Regulatory Support

The Post Consumer Recycled Textiles Market is experiencing a surge in regulatory support aimed at promoting sustainable practices. Governments are increasingly implementing policies that encourage recycling and the use of recycled materials in textile production. For instance, various countries have introduced extended producer responsibility (EPR) regulations, which require manufacturers to take responsibility for the entire lifecycle of their products. This regulatory framework not only incentivizes the recycling of textiles but also fosters innovation in the industry. As a result, the market is likely to witness a rise in the adoption of post-consumer recycled textiles, as companies strive to comply with these regulations and enhance their sustainability profiles.

Technological Innovations

Technological innovations play a pivotal role in shaping the Post Consumer Recycled Textiles Market. Advances in recycling technologies, such as chemical recycling and fiber regeneration, are enhancing the efficiency and quality of recycled textiles. These innovations enable the transformation of post-consumer waste into high-quality fibers that can compete with virgin materials. Furthermore, the integration of digital technologies, such as blockchain, is improving traceability and transparency in the supply chain. As these technologies continue to evolve, they are likely to drive the growth of the post-consumer recycled textiles market, making it more viable for manufacturers to adopt sustainable practices.

Economic Incentives for Recycling

Economic incentives for recycling are becoming a crucial driver in the Post Consumer Recycled Textiles Market. Various governments and organizations are offering financial support and subsidies to promote recycling initiatives. These incentives can take the form of tax breaks, grants, or funding for recycling facilities, which encourage businesses to invest in post-consumer recycled textiles. As a result, the cost of sourcing recycled materials may decrease, making it more attractive for manufacturers to incorporate them into their products. This economic support is likely to stimulate growth in the post-consumer recycled textiles market, as it aligns with broader sustainability goals and encourages responsible consumption.

Rising Demand for Sustainable Fashion

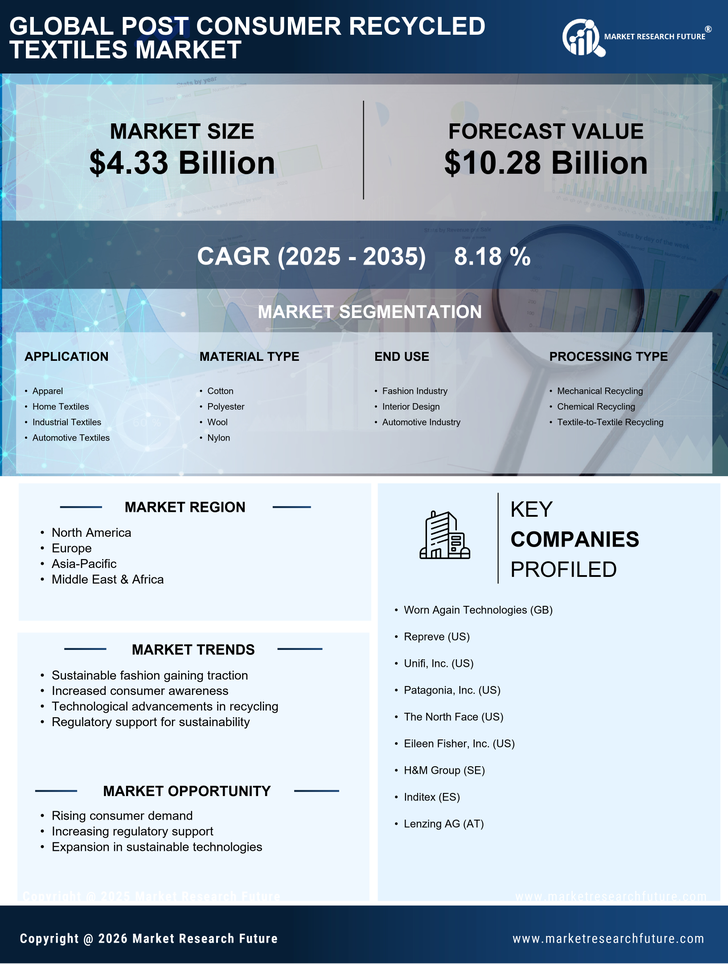

The Post Consumer Recycled Textiles Market is significantly influenced by the rising demand for sustainable fashion. Consumers are increasingly seeking eco-friendly alternatives to traditional textiles, driven by a growing awareness of environmental issues. This shift in consumer behavior is prompting brands to incorporate post-consumer recycled materials into their product lines. According to recent data, the sustainable fashion market is projected to grow at a compound annual growth rate (CAGR) of over 9% in the coming years. This trend not only reflects a change in consumer preferences but also indicates a broader movement towards sustainability in the fashion industry, thereby bolstering the demand for post-consumer recycled textiles.

Corporate Social Responsibility Initiatives

The Post Consumer Recycled Textiles Market is increasingly influenced by corporate social responsibility (CSR) initiatives. Many companies are recognizing the importance of sustainability in their business models and are actively seeking to reduce their environmental impact. By investing in post-consumer recycled textiles, brands can enhance their CSR profiles and appeal to environmentally conscious consumers. This trend is evident as numerous fashion retailers have committed to using a certain percentage of recycled materials in their collections. Such initiatives not only contribute to the growth of the post-consumer recycled textiles market but also foster a culture of sustainability within the industry.