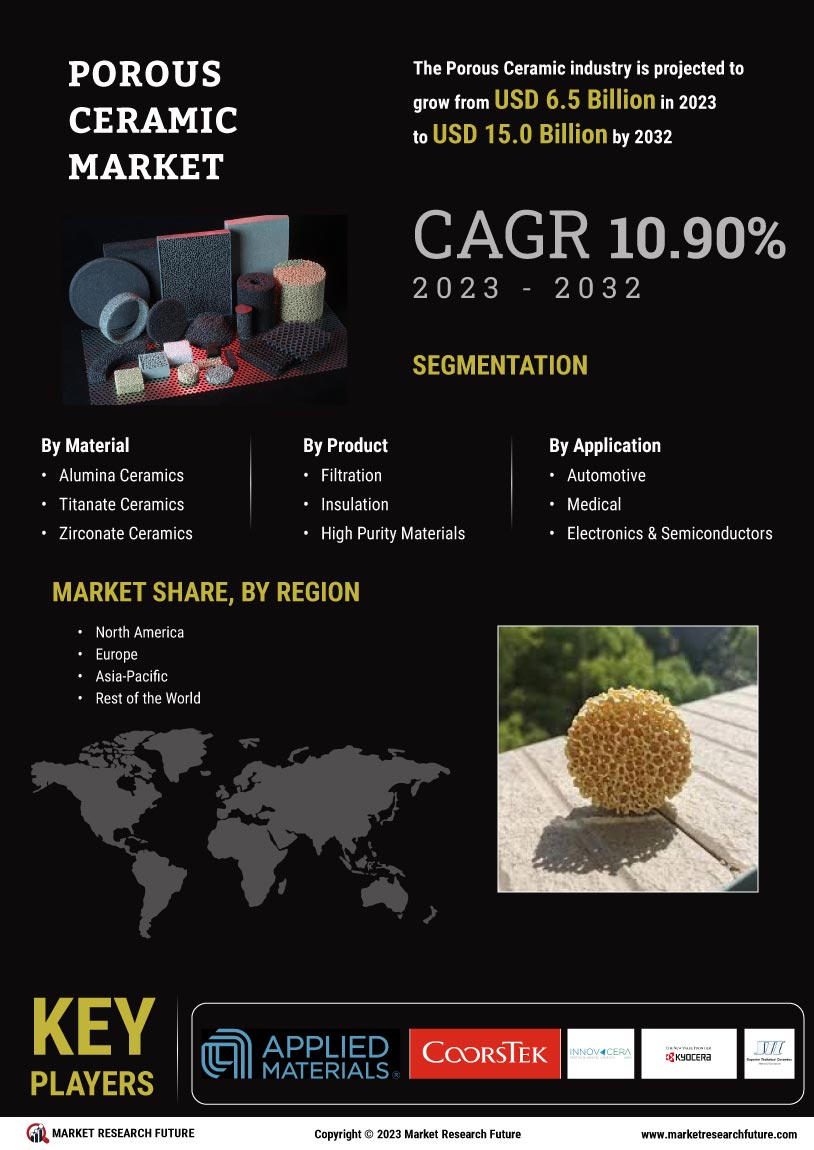

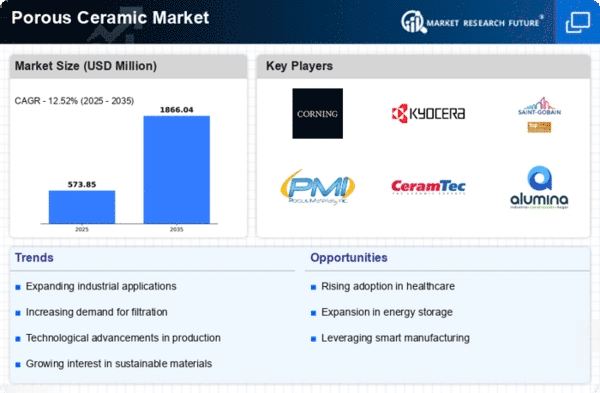

Market Growth Projections

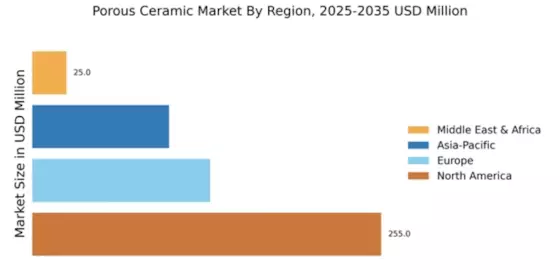

The Global Porous Ceramic Market Industry is poised for substantial growth, with projections indicating a market size of 7.21 USD Billion in 2024 and an anticipated increase to 20.5 USD Billion by 2035. This growth trajectory reflects a robust CAGR of 9.95% from 2025 to 2035, driven by diverse applications across various sectors. The increasing demand for porous ceramics in healthcare, energy, filtration, and construction underscores the material's versatility and relevance in addressing contemporary challenges. As industries continue to innovate and seek sustainable solutions, the porous ceramic market is likely to expand significantly, presenting opportunities for stakeholders.

Rising Adoption in Energy Applications

The Global Porous Ceramic Market Industry is witnessing a rising adoption of porous ceramics in energy applications, particularly in fuel cells and batteries. These materials enhance energy efficiency and performance, making them attractive for renewable energy solutions. As global energy demands shift towards sustainable sources, the role of porous ceramics becomes increasingly critical. The integration of these materials in energy systems could lead to substantial market growth, with a projected CAGR of 9.95% from 2025 to 2035. This growth reflects the industry's potential to contribute to cleaner energy technologies and the transition towards a low-carbon economy.

Advancements in Filtration Technologies

Innovations in filtration technologies significantly propel the Global Porous Ceramic Market Industry. Porous ceramics are extensively used in water treatment, air filtration, and industrial processes due to their superior filtration capabilities. The material's ability to remove contaminants and improve water quality aligns with global sustainability goals. As industries seek to enhance efficiency and reduce environmental impact, the demand for advanced filtration solutions is likely to rise. This trend is expected to contribute to the market's growth, with projections indicating a market size of 20.5 USD Billion by 2035, driven by the increasing adoption of porous ceramics in filtration applications.

Growing Demand in Healthcare Applications

The Global Porous Ceramic Market Industry experiences a notable surge in demand driven by its applications in healthcare. Porous ceramics are utilized in bone grafts, dental implants, and drug delivery systems due to their biocompatibility and ability to promote tissue integration. As the global population ages, the need for advanced medical solutions increases, suggesting a robust market growth trajectory. The market is projected to reach 7.21 USD Billion in 2024, with healthcare applications playing a pivotal role in this expansion. The increasing focus on innovative medical technologies further supports the growth of porous ceramics in the healthcare sector.

Emerging Applications in Environmental Remediation

The Global Porous Ceramic Market Industry is expanding into emerging applications in environmental remediation. Porous ceramics are increasingly utilized in the treatment of contaminated soils and wastewater due to their ability to adsorb pollutants effectively. As environmental regulations tighten globally, industries are compelled to adopt sustainable practices, which may drive the demand for porous ceramics in remediation efforts. This trend highlights the material's versatility and potential to address pressing environmental challenges. The growing focus on sustainability and environmental protection is likely to bolster the market, contributing to its overall growth in the coming years.

Increasing Use in Construction and Building Materials

The Global Porous Ceramic Market Industry benefits from the increasing use of porous ceramics in construction and building materials. These materials offer excellent thermal insulation, sound absorption, and lightweight properties, making them ideal for modern architectural applications. As urbanization accelerates globally, the demand for innovative building solutions rises, driving the adoption of porous ceramics in construction projects. This trend is likely to enhance market growth, as builders and architects seek materials that meet both aesthetic and functional requirements. The integration of porous ceramics in construction could lead to a more sustainable built environment, further supporting the industry's expansion.