Potash Ore Size

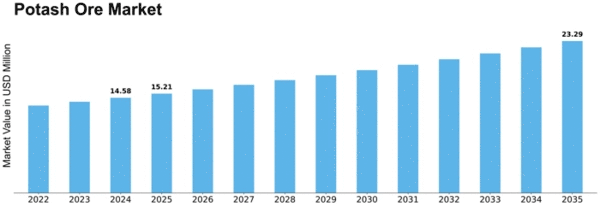

Potash Ore Market Growth Projections and Opportunities

The elements of the potash ore market are comprehensively molded by a broad exhibit of variables, including financial circumstances, rural practices, and worldwide exchange elements. Farming Dependent Status: The crucial capability of potash metal in farming is the chief variable pushing the market. Potash, a fundamental constituent of composts, works with crop advancement and further develops soil richness. The continuous ascent in worldwide populace and food request requires the proceeded with vitality of potash metal to feasible agribusiness. Development in Populace and Food Security: The market factors are firmly entwined with the development of the worldwide populace and the resulting need for uplifted food creation. Potash, being a basic supplement for crops, assumes a urgent part in the development of the potash ore market because of its significance in accomplishing food security targets. Rural Pivot Techniques: Dynamic parts of the potash ore market are impacted by horticultural practices, like harvest pivot. As a manageable rural strategy, crop pivot is subject to potash to save soil ripeness. The interest in potash ore is affected by the accentuation put on such practices. Applications in Industry and Monetary Turn of events: potash ore is used in a large number of modern cycles notwithstanding its farming applications. The impact of monetary development, explicitly in areas that depend on potash for compound assembling, on market elements is characteristic of the more extensive financial climate. Mining Mechanical Advances: Continuous mechanical advancements in mining processes affect the maintainability and viability of potash metal extraction. Market elements are impacted by headways in mining advances, which have repercussions on the store network and in general creation. Guidelines of the Climate and Maintainability: Severe natural guidelines essentially impact the elements of the market. Guaranteeing adherence to natural guidelines is extremely critical with regards to potash ore mining exercises. The business' commitment to supportable practices likewise assumes a significant part in molding market elements. The Elements of Global Exchange and Contest: Potash is a universally exchanged item, and worldwide exchange examples and contest influence market elements. The market costs and accessibility of potash ore are impacted by changes in international occasions, worldwide economic alliance, and the serious climate. Endowments and Government Approaches With respect to Agribusiness: The market elements of potash ore are essentially impacted by government approaches, explicitly those relating to rural endowments. Market development and request are influenced by appropriations that energize the utilization of manures, including those that contain potash. Strategies Framework Improvement: The advancement of framework, especially in the areas of operations and transportation, essentially impacts the elements of the potash ore market. The general viability of the market is affected by the opportune and practical development of potash mineral from mining locales to end-clients, which is made conceivable by proficient transportation organizations. Value Instability and Market Contest: Cost unpredictability and the cutthroat climate are inborn attributes of the potash ore market. The exchange states of potash ore are impacted by various elements, including provider market rivalry, money vacillations, and market contest.

Leave a Comment