Rising Demand in Automotive Sector

The Global Polycarbonate Composites Market Industry experiences a notable surge in demand from the automotive sector, driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. Polycarbonate composites are increasingly utilized in manufacturing components such as dashboards, lighting systems, and windows. As automotive manufacturers aim to meet stringent environmental regulations, the adoption of polycarbonate composites is projected to grow. The market is expected to reach 2.19 USD Billion in 2024, reflecting a robust growth trajectory as automakers prioritize sustainable materials to improve vehicle performance and safety.

Increasing Adoption in Construction Sector

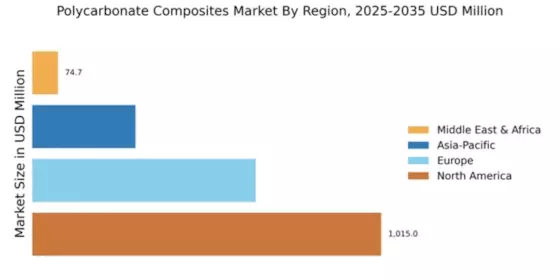

The Global Polycarbonate Composites Market Industry is witnessing increased adoption in the construction sector, where these materials are utilized for their strength, lightweight nature, and thermal insulation properties. Polycarbonate composites are commonly employed in roofing, glazing, and façade applications, providing energy-efficient solutions that align with contemporary architectural trends. As urbanization accelerates globally, the demand for innovative building materials is expected to rise. This trend may drive the market forward, with a projected CAGR of 7.05% from 2025 to 2035, reflecting the growing emphasis on sustainable construction practices.

Technological Advancements in Material Science

The Global Polycarbonate Composites Market Industry is significantly influenced by technological advancements in material science, which enhance the performance characteristics of polycarbonate composites. Innovations in manufacturing processes and formulations are leading to improved mechanical properties, UV resistance, and thermal stability. These advancements enable the development of high-performance composites suitable for diverse applications, including automotive, aerospace, and consumer goods. As industries seek to leverage these enhanced materials, the market is poised for growth, with manufacturers increasingly investing in research and development to explore new applications and improve product offerings.

Growth in Electronics and Electrical Applications

The Global Polycarbonate Composites Market Industry benefits from the expanding electronics and electrical applications, where polycarbonate composites are favored for their excellent electrical insulation properties and impact resistance. These materials are commonly used in the production of housings, connectors, and circuit boards. As the demand for consumer electronics continues to rise, manufacturers are increasingly turning to polycarbonate composites to ensure durability and reliability in their products. This trend is likely to contribute to the market's growth, with projections indicating a market size of 4.64 USD Billion by 2035, underscoring the material's relevance in modern technology.

Environmental Regulations and Sustainability Initiatives

The Global Polycarbonate Composites Market Industry is shaped by stringent environmental regulations and sustainability initiatives that encourage the use of eco-friendly materials. Governments worldwide are implementing policies aimed at reducing carbon footprints and promoting the use of recyclable materials in various industries. Polycarbonate composites, known for their recyclability and lower environmental impact compared to traditional materials, are becoming increasingly attractive to manufacturers. This shift towards sustainable practices is likely to bolster market growth, as companies strive to comply with regulations while meeting consumer demand for environmentally responsible products.