Research Methodology on Poly Butylene Adipate-Co-Terephthalate Market

1. Introduction

Research methodology is used to define the research design and methods used by the researchers to complete a research study or to answer a research query. They are used to provide a structure for how data is collected, analyzed and interpreted and also help in providing conclusions and recommendations.

In this report on the Poly Butylene Adipate-Co-Terephthalate (PBAT) market, a detailed market research methodology is laid out, discussing data triangulation techniques used throughout the report such as primary and secondary research methods and also the bottom-up and top-down approach.

2. Objective of the Study

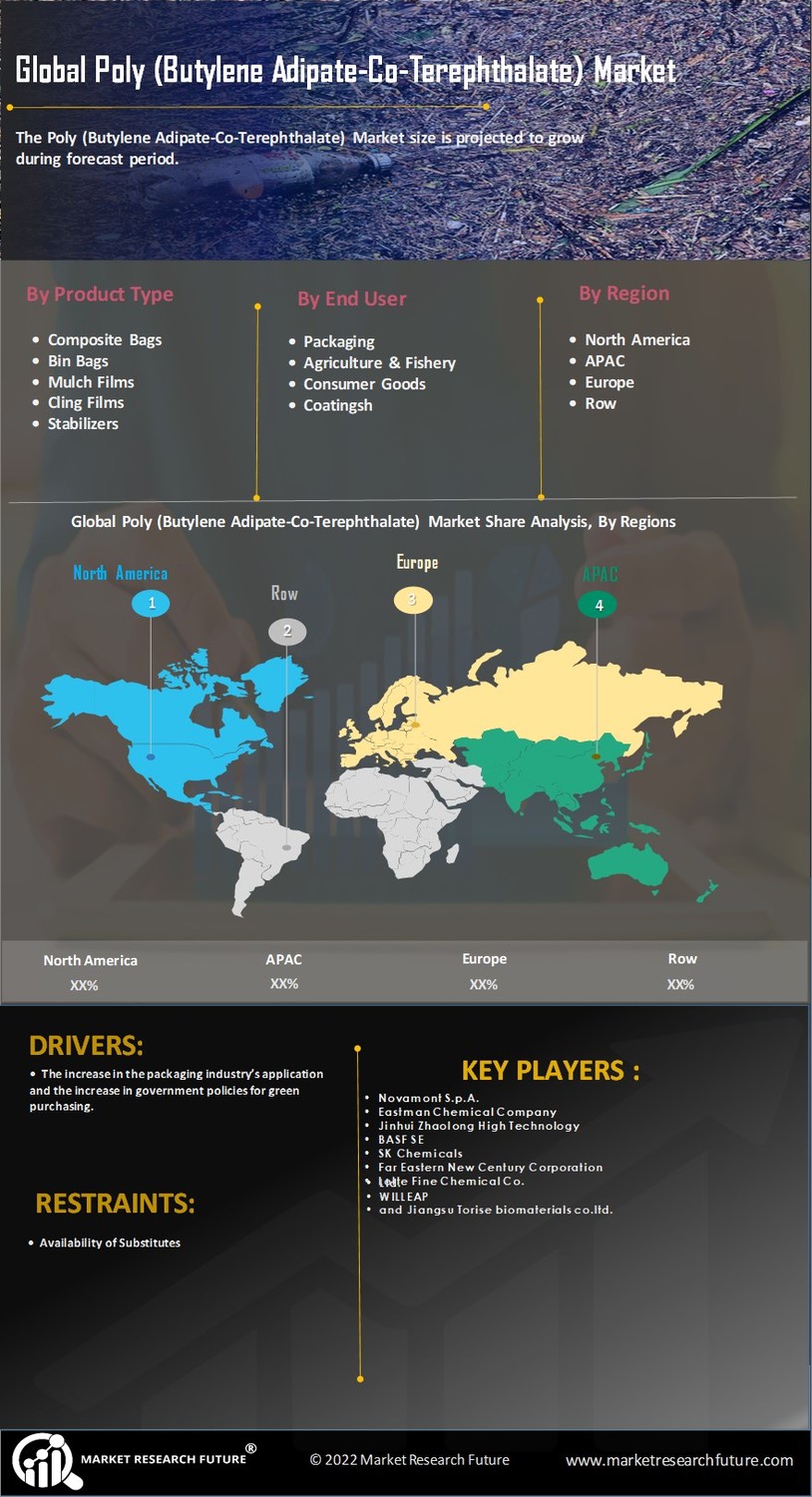

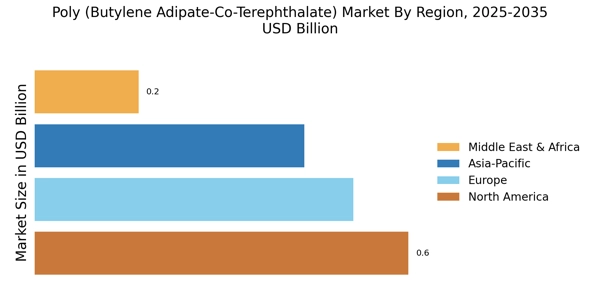

The goal of this research has been to understand the global market size of the Poly Butylene Adipate-Co-Terephthalate (PBAT) market, including its potential growth rate. This report also aims to gain insight into the major regional market trends as well as to identify the key players in the global Poly Butylene Adipate-Co-Terephthalate (PBAT) market.

3. Research Design

To gain an accurate prediction about the future growth of the Poly Butylene Adipate-Co-Terephthalate (PBAT) market, a combination of secondary and primary research methods was used. The secondary research consists of sources such as news articles, trade journals, industry magazines, white papers, annual reports and data published by the Government or by the organizations. The objective of the primary research was to provide realistic data from which relevant trends and patterns would be drawn.

Before the start of the research, a pre-research was conducted with the help of both primary and secondary sources, which provided information regarding the overall structure of the Poly Butylene Adipate-Co-Terephthalate (PBAT) market, the various roles of the players in the market, the major applications and their market share. This information was then verified and validated through a structured research process.

Furthermore, the “Bottom Up” approach was adopted to arrive at the overall market size of the Poly Butylene Adipate-Co-Terephthalate (PBAT) Market from the regional revenues. This information was collected and analyzed using multiple triangulation techniques and a “Top Down” approach to arrive at the estimated figures.

4. Data Collection and Verification

Data collected through secondary sources includes public information such as statistical databases, paid databases and several market research reports. Information gathered from magazines, books, industry journals, websites, press releases etc. was also used. The primary research aimed to provide realistic market figures and the fuel for developing a comprehensive market scenario.

The primary research was conducted on a global basis as well as in different regions, which includes surveys of industry experts, interviews with senior industry personnel and key industry players and also through case studies conducted on relevant topics. The primary survey was conducted along with the secondary research. The questions that were used in the primary research were different for the industry experts and the market players.

The data collected from both primary as well as secondary sources is further verified and validated with the help of internal and external databases, to ensure the accuracy of the data.

5. Secondary Research

In this report, the authors used a significant number of secondary sources. The authors used various sources such as paid databases, company press releases, articles from journals, correspondences with key industry participants, websites of the companies mentioned in the report and various financial and statistical reports.

The secondary sources used in this report are,

• The Economic Times

• Market Research Reports

• Bloomberg

• Technavio

• Press Releases

• Annual Reports

• Trade Journals

• Government Publications

• Factiva

• Business Week

• United States Department of Commerce

• World Trade Organization

• Various Market Research Reports

6. Primary Research

The authors conducted primary research to understand the dynamics of the PBAT market and were able to collect data on key industry players, their performance, market trends and industry experts.

The primary research was conducted through interviews with various C-level and senior-level executives, industry experts and key players. The interviews and surveys helped in understanding the market dynamics and gain knowledge about the industry trends, economic factors, industry statutes, production and technical aspects. The authors also conducted structured interviews with industry participants and had over 50 interviews and surveys as a part of our primary research.

7. Time-series Analysis

The authors used Time-Series Analysis to study the historical data and investigate the market movements of the Poly Butylene Adipate-Co-Terephthalate (PBAT) market. The Time-Series analysis was used to analyze the past market size which helped in predicting the future size of the market.

8. Demand Side and Supply Side Data Triangulation

The authors also used a demand-side and supply-side data triangulation method to analyze the overall Poly Butylene Adipate-Co-Terephthalate (PBAT) market. The authors used company information, market size data, interviews and surveys, market intelligence and market overview reports to understand the overall market landscape.

By triangulating these multiple sources, the authors were able to generate a comprehensive understanding of the structure and size of the PBAT market, concerning the different types of applications, regional demand, product types, and market share.

9. Factor Analysis

The authors used a factor analysis approach to determine the potential growth opportunities and the timeline for the Poly Butylene Adipate-Co-Terephthalate (PBAT) market. The authors used factors such as political, legal, and environmental considerations which can influence the market, technological developments, customer preferences, competitive intensity, government regulations and the cost of raw materials and labour.

These factors were used to analyze the overall conditions of the PBAT market and to make predictions for the growth of the market.

10. Quantitative and Qualitative Analysis

The authors used both qualitative and quantitative analysis to accurately predict the future of the Poly Butylene Adipate-Co-Terephthalate (PBAT) market. The authors used quantitative analysis tools such as trend analysis, demand-supply analysis, cost and pricing analysis and market share analysis, to generate and validate market estimates. The authors also used qualitative analysis techniques such as Porter’s Five Forces Analysis, SWOT Analysis, pESTEL Analysis and demand-supply side analysis, to gain a better understanding of the market drivers, restraints and opportunities in the Poly Butylene Adipate-Co-Terephthalate (PBAT) market.

11. Conclusion

In conclusion, the authors used a comprehensive and structured methodology that included the use of both primary and secondary research methods, time-series analysis, demand-supply side data triangulation, bottom-up and top-down approaches and factor analysis. All these methods were successfully used to provide accurate estimates of the global market size of the Poly Butylene Adipate-Co-Terephthalate (PBAT) market and its potential growth rate. The authors also used qualitative and quantitative analysis tools to accurately predict the future of the market from 2023 to 2030.