Growth in Construction Activities

The construction industry is witnessing a resurgence, with increased investments in infrastructure and residential projects. This growth is likely to bolster the Polymethyl Methacrylate Film And Sheet Market, as PMMA is favored for its durability and aesthetic appeal in applications such as skylights, partitions, and signage. The construction sector is expected to expand at a rate of around 5% annually, driven by urbanization and population growth. PMMA's versatility allows it to be utilized in various architectural designs, enhancing both functionality and visual appeal. Consequently, the demand for PMMA films and sheets is anticipated to rise, indicating a positive trajectory for the Polymethyl Methacrylate Film And Sheet Market.

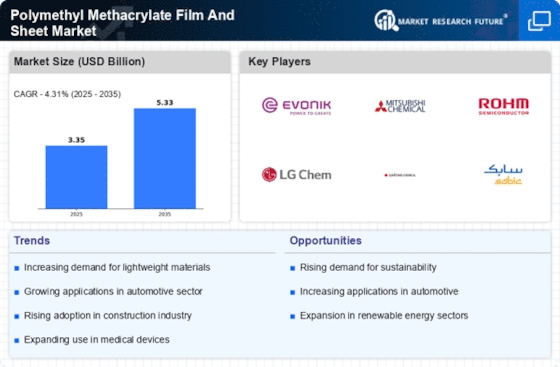

Rising Demand in Automotive Sector

The automotive sector is experiencing a notable increase in the adoption of lightweight materials, which enhances fuel efficiency and reduces emissions. Polymethyl Methacrylate Film And Sheet Market is benefiting from this trend, as PMMA offers excellent optical clarity and impact resistance, making it suitable for automotive applications such as windows and interior components. The automotive industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, further driving the demand for PMMA products. As manufacturers seek to comply with stringent environmental regulations, the lightweight nature of PMMA becomes increasingly appealing, suggesting a robust future for the Polymethyl Methacrylate Film And Sheet Market.

Increasing Focus on Aesthetic Appeal

In various industries, there is a growing emphasis on aesthetic appeal, particularly in consumer products and interior design. The Polymethyl Methacrylate Film And Sheet Market is well-positioned to capitalize on this trend, as PMMA offers a wide range of colors and finishes that enhance product attractiveness. Its clarity and glossiness make it a preferred choice for applications in lighting fixtures, displays, and decorative elements. As consumers increasingly prioritize aesthetics in their purchasing decisions, the demand for PMMA products is likely to rise. This trend suggests a favorable outlook for the Polymethyl Methacrylate Film And Sheet Market, as manufacturers seek to create visually appealing products.

Technological Innovations in Manufacturing

Technological advancements in the production of PMMA films and sheets are significantly influencing the Polymethyl Methacrylate Film And Sheet Market. Innovations such as improved extrusion techniques and enhanced polymerization processes are leading to higher quality products with better performance characteristics. These advancements not only reduce production costs but also enable manufacturers to meet the growing demand for customized solutions across various sectors. The introduction of new formulations and additives is likely to expand the application range of PMMA, making it more competitive against alternative materials. As a result, the Polymethyl Methacrylate Film And Sheet Market is poised for growth, driven by these technological improvements.

Environmental Regulations and Sustainability

The increasing stringency of environmental regulations is prompting industries to seek sustainable materials. The Polymethyl Methacrylate Film And Sheet Market is benefiting from this shift, as PMMA is recyclable and can be produced with lower environmental impact compared to other plastics. As companies strive to meet sustainability goals, the demand for eco-friendly materials is expected to grow. The market for PMMA is projected to expand as manufacturers highlight the environmental benefits of using PMMA films and sheets in their products. This trend indicates a promising future for the Polymethyl Methacrylate Film And Sheet Market, as sustainability becomes a key driver of material selection.