Global Trade Dynamics

The Global Potash Ore Market Industry is significantly influenced by international trade dynamics. Countries that are major producers, such as Canada and Russia, play a crucial role in the global supply chain. Trade agreements and tariffs can impact potash prices and availability, affecting agricultural sectors worldwide. For instance, fluctuations in trade policies may lead to price volatility, which could either stimulate or hinder market growth. As nations strive for food security, the interdependence on potash imports and exports will likely shape the market landscape, necessitating strategic partnerships and collaborations.

Increasing Agricultural Demand

The Global Potash Ore Market Industry experiences a robust demand driven by the increasing need for fertilizers in agriculture. As global populations rise, the necessity for food production escalates, leading to a projected market value of 30.5 USD Billion in 2024. Potash, being a vital nutrient for crops, is essential for enhancing yield and quality. Countries with significant agricultural sectors, such as the United States and Brazil, are likely to contribute to this growth. The emphasis on sustainable farming practices further amplifies the demand for potash, as farmers seek to improve soil health and crop resilience.

Emerging Markets and Economic Growth

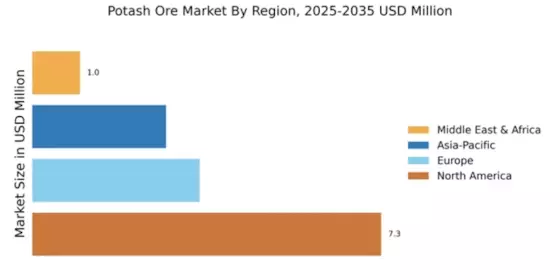

Emerging markets are becoming pivotal in the Global Potash Ore Market Industry, driven by economic growth and rising agricultural investments. Countries in Asia and Africa are witnessing increased agricultural activities, leading to heightened demand for fertilizers, including potash. As these economies develop, the need for enhanced agricultural productivity becomes paramount. Investments in infrastructure and farming technologies are likely to support this growth. The expanding middle class in these regions may also drive demand for higher-quality food, further increasing the need for potash fertilizers. This trend suggests a promising outlook for the market in the coming years.

Technological Advancements in Mining

Technological innovations in mining processes are poised to enhance the efficiency of potash extraction, thereby impacting the Global Potash Ore Market Industry positively. Advanced techniques such as solution mining and selective dissolution are becoming more prevalent, allowing for lower operational costs and reduced environmental impact. These advancements may lead to increased production capacities, which could support the market's growth trajectory. As the industry adapts to these technologies, it is anticipated that the market will evolve, potentially reaching a value of 45.2 USD Billion by 2035, reflecting a compound annual growth rate of 3.64% from 2025 to 2035.

Environmental Regulations and Sustainability

The Global Potash Ore Market Industry is increasingly shaped by stringent environmental regulations and a growing emphasis on sustainability. Governments worldwide are implementing policies aimed at reducing the environmental footprint of mining operations. This trend encourages potash producers to adopt more sustainable practices, such as reducing water usage and minimizing land disruption. As consumers become more environmentally conscious, the demand for sustainably sourced potash may rise, influencing market dynamics. Companies that prioritize eco-friendly practices could gain a competitive edge, potentially leading to increased market share and profitability.