Market Share

Polypropylene Compounds Market Share Analysis

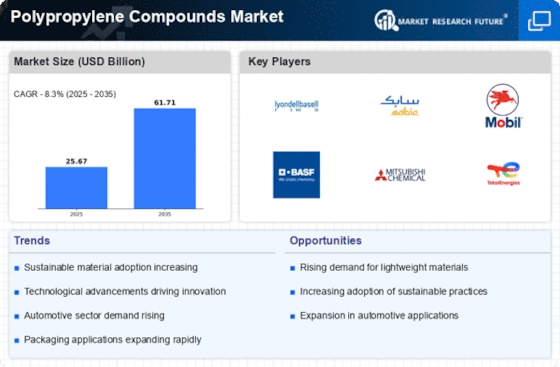

The polypropylene compounds market, a great phase in the plastics industry, employs a number of market percentage positioning strategies to face out in a competitive marketplace. Companies recognize product differentiation by imparting a wide range of polypropylene compounds tailored for specific packages. The market positioning frequently revolves around innovation in compound formulations. Polypropylene compound producers put money into studies and improvements to create superior formulations with stepped-forward mechanical houses, flame retardancy, and environmental sustainability. Forming strategic partnerships with stop-user industries is a collaborative marketplace positioning technique. Polypropylene compound manufacturers collaborate with car, packaging, and production sectors to align their products with specific enterprise needs. The emphasis on sustainability is vital for market positioning. Polypropylene compounds vendors integrate environmentally pleasant practices, including the usage of recycled substances or growing recyclable compounds. Expanding strategically into new international markets is crucial for market growth. Polypropylene compound manufacturers have set up a presence in regions with developing industrial sports, infrastructure development, and growing calls for polymer compounds. Offering responsive customer support and technical assistance is imperative. Polypropylene compound manufacturers prioritize client satisfaction via support in material choice, application trying out, and troubleshooting. Establishing a robust online presence via virtual advertising is vital within the current enterprise panorama. Polypropylene compound providers leverage virtual structures to exhibit their product abilities, interact with potential customers, and offer instructional content. Adopting strategic pricing fashions is essential for market positioning. Polypropylene compound manufacturers put into effect pricing techniques that stabilize competitiveness with profitability. Building sturdy brands and coping with popularity is essential for marketplace visibility. Polypropylene compound providers invest in branding efforts, highlighting product capabilities, best, and progressive formulations. Continuous studies on emerging technology are essential. Polypropylene compound producers live knowledgeable about evolving manufacturing methods, compounding technologies, and market dynamics. Adapting to regulatory requirements is non-negotiable. Polypropylene compound vendors ensure compliance with neighborhood and worldwide guidelines associated with cloth safety, fine, and environmental effects. Investing in team member education and skill improvement is a strategic circulate. Polypropylene compound groups make sure that their workforce is prepared with the essential technical information and understanding. Embracing energy-green manufacturing practices is a comprehensive market positioning strategy. Polypropylene compound producers invest in technology and approaches that lessen energy consumption and environmental impact. Energy-efficient practices align with sustainability dreams and contribute to marketplace leadership.

Leave a Comment