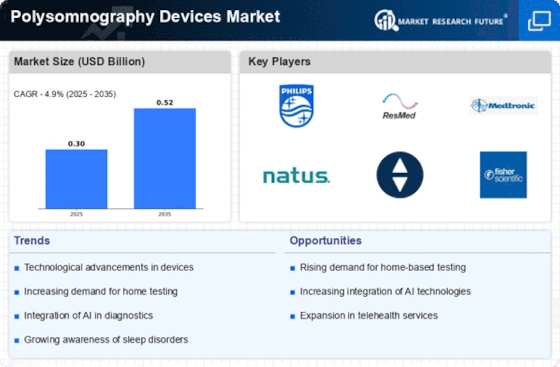

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the market of Polysomnography Devices Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Polysomnography Devices industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Polysomnography Devices industry to benefit clients and increase the market sector. In recent years, the Polysomnography Devices industry has offered some of the most significant advantages to medicine. Major players in the Polysomnography Devices Market, including CleveMed, Nox Medical, SOMNOmedics GmbH, ResMed, Cidelec, Vyaire Medical, Koninklijke Philips, Natus Medical, BMC Medical, Recorders & Medicare Systems, CleveMed, Medicom MTD, Dr.

Langer Medical, Compumedics, Neurovirtual, Contec Medical Systems, and Shanghai NCC Medical, are attempting to increase market demand by investing in research and development operations.

For the diagnosis, treatment, and management of respiratory disorders such sleep disordered breathing (SDB), sleep apnea, and chronic obstructive pulmonary disease (COPD), ResMed Inc. (ResMed) designs, produces, and distributes medical equipment. Air flow generators such as CPAP machines, auto-bilevel machines, VPAP machines, APAP machines, humidifiers, and ventilation products are among its main products, along with masks, headgear, accessories, motors, diagnostic products, and data/patient management products. It also produces masks, headgear, and other protective gear.

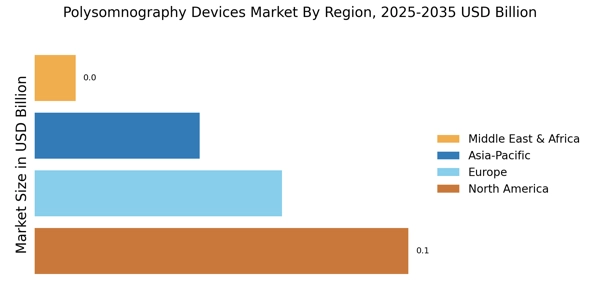

The business offers its goods to third party payers, home healthcare providers, and sleep clinics. In the Americas, Europe, and Asia-Pacific, it conducts business through a network of fully owned subsidiaries, direct offices, and independent distributors. The United States' ResMed has its headquarters in San Diego, California. ResMed paid $300 million to acquire Healthdyne Technologies in June 2022. ResMed will have access to Healthdyne's sleep apnea products through the acquisition, including its Sleep EasyTM continuous positive airway pressure (CPAP) system.

Koninklijke Philips NV (Philips) is a diversified technology firm that creates and produces consumer electronics and medical solutions. Diagnostic imaging, enterprise diagnostic informatics, image-guided therapy, ultrasound, monitoring and analytics, sleep and respiratory care, population health management, linked care informatics, and therapeutic care are all sectors in which the business provides products and solutions. Products available include power toothbrushes, brush heads, infant bottles, sterilizers, breast pumps, shavers, groomers, trimmers, and items for skin, hair, and hair removal.

It also sells personal care and dental healthcare items. The corporation operates in North America, Europe, and the Asia-Pacific region. The corporate headquarters of Philips are located in North Brabant, the Netherlands. Philips paid $5.1 billion to acquire Respironics, Inc. in August 2022. Philips will get access to Respironics' CPAP and BiPAP equipment as a result of the acquisition.