Cost-Effectiveness

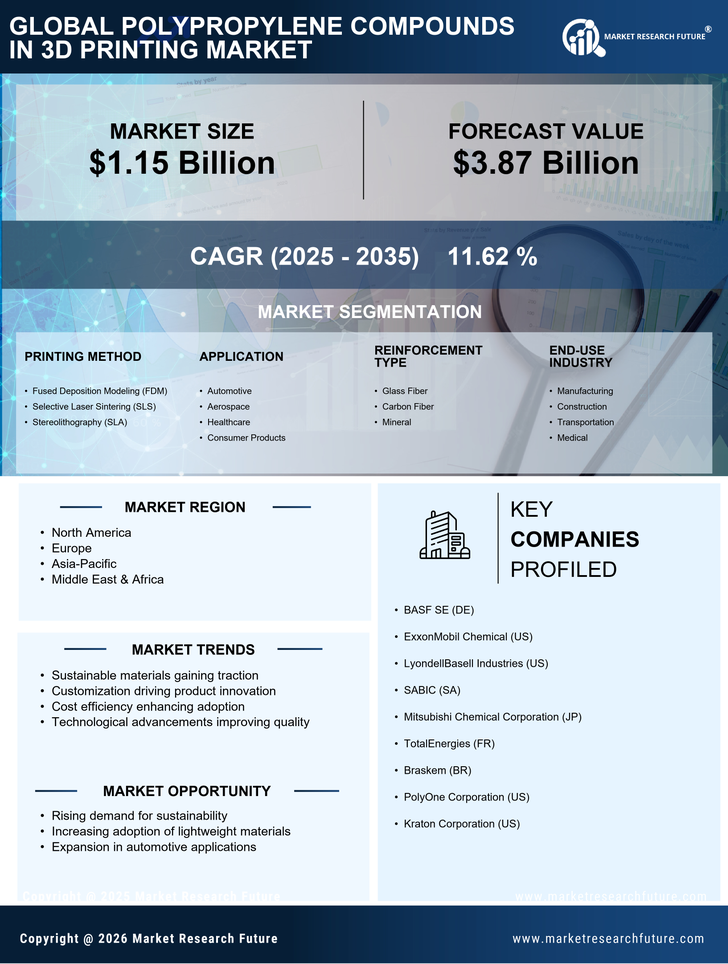

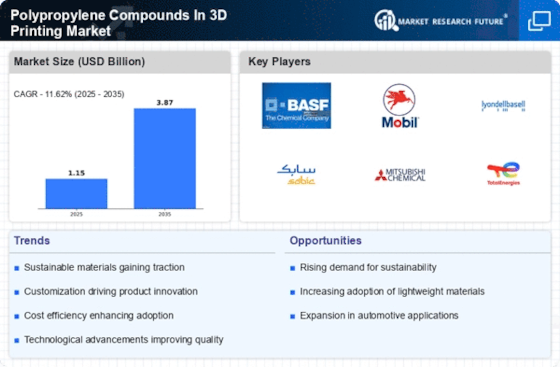

The cost-effectiveness of polypropylene compounds is a crucial driver for the Polypropylene Compounds In 3D Printing Market. Compared to other materials, polypropylene offers a favorable balance between performance and price, making it an attractive option for manufacturers. Market data indicates that the overall cost of 3D printing with polypropylene is lower than that of many alternative materials, which could encourage wider adoption. This economic advantage is particularly relevant for small to medium-sized enterprises looking to leverage 3D printing technology without incurring prohibitive costs.

Regulatory Support

Regulatory support for additive manufacturing is likely to influence the Polypropylene Compounds In 3D Printing Market positively. Governments and industry bodies are increasingly recognizing the potential of 3D printing to drive innovation and economic growth. Initiatives aimed at promoting the use of advanced manufacturing technologies may lead to increased funding and resources for research and development in polypropylene compounds. This supportive regulatory environment could facilitate the growth of the market, as companies are encouraged to explore and invest in polypropylene-based 3D printing solutions.

Customization Demand

The rising demand for customization in various industries is likely to propel the Polypropylene Compounds In 3D Printing Market. As businesses strive to differentiate their products, the ability to create tailored solutions through 3D printing becomes increasingly valuable. Polypropylene compounds offer versatility in design and functionality, making them suitable for a wide range of applications. Market analysis indicates that sectors such as automotive and consumer goods are particularly focused on customized solutions, which could lead to a significant increase in the adoption of polypropylene in 3D printing processes.

Technological Innovations

Technological advancements in 3D printing techniques are expected to enhance the Polypropylene Compounds In 3D Printing Market. Innovations such as improved printing speeds, enhanced material properties, and better adhesion techniques are making polypropylene compounds more appealing for various applications. Recent studies suggest that the integration of advanced technologies could lead to a substantial increase in the efficiency and quality of 3D printed products. As these technologies evolve, they may further solidify the position of polypropylene compounds as a preferred choice in the 3D printing landscape.

Sustainability Initiatives

The increasing emphasis on sustainability within the manufacturing sector appears to drive the Polypropylene Compounds In 3D Printing Market. Companies are increasingly seeking materials that not only meet performance standards but also align with environmental goals. Polypropylene, being recyclable and less harmful to the environment, is gaining traction. Recent data indicates that the demand for sustainable materials in 3D printing has surged, with a notable percentage of manufacturers prioritizing eco-friendly options. This trend suggests that polypropylene compounds may play a pivotal role in meeting these sustainability targets, thereby enhancing their market presence.