Market Share

Polyolefin Battery Separator Films Market Share Analysis

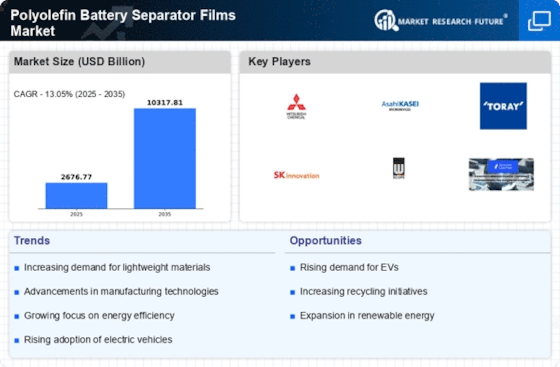

It has experienced a surge in demand, given its role as a key component of the growing electric vehicle (EV) and energy storage sectors. Many companies have realized that gaining competitive advantage involves positioning oneself well in terms of market share. One way is through product innovation to create differentiation among others, while another would be to attain cost leadership whereby firms concentrate on improving production processes through reducing manufacturing costs, thus achieving economies of scale. As such, companies can develop low-cost polyolefin battery separator films, which will still ensure effectiveness, enabling them to attract price-sensitive customers and potentially giving them a competitive edge. Thus, this approach calls for effective supply chain management supported by investments into technology as well as continuous improvement so as to balance between cost reduction and quality control which becomes more complex in a globalized market. Market segmentation is an indispensable strategy for companies in the polyolefin battery separator films market. Companies can enter niche markets and gain a competitive edge by identifying specific target markets and developing products to meet different applications. This approach requires understanding the diverse needs of customers within different industries, such as electric vehicles, consumer electronics, and renewable energy storage, so as to tailor product offerings accordingly. The polyolefin battery separator films market is moving towards cooperation and alliances among the major players involved. For instance, collaboration with manufacturing firms, research institutions, or technology providers helps to leverage complementary strengths, share resources, and solve the market challenges that exist collectively. Again, geographical expansion is another significant strategy in the polyolefin battery separator film segment. As global demand for electric cars rises alongside energy storage solutions, companies are looking forward to new markets to expand their operations. Establishing strongholds in emerging economies' regions or those with the potential for quick growth enables such firms to attract new opportunities and enlarge their presence in a given country or region. It may involve setting up production plants, distribution channels, or local arrangements to address unique regional specifications.

Leave a Comment