Growth in E-commerce and Retail Sectors

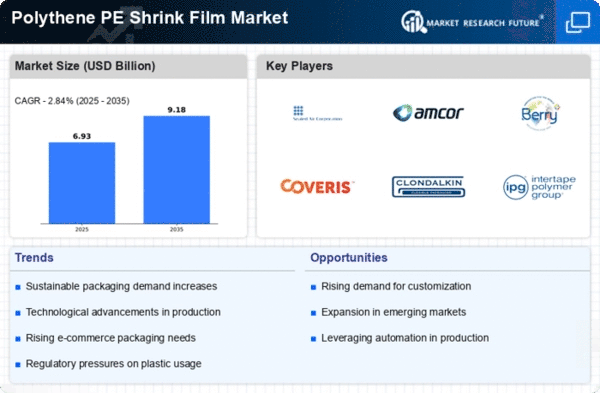

The expansion of the e-commerce and retail sectors significantly influences the Global Polythene PE Shrink Film Market Industry. As online shopping continues to proliferate, the need for effective packaging solutions becomes paramount. Polythene PE shrink films provide excellent protection and presentation for products, making them a preferred choice among retailers. The convenience of shrink-wrapped products enhances consumer appeal, thereby driving sales. This trend is expected to contribute to the market's growth, with projections indicating a market value of 9.18 USD Billion by 2035, reflecting the increasing reliance on efficient packaging in the retail landscape.

Technological Advancements in Film Production

Technological advancements in the production of polythene PE shrink films are reshaping the Global Polythene PE Shrink Film Market Industry. Innovations in manufacturing processes, such as improved extrusion techniques and enhanced polymer formulations, lead to films with superior properties. These advancements result in films that are thinner, stronger, and more versatile, catering to diverse packaging needs. Moreover, the integration of automation and smart technologies in production lines enhances efficiency and reduces costs. As a result, manufacturers can offer high-quality products that meet evolving consumer demands, thereby driving market growth and contributing to a projected CAGR of 2.85% from 2025 to 2035.

Increasing Applications Across Various Industries

The versatility of polythene PE shrink films facilitates their adoption across various industries, thereby bolstering the Global Polythene PE Shrink Film Market Industry. These films find applications in sectors such as food and beverage, pharmaceuticals, and consumer goods. For instance, in the food industry, shrink films are utilized for packaging perishable items, ensuring freshness and extending shelf life. In pharmaceuticals, they provide tamper-evident packaging, enhancing product safety. This broad applicability not only drives demand but also encourages innovation in film design and functionality, positioning the market for sustained growth in the coming years.

Rising Demand for Sustainable Packaging Solutions

The Global Polythene PE Shrink Film Market Industry is experiencing a notable shift towards sustainable packaging solutions. As consumers increasingly prioritize eco-friendly products, manufacturers are compelled to adapt their offerings. Polythene PE shrink films, known for their recyclability and reduced environmental impact, are gaining traction. This trend is further supported by regulatory frameworks promoting sustainable practices. For instance, the European Union's directives on plastic waste are influencing market dynamics. Consequently, the demand for sustainable packaging is projected to drive the market's growth, contributing to an estimated value of 6.74 USD Billion in 2024.