Increased Construction Activities

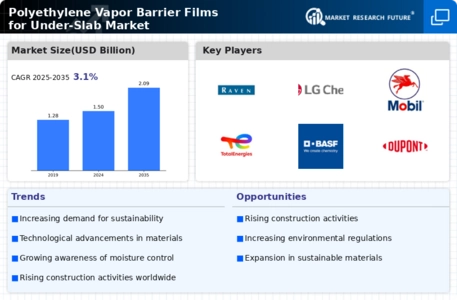

The Polyethylene Vapor Barrier Films for Under-Slab Market is experiencing a surge in demand due to heightened construction activities across various sectors. As urbanization continues to expand, the need for residential and commercial buildings increases, leading to a greater requirement for effective moisture control solutions. Polyethylene vapor barrier films are essential in preventing moisture intrusion, which can compromise structural integrity. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to drive the demand for polyethylene vapor barrier films, as builders and contractors seek reliable materials to enhance the durability and longevity of their projects.

Regulatory Standards and Building Codes

The Polyethylene Vapor Barrier Films for Under-Slab Market is significantly influenced by evolving regulatory standards and building codes. Governments and regulatory bodies are increasingly mandating the use of vapor barriers in construction to ensure energy efficiency and moisture control. Compliance with these regulations is essential for builders and contractors, driving the demand for polyethylene vapor barrier films. Recent updates to building codes in various regions emphasize the importance of moisture management, which could lead to a rise in the adoption of polyethylene films. This regulatory push is likely to create a favorable environment for market growth, as adherence to standards becomes a priority for construction projects.

Sustainability and Eco-Friendly Practices

The emphasis on sustainability and eco-friendly practices is becoming a significant driver in the Polyethylene Vapor Barrier Films for Under-Slab Market. As environmental concerns rise, builders and consumers are increasingly seeking materials that minimize ecological impact. Polyethylene films that are recyclable or made from recycled materials are gaining popularity, aligning with the broader trend towards sustainable construction. Market analysis suggests that the demand for eco-friendly building materials is expected to grow by over 20% in the coming years. This shift towards sustainability is likely to enhance the market for polyethylene vapor barrier films, as stakeholders prioritize environmentally responsible solutions in their projects.

Rising Awareness of Moisture-Related Issues

There is a growing awareness regarding the detrimental effects of moisture-related issues in buildings, which significantly influences the Polyethylene Vapor Barrier Films for Under-Slab Market. Moisture can lead to mold growth, structural damage, and health concerns, prompting builders and homeowners to prioritize moisture control solutions. As a result, the demand for polyethylene vapor barrier films is expected to rise. Market data indicates that approximately 30% of building failures are attributed to moisture problems, underscoring the necessity for effective vapor barriers. This awareness is likely to drive investments in high-quality polyethylene films, as stakeholders recognize the long-term benefits of preventing moisture intrusion.

Technological Innovations in Material Science

Technological advancements in material science are playing a pivotal role in shaping the Polyethylene Vapor Barrier Films for Under-Slab Market. Innovations such as enhanced barrier properties, improved durability, and eco-friendly formulations are emerging, making polyethylene films more effective and appealing to consumers. Manufacturers are increasingly focusing on developing films that not only meet performance standards but also align with sustainability goals. For instance, the introduction of recycled polyethylene films is gaining traction, catering to environmentally conscious builders. This trend is likely to expand the market, as stakeholders seek advanced solutions that offer both performance and sustainability.