Polycarbonate Composites Size

Polycarbonate Composites Market Growth Projections and Opportunities

Polycarbonate Composites Market dynamics are shaped by many market factors. The growing need for lightweight and high-performance materials in numerous industries drives market expansion. Polycarbonate composites, with its high strength-to-weight ratio, are used in automotive, aerospace, and construction, driving their market share.

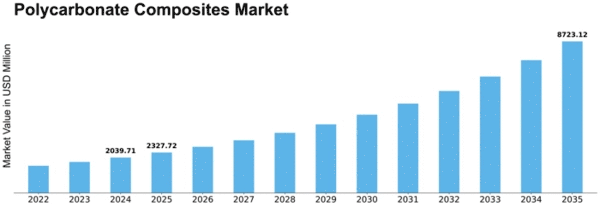

The polycarbonate composites market is estimated to reach USD 3.5 billion, growing 5.8%.

Demand for polycarbonate composites is also driven by the promotion of eco friendly materials. Recyclability and low environmental impact make these composites a viable solution for industries worldwide trying to lessen their environmental impact. The market trend toward eco friendly solutions affects manufacturers and customers.

Technological advances and environmental concerns shape the Polycarbonate Composites Market. Continuous research and development improves manufacturing processes and creates new goods. This improves polycarbonate composite quality and increase their applications, boosting market growth.

Regulatory frameworks and standards also affect market factors. Polycarbonate composites are regulated for safety, quality, and environmental impact. Compliance with these criteria is essential for firms to compete and gain consumer trust. Compliance with such restrictions promotes market stability and end-user satisfaction.

Automotive is a prominent Polycarbonate Composites Market driver. Polycarbonate composites are used more in vehicle parts to improve fuel efficiency. Polycarbonate composites are preferred by manufacturers as electric vehicles gain popularity, increasing the need for lightweight materials.

Economic conditions and market developments affect the Polycarbonate Composites Market globally. Raw material prices, currency exchange rates, and economic stability affect production costs and product pricing. For competitiveness and market expansion, manufacturers must proactively manage these external influences.

Consumer tastes and trends shape the market. As awareness of polycarbonate composites grows, consumers prefer products with higher performance, durability, and environmental sustainability. This consumer shift pushes manufacturer decisions and industry innovation to satisfy changing expectations.

Finally, the Polycarbonate Composites Market is interconnected with many aspects. Technological advances, regulatory compliance, consumer preferences, and economic conditions shape the market. As industries continue to prioritize lightweight, high-performance, and sustainable materials, the demand for polycarbonate composites is likely to observe continuous rise, positioning it as a significant player in the global materials market."

Leave a Comment