The heightened focus on safety standards in industrial operations is influencing the Global Pneumatic Components Market Industry. Regulatory bodies are enforcing stringent safety regulations, compelling industries to adopt pneumatic systems that meet these standards. This trend is particularly relevant in sectors such as construction and mining, where safety is paramount. Companies are investing in high-quality pneumatic components that ensure safe and reliable operations. As safety regulations continue to evolve, the demand for compliant pneumatic solutions is expected to grow, further driving the market.

Growing Demand for Energy Efficiency

Energy efficiency is becoming a focal point for industries worldwide, driving the Global Pneumatic Components Market Industry. Companies are increasingly seeking pneumatic systems that minimize energy consumption while maximizing output. This demand is particularly evident in sectors like automotive and food processing, where energy costs can significantly impact overall operational expenses. The push for sustainability and reduced carbon footprints is prompting manufacturers to innovate and develop energy-efficient pneumatic solutions. As a result, the market is anticipated to grow, with a projected value of 25.4 USD Billion by 2035, reflecting the industry's commitment to energy-efficient technologies.

Technological Advancements in Pneumatics

Technological advancements are reshaping the landscape of the Global Pneumatic Components Market Industry. Innovations such as smart sensors and IoT integration are enhancing the functionality and efficiency of pneumatic systems. These advancements enable real-time monitoring and predictive maintenance, reducing downtime and operational costs. Industries are increasingly adopting these technologies to improve their processes and maintain competitiveness. The integration of advanced technologies is expected to drive market growth, as companies seek to leverage these innovations for enhanced productivity and reliability in their pneumatic systems.