Increasing Demand for Fresh Produce

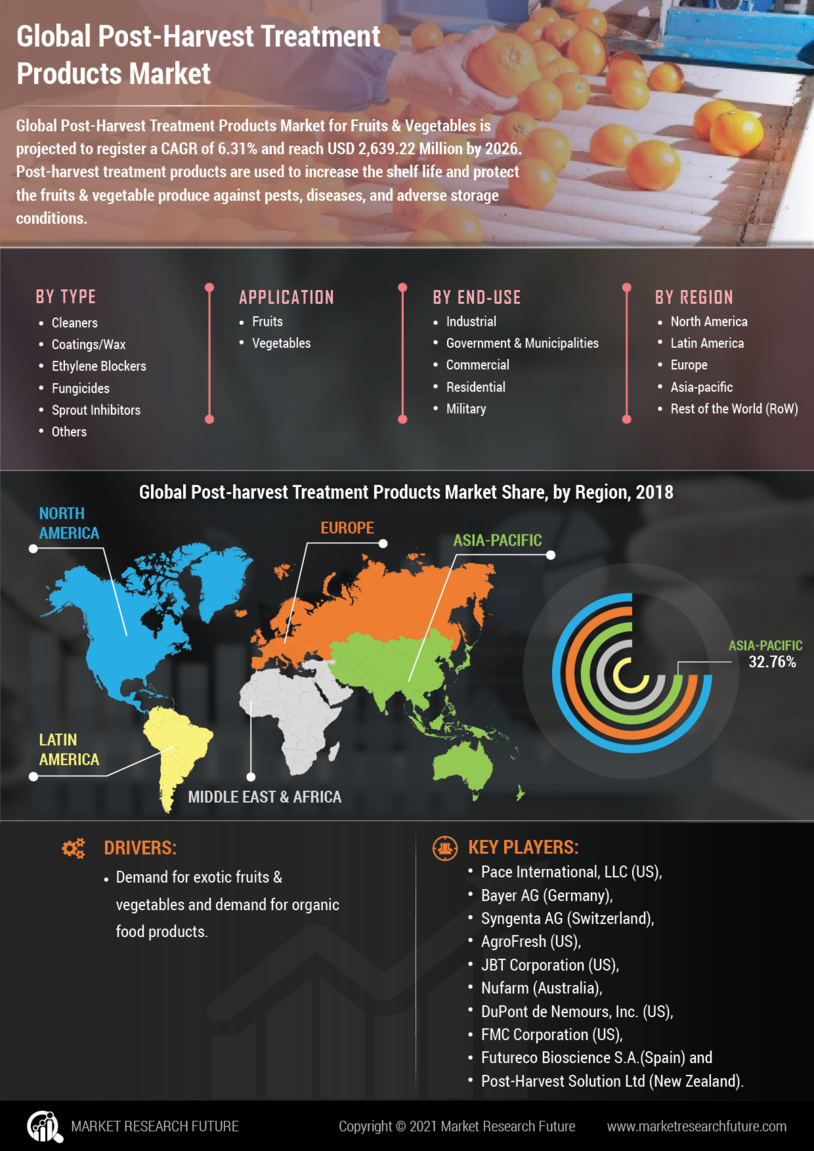

The Post-Harvest Treatment Products Market is experiencing a surge in demand for fresh produce, driven by changing consumer preferences towards healthier eating habits. As consumers increasingly seek fresh fruits and vegetables, the need for effective post-harvest treatments becomes paramount. These treatments help in extending the shelf life of produce, thereby reducing waste and ensuring that products reach consumers in optimal condition. According to recent data, the market for fresh produce is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to propel the demand for post-harvest treatment products, as producers and retailers strive to meet consumer expectations for quality and freshness.

Regulatory Compliance and Food Safety

The Post-Harvest Treatment Products Market is significantly influenced by stringent food safety regulations and standards. Governments and regulatory bodies are increasingly emphasizing the importance of safe food handling and storage practices to protect public health. Compliance with these regulations often necessitates the use of effective post-harvest treatments to ensure that produce is free from contaminants and pathogens. As a result, producers are investing in advanced treatment solutions to meet these requirements. The market for food safety testing and treatment products is projected to expand, reflecting the growing awareness and demand for safe food products among consumers.

Technological Innovations in Treatment Methods

Technological advancements play a crucial role in shaping the Post-Harvest Treatment Products Market. Innovations such as modified atmosphere packaging, ethylene inhibitors, and advanced refrigeration techniques are enhancing the efficacy of post-harvest treatments. These technologies not only improve the quality and longevity of produce but also reduce the reliance on chemical treatments, aligning with the growing trend towards sustainability. The integration of smart technologies, such as IoT and AI, is also emerging, allowing for real-time monitoring of storage conditions. This shift towards more sophisticated treatment methods is expected to drive market growth, as stakeholders seek to optimize their operations and minimize losses.

Consumer Awareness and Education on Food Quality

Consumer awareness regarding food quality and safety is a driving force in the Post-Harvest Treatment Products Market. As consumers become more educated about the impact of post-harvest treatments on the quality and safety of food, they are increasingly demanding transparency from producers. This trend is prompting stakeholders to adopt better post-harvest practices and invest in treatment products that ensure high-quality produce. Market Research Future indicates that consumers are willing to pay a premium for products that are treated with safe and effective post-harvest solutions. This shift in consumer behavior is likely to encourage producers to prioritize the use of advanced treatment products to meet market expectations.

Rising Global Population and Food Security Concerns

The Post-Harvest Treatment Products Market is poised for growth due to the rising global population and the associated concerns regarding food security. As the world population continues to increase, the demand for food is expected to rise significantly. This situation necessitates efficient post-harvest management practices to minimize losses and ensure that food supply chains remain robust. It is estimated that approximately one-third of food produced for human consumption is wasted, primarily due to inadequate post-harvest handling. Therefore, the adoption of effective post-harvest treatment products is likely to become a priority for producers aiming to enhance food security and reduce waste.