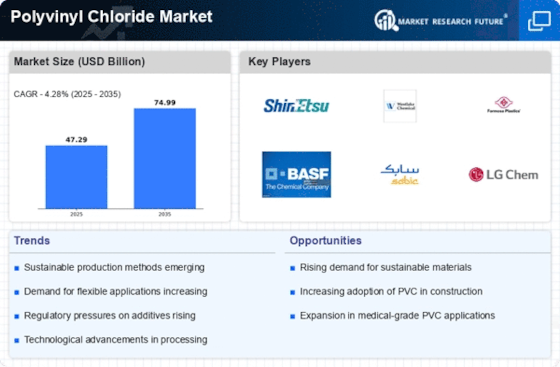

Major market players are spending a lot of money on R&D to increase their product lines, which will help the market grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Polyvinyl Chloride industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

Manufacturing locally to cut operating costs is one of the main business tactics manufacturers use in the global polyvinyl chloride industry to benefit customers and expand the market sector. Major market players, including

LG Chem, Orbia,

SABIC, Tianye Group, Occidental Petroleum Corporation, and others, are attempting to increase market demand by funding R&D initiatives.

LG Chem is a multinational chemical company based in South Korea. LG Chem's energy solutions division focuses on developing and manufacturing lithium-ion batteries for electric vehicles, energy storage systems, and mobile devices. The company is a leading supplier of batteries to the global electric vehicle market and has partnerships with several major automakers. LG Chem's petrochemicals division produces a wide range of products, including basic petrochemicals, synthetic resins, and specialty chemicals. The advanced materials division develops and produces high-performance materials such as OLED display materials, engineering plastics, and carbon fiber composites.

The life sciences division focuses on the development and manufacture of pharmaceuticals, medical devices, and biosimilars.

SABIC, or the Saudi Basic Industries Corporation, is a multinational chemical manufacturing company based in Riyadh, Saudi Arabia. SABIC operates in a wide range of industries, including petrochemicals, chemicals, plastics, Agri-nutrients, and metals. The company's product portfolio includes a variety of chemicals and plastics, such as polyethylene, polypropylene, polycarbonate, and engineering thermoplastics. SABIC also produces a range of specialty chemicals and intermediates, including fertilizers, metals, and additives.

Ineos Inovyn, a vinyl manufacturer with its headquarters located in the United Kingdom, has added goods with a higher recycled content and a much lower carbon footprint to its line of polyvinyl chloride (PVC) in 2023. According to the business, Biovyn, the bio-attributed PVC that was introduced in 2019 and is intended to be carbon neutral, is a net zero alternative. According to Ineos Inovyn, Biovyn is being utilized more and more in a variety of industries, including the automotive, building and construction, medical, and fashion.

PVC and TPE Antimicrobial Compounds for Healthcare Applications are being introduced by TekniPlex Healthcare in 2023. Many products that come into touch with patients, such as syringes, catheters, connections, gas hoses, and needle-free injectors, can be made using bacteria-neutralizing chemicals. Polyvinyl chloride (PVC) and

thermoplastic elastomer (TPE) compounds made with silver ion technology are available from TekniPlex. In order to create its line of antimicrobial goods, TekniPlex Healthcare combines its extensive selection of medical-grade flexible and rigid PVC compounds, or medical-grade CELLENE® TPE compounds, with natural antimicrobial qualities found in silver ion additions.

Together with MCT Cards & Technology Pvt. Ltd. and NPCI (National Payments Corporation of India), Tide, the top SME-focused business financial platform in the UK, announced today the launch of India's first recycled Rupay card in 2023. Transcorp International Limited is a Reserve Bank of India (RBI) regulated Prepaid Payment Instrument (PPI) license holder.