Growth in Chemical Processing Sector

The Polytetrafluoroethylene (PTFE) Film Market is significantly influenced by the growth of the chemical processing sector. PTFE films are favored for their exceptional resistance to corrosive chemicals, making them ideal for use in various chemical processing applications. As the chemical industry expands, driven by increasing production capacities and the need for advanced materials, the demand for PTFE films is likely to rise. Recent data suggests that the chemical processing sector is expected to witness a compound annual growth rate of over 5% in the coming years, further propelling the PTFE film market.

Regulatory Support for Advanced Materials

The Polytetrafluoroethylene (PTFE) Film Market is likely to gain momentum from regulatory support aimed at promoting advanced materials. Governments are increasingly recognizing the importance of high-performance materials in enhancing safety and efficiency across various sectors. Initiatives that encourage the use of innovative materials, including PTFE films, are expected to drive market growth. For instance, regulations that mandate the use of non-toxic and durable materials in construction and manufacturing are likely to favor PTFE films, thereby expanding their market presence. This regulatory landscape could provide a significant boost to the PTFE film market.

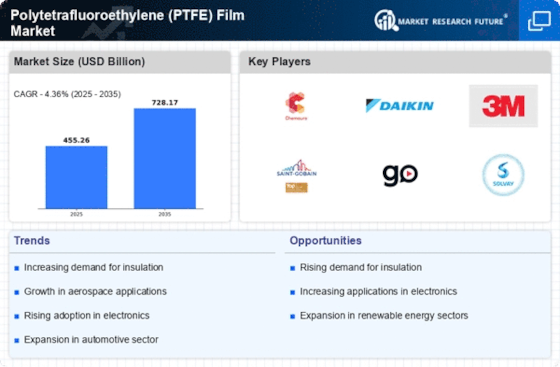

Rising Demand for High-Performance Materials

The Polytetrafluoroethylene (PTFE) Film Market is benefiting from the rising demand for high-performance materials across various applications. Industries are increasingly seeking materials that can withstand extreme temperatures and harsh environments. PTFE films, known for their thermal stability and mechanical strength, are becoming the material of choice in applications such as insulation and protective coatings. This trend is particularly evident in sectors like electronics and telecommunications, where the need for reliable and durable materials is paramount. As industries continue to prioritize performance, the PTFE film market is poised for substantial growth.

Increasing Applications in Various Industries

The Polytetrafluoroethylene (PTFE) Film Market is experiencing a surge in demand due to its diverse applications across multiple sectors. Industries such as aerospace, automotive, and pharmaceuticals are increasingly utilizing PTFE films for their unique properties, including chemical resistance and low friction. For instance, in the aerospace sector, PTFE films are employed in insulation and sealing applications, enhancing performance and safety. The automotive industry also benefits from PTFE films in fuel systems and gaskets, where durability is paramount. As these industries continue to expand, the demand for PTFE films is projected to grow, indicating a robust market trajectory.

Technological Innovations in Manufacturing Processes

The Polytetrafluoroethylene (PTFE) Film Market is witnessing advancements in manufacturing processes that enhance the quality and efficiency of PTFE film production. Innovations such as improved extrusion techniques and advanced coating methods are enabling manufacturers to produce films with superior properties. These technological advancements not only reduce production costs but also improve the performance characteristics of PTFE films, making them more appealing to end-users. As manufacturers continue to invest in research and development, the PTFE film market is expected to benefit from enhanced product offerings and increased competitiveness.